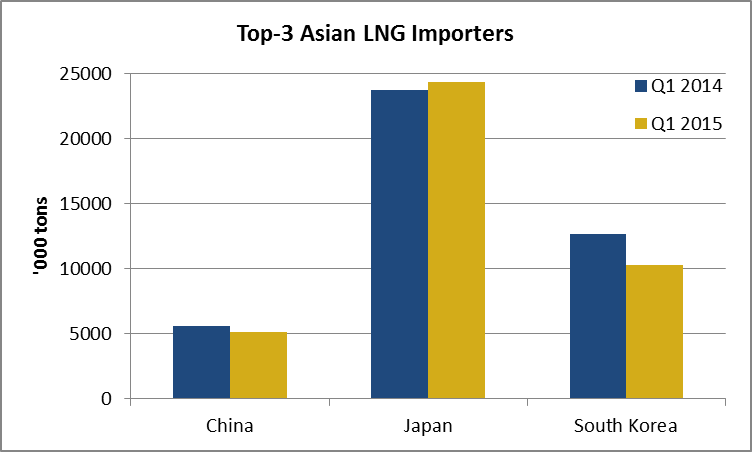

In 2014, the LNG year was somehow a replica of the previous one as it was characterized by rising Asian demand, decreasing European demand and a high price differential between the two biggest LNG markets. In 2015, as the trade data of Q1 show, the dynamics are likely to be different. First data show that the pressure on the Asian market is falling due to lower demand and growing production in the Pacific basin. In addition, gross imports are increasing in Europe while the re-export business is collapsing. Elsewhere in the world, the LNG industry continues to develop, as new projects keep coming on stream.

Read below or Download PDF