Global LNG trade remained stable year on year in May 2020 amid extremely depressed prices

Global LNG net imports* were up 0.46 Mt in May 2020 compared to April and essentially stable year-on-year (-0.2%) after a 2% Y-o-Y decline in April. These figures contrast with the 11.5% Y-o-Y growth recorded in Q1. Global net imports in May were 13% below January’s which demonstrates a certain level of supply response to low prices but is also largely a seasonal phenomenon. Indeed, in the five year period between 2015 and 2019, the decline in monthly imports from January to April has varied from -20% in 2015 to -6% in 2017.

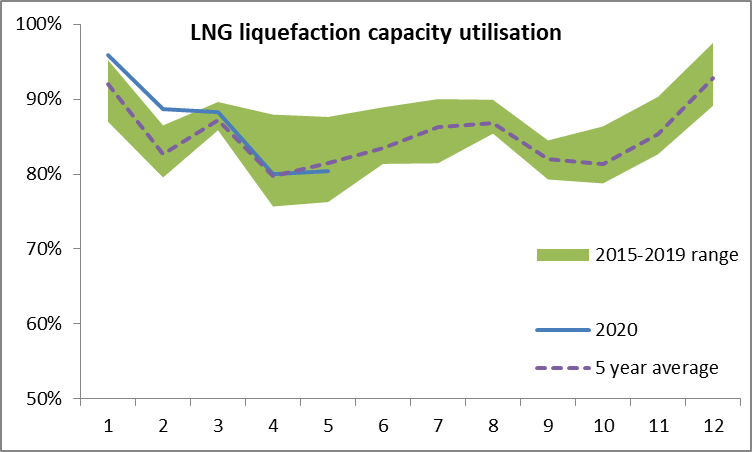

LNG exports in May 2020 represented approximately 82% of the global liquefaction installed capacity which was only marginally lower than the average capacity utilization at this time of the year over the 5 previous year. They increased by 1% compared to May 2019, with the largest increases in the United States, Nigeria, Algeria and the Russian Federation, reflecting higher capacity utilization in the latter three countries and the launch of a number of new liquefaction trains in 2019 and early 2020 in the United States, where nominal liquefaction capacity increased from 34 to 65 Mtpa between May 2019 and May 2020.

Source: CEDIGAZ