Executive Summary of the CEDIGAZ report on the Iranian Gas Chain under US sanctions by Dr Sara Vakhshouri founder and president of SVB Energy International and specialist of the Iranian energy sector

Iran has one of the largest proven natural gas reserves in the world, hosts about 17% of the world’s proven natural gas reserves. Iran is also the world’s third–largest dry natural gas producer after the United States and Russia. About 80% of Iran’s gas reserves are from non-associated gas fields.

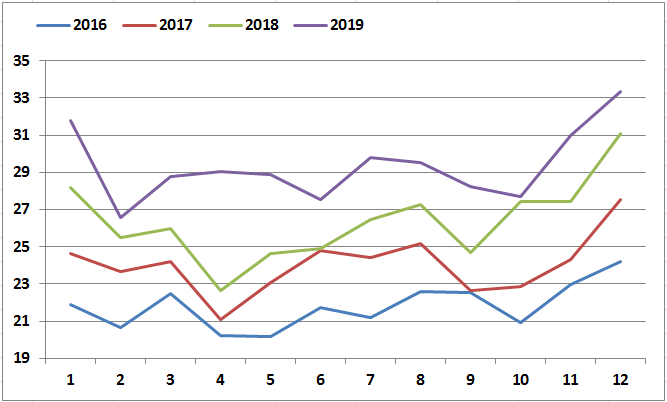

Based on Iran’s 6th Five Year Economic Plan (2016-2021), Iran’s rich gas production should reach 474.5 bcm a year or 1300 mcm a day by March 2021. This is almost twice its production of 250.7 bcm in 2016. Despite the upward natural gas output trend, due to sanctions, Iran will not hit its planned production target.

In March 2019, Iran’s processed about 889 mcm/d of rich gas that was produced from independent gas and form oil fields. Rich gas in Iran is processed by NGL factories, gas refineries and dehydration units. The largest share of refined gas production capacity belongs to gas refineries in South Pars.

Despite the fact that Iran is the world’s third largest producer of natural gas, its exports only constitute less than 1% of global gas trade. This is primarily due to its large domestic demand and then because of sanctions on its exports, and lack of investment and access to required technologies.

Iran’s condensate and gas liquid output has soared over the past decade. Most gas liquids are produced in the previously described NGL plants. Nevertheless, the actual production of these units has been less than 50% of their nominal capacity. This was significantly low during the nuclear sanctions and newest round of US sanctions. As a result, Iran has had to offset its oil production and adjust its ability to export. Lower crude oil production had additionally limited overall NGL production volumes, which is the byproduct of crude oil production in Iran.

Tighter US sanctions on Iran energy industry have had a significant and undeniable impact upon Iran’s gas development projects. If US sanctions against Iran continue in the long term, and Iran does not succeed in accessing international capital and technology, it will not increase its natural gas production. In, fact its production levels may start to decrease due to natural decline in South Pars production.

Unlike President Obama’s nuclear sanctions, the current sanctions include condensate export alongside the crude oil export in order to put “maximum pressure” on Iran. As a result of limitations on its condensate export, Iran is struggling to maintain its gas production particularly from South Pars.

Dr Sara Vakhshouri for CEDIGAZ

Complete report available to CEDIGAZ members https://private.cedigaz.org

Get the report (non-members)

Global Imports (net of re-exports) grew by 12% in H1 2019 to reach 169 Mt (+18.5 Mt Y-o-Y) driven by the surge of European imports. Asian demand was insufficient to absorb the sharp supply rise. Overall demand in Asia remained almost flat as strong growth in China (+4.7 Mt) and Bangladesh (+1.6 Mt) was offset by declines in Japan (3.3 Mt) and South Korea (3 Mt).

Global Imports (net of re-exports) grew by 12% in H1 2019 to reach 169 Mt (+18.5 Mt Y-o-Y) driven by the surge of European imports. Asian demand was insufficient to absorb the sharp supply rise. Overall demand in Asia remained almost flat as strong growth in China (+4.7 Mt) and Bangladesh (+1.6 Mt) was offset by declines in Japan (3.3 Mt) and South Korea (3 Mt).