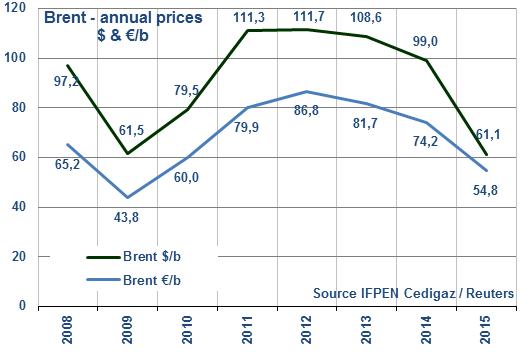

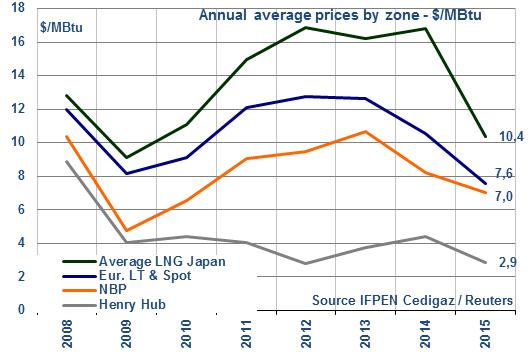

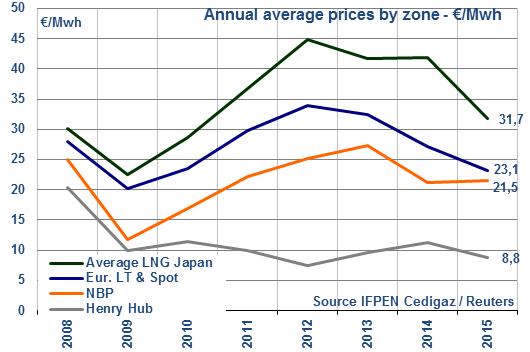

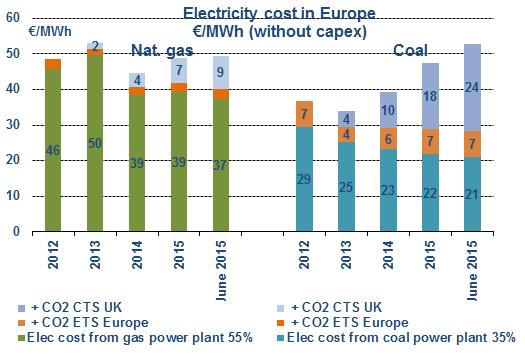

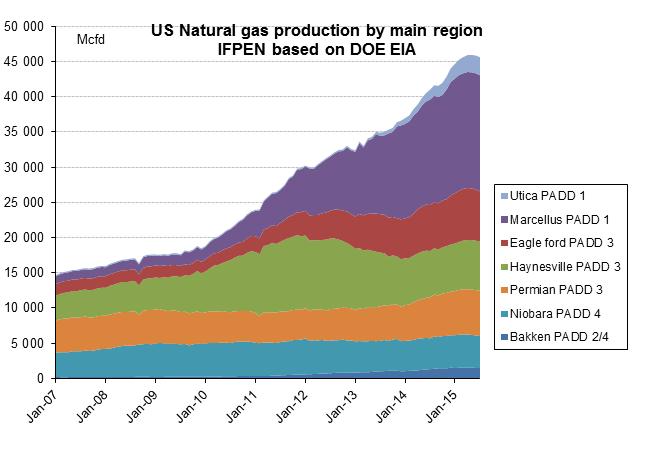

Brent: A forecast of $53-64/b for 2015 In the first half of 2015, the Brent price ranged from $45 to 66/b and averaged $58/b (WTI at $53/b). Recent trends reflect several influences: 1/ the appreciation of the dollar ($/€: +26% between June 2014 and April 2015; -4% since then); 2/ the cutback in upstream investments announced early in the year by oil operators; 3/ the decline in drilling activity in the United States (-60% since September 2014); 4/ the armed intervention in Yemen by Saudi Arabia and its allies since March 26; 5/ the sustained growth in demand forecast for 2015 (IEA: +1.4 Mbd). Studying the equilibrium of the oil market, one notes expectations that the surplus will fall from its record level of 2.9 Mbd (Q2) to 1.3 Mbd (Q3) and then 0.9 Mbd (Q4). This forecast is based on a rise in demand over the last two quarters, a slight dip in the non-OPEC supply and a stable OPEC supply at 31 Mbd. In this configuration, maintaining a significant surplus could moderate price pressure, which is what the market is expecting: since January, the Brent forecast for 2015 has been in the $54-64/b range. Variations are possible, depending on what actually happens on the demand side (the effects of global economic growth)and on the supply side (e.g. the effects of tight oil in the U.S., developments concerning the sanctions on Iran and geopolitics) and influenced by the consequences of financial or monetary instability. NBP: A forecast of €20.3-22.4/MWh for 2015 Based on market anticipations, the NBP price for 2015 is expected to be in the €20.3-22.4/MWh range, close to last year’s average of €21.2/MWh ($8.2/MBtu). For the end of the year, current forecasts call for levels ranging from €20/MWh ($6.6/MBtu) to nearly €23/MWh ($7.6/MBtu). In addition to the weather conditions, several factors may affect the NBP price, including the tense situation between Russia and Ukraine and the drop in production at the Groningue gas field (Netherlands). It is now thought that the latter’s output will be capped at 30 bcm in 2015, compared to 42 bcm in 2014 and 54 bcm in 2013. The increase in carbon tax support in the United Kingdom, fixed since April 2015 at £18/TCO2 (€25-24/TCO2) as opposed to £9.5/TCO2 in 2014, will have a big impact on the structure of the electricity sector. Serious erosion of the competitiveness of coal-fired power plants should push up gas consumption in this sector, a support factor for the gas spot price. The story is different on the European continent, where natural gas continues to be doubly penalized by the excessively low prices not only of CO2 but also, in some countries, of electricity (the effect of renewable energies). Overly low prices of CO2 benefit coal while those of electricity reduce or wipe out operator margins. Long-term indexed price (indicative price): A forecast in the vicinity of €23/MWh for 2015 The long-term price (indexed to a combination of oil and NBP spot market prices) could be about €23/MWh ($7.6/MBtu) for 2015, down 15% compared to 2014. This trend accounts for the expected 38% decrease in the oil price (about $60/b for 2015) and the decline in the euro (-16% to $1.12). It should be pointed out that the spot share used to compute the indicative price is close to 60% (the percentage that has been used in France). In June, the Commission de régulation de l’énergie (CRE) proposed raising it to 77.4%, a reflection of the growing influence of spot markets in Europe. Henry Hub: under $3/MBtu for 2015 Since the beginning of the year, the monthly HH average has been in the $2.6-3/MBtu range. The futures markets are expecting prices on this order for the next few months, gradually increasing to exceed $3 by year-end. The annual average could be in the neighborhood of $2.8-2.9/MBtu, nearing the low of 2012. At that level, the price of exported LNG would be $9 to Asia and $7 to Europe, close to current levels. The downward pressure reflects the still-ongoing rise in U.S. output: the latest DOE forecast for 2015 stands at 770 bcm (74.4 bcfd). However, it will be necessary to closely follow trends at the main shale gas basins, where production is beginning to fall. This trend could continue if the increase in productivity per well does not compensate for the decrease in drilling activity (-31% for gas). Stay tuned! By Guy Maisonnier, Senior Economist – IFPEN www.cedigaz.org |