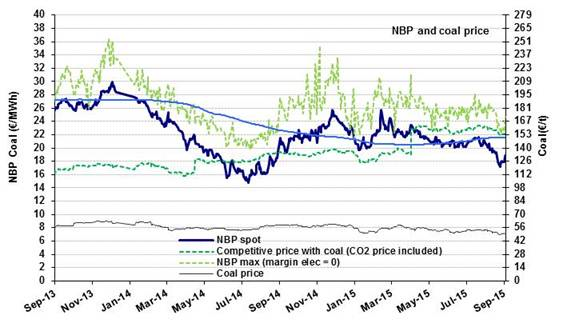

NBP: summer prices moderate, without sharp drops

This summer, the average NBP price did not decline to the same extent as last year. In July, it even found itself under slight pressure: at €21.2/MWh ($6.8/MBtu), it was 2% higher than in June and 30% higher than in June of last year. During August, the price saw a fairly marked downtrend, hitting a low of €17.2/MWh on August 24 before rallying. The first September quotations, progressing due to sustained demand, were in the neighborhood of €18.9/MWh ($6.2/MBtu). These moderate values helped make natural gas more competitive in the electricity sector compared to coal, a phenomenon fostered since April by the increase in carbon tax support, now fixed at £18/TCO2 (about €24/TCO2). The result has been a fairly notable increase in gas consumption in this sector: 18% more in June on an annualized basis, as opposed to a 24% decrease for coal over the same period.

This summer, the average NBP price did not decline to the same extent as last year. In July, it even found itself under slight pressure: at €21.2/MWh ($6.8/MBtu), it was 2% higher than in June and 30% higher than in June of last year. During August, the price saw a fairly marked downtrend, hitting a low of €17.2/MWh on August 24 before rallying. The first September quotations, progressing due to sustained demand, were in the neighborhood of €18.9/MWh ($6.2/MBtu). These moderate values helped make natural gas more competitive in the electricity sector compared to coal, a phenomenon fostered since April by the increase in carbon tax support, now fixed at £18/TCO2 (about €24/TCO2). The result has been a fairly notable increase in gas consumption in this sector: 18% more in June on an annualized basis, as opposed to a 24% decrease for coal over the same period.