The 2014 edition of CEDIGAZ’s flagship survey Natural Gas in the World highlights some disturbing signs of weakness on the demand and supply sides, indicating structural challenges that will need to be addressed before a golden age of gas can occur.

In 2013, growth in worldwide gas demand decelerated, up by only 1% versus 2.4% in 2012. This is less than the 3% growth achieved by coal and, most remarkably, less than that of oil (1.4%). Moreover, gas was the only fossil fuel to record lower growth in 2013 than in 2012. This phenomenon may be observed even in Asia – a powerhouse in terms of growth in gas demand – where demand rose 4% in 2013, down from 6% one year earlier. Gas demand had already shown its limitations in 2012, when it gained only 2.4%, compared to an average growth of 2.8% per year in the previous decade.

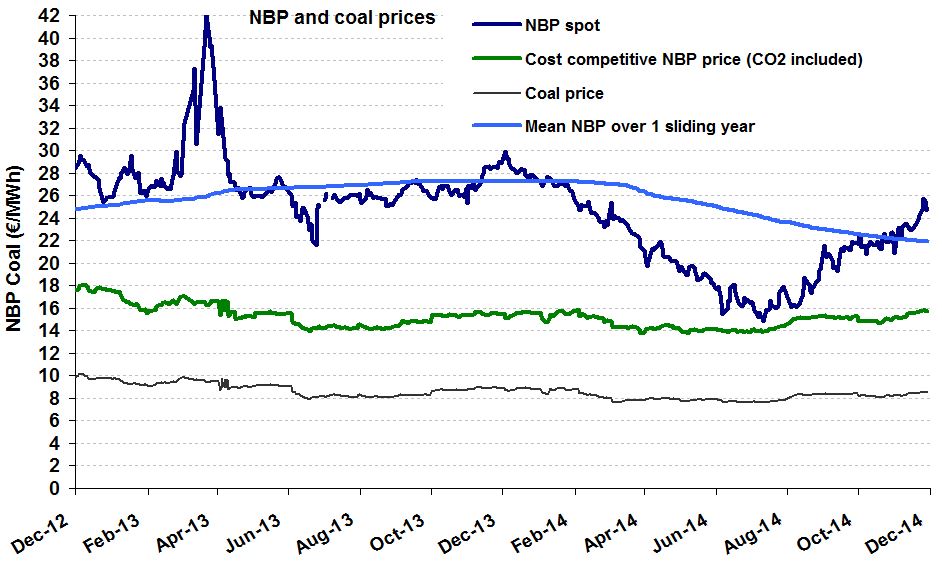

The NBP price stood at €23.7/MWh ($8.7/MBtu) in November, an increase of 8.7% in one month. This level is nearly 15% lower than that of November 2013. The uptrend has been favored by a seasonal increase in demand (even if only relative) and the decreases in Norwegian deliveries (incident at the Troll gas field).

The NBP price stood at €23.7/MWh ($8.7/MBtu) in November, an increase of 8.7% in one month. This level is nearly 15% lower than that of November 2013. The uptrend has been favored by a seasonal increase in demand (even if only relative) and the decreases in Norwegian deliveries (incident at the Troll gas field).