2014 has been a very mixed year for natural gas, according to the First Estimates 2014 released by the International Association CEDIGAZ today. For the second consecutive year, gas demand slowed down in 2014, with subdued activity in the global gas industry at all stages of the chain.

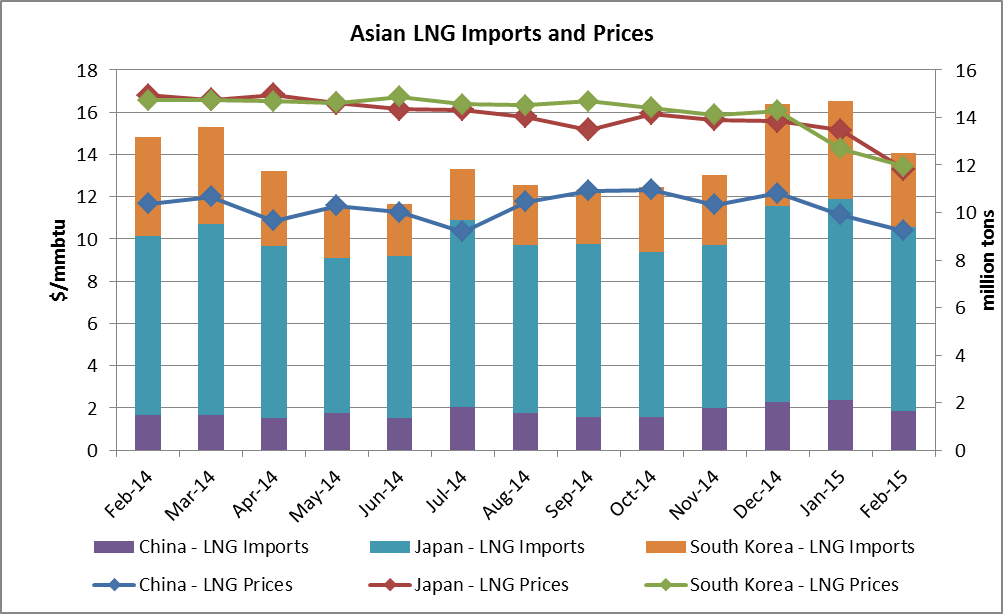

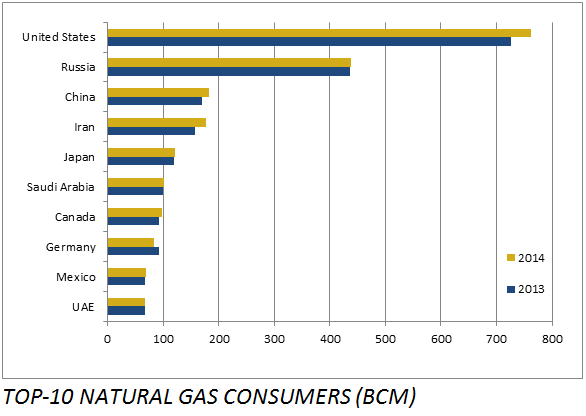

Global natural gas consumption (including storage variations) was sluggish in 2014 and remained at a quite similar level than in 2013. This can be explained by increased competition between energies, especially coal, the economic slowdown (Europe, China, Russia…), geopolitical turmoil (Russia-Ukraine conflict) and the mild weather conditions which negatively impacted the expansion of gas demand (Europe, Asia). The global consumption trend showed regional disparities. Natural gas demand in North America and the Middle East continued to register strong expansion, but the growth in Asia slowed down, while consumption in the Commonwealth of Independent States (CIS) and Europe declined dramatically. Plummeting consumption in Europe (- 10%) in particular weighed significantly on the overall trend.

Global natural gas consumption (including storage variations) was sluggish in 2014 and remained at a quite similar level than in 2013. This can be explained by increased competition between energies, especially coal, the economic slowdown (Europe, China, Russia…), geopolitical turmoil (Russia-Ukraine conflict) and the mild weather conditions which negatively impacted the expansion of gas demand (Europe, Asia). The global consumption trend showed regional disparities. Natural gas demand in North America and the Middle East continued to register strong expansion, but the growth in Asia slowed down, while consumption in the Commonwealth of Independent States (CIS) and Europe declined dramatically. Plummeting consumption in Europe (- 10%) in particular weighed significantly on the overall trend.