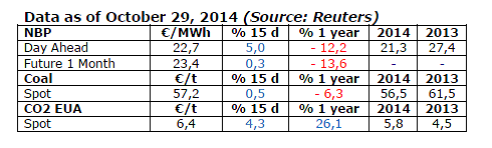

NBP: volatile and rising

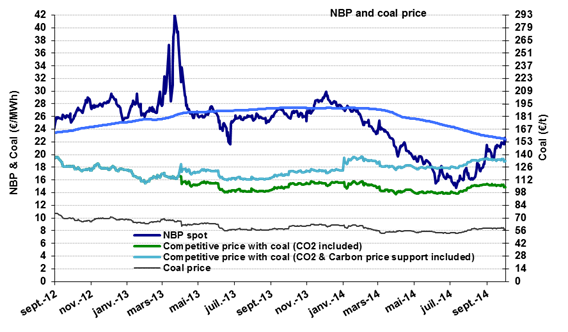

The NBP price stood at €21.8/MWh ($8.1/MBtu) in October, an increase of 4.5% in one month. However, it stayed at a level that continues to be moderate, 17% lower than the price a year ago. The market remains relatively volatile (-5% to +4% compared to the average) influenced by factors such as the temperature, fluctuations in Norwegian deliveries and declarations related to the Russo-Ukrainian negotiations. For instance, on October 17 (+1.6%), the Russian president warned Europe about big transit risks for gas this winter, just before the October 21 negotiations with Ukraine (still ongoing on the 29th). For now, the market is not anticipating a crisis. The projected winter price remains moderate, between €23.5 and 25.5/MWh ($8.7 and 9.4/MBtu) compared to €26/MWh ($10.3/MBtu) last winter. Actual trends will depend in particular on temperature (currently moderate) and deliveries from Russia. The range of “possibles” remains fairly broad, with Asian LNG providing a potential ceiling for the NBP price in the event of a crisis.

The NBP price stood at €21.8/MWh ($8.1/MBtu) in October, an increase of 4.5% in one month. However, it stayed at a level that continues to be moderate, 17% lower than the price a year ago. The market remains relatively volatile (-5% to +4% compared to the average) influenced by factors such as the temperature, fluctuations in Norwegian deliveries and declarations related to the Russo-Ukrainian negotiations. For instance, on October 17 (+1.6%), the Russian president warned Europe about big transit risks for gas this winter, just before the October 21 negotiations with Ukraine (still ongoing on the 29th). For now, the market is not anticipating a crisis. The projected winter price remains moderate, between €23.5 and 25.5/MWh ($8.7 and 9.4/MBtu) compared to €26/MWh ($10.3/MBtu) last winter. Actual trends will depend in particular on temperature (currently moderate) and deliveries from Russia. The range of “possibles” remains fairly broad, with Asian LNG providing a potential ceiling for the NBP price in the event of a crisis.