The International Association Cedigaz has just released its Hydrogen Market Review: “Canada’s Clean Hydrogen Pathway: Harnessing multiple assets for global leadership”, which assesses market developments, policies and prospects of the hydrogen industry in Canada. The report also provides information on Canadian clean hydrogen projects.

- Canada released the Hydrogen Strategy in December 2020 with the aim to become a global leading player in the hydrogen economy. Canada benefits from two unique advantages over most other nations —its rich natural resources to produce clean hydrogen and its technological leadership in fuel cells and CCUS.

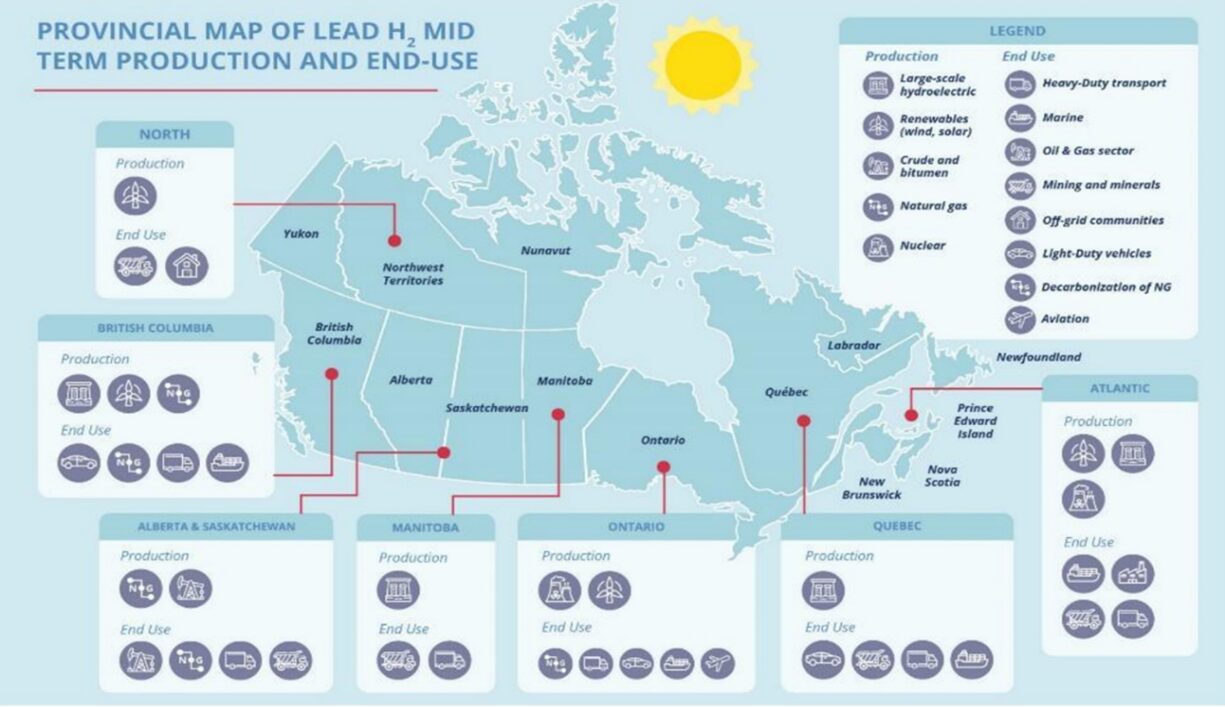

- Given Canada’s diversified assets, different pathways to produce clean hydrogen are emerging based on regional access to feedstocks and existing electricity grid. Western Canada has a strong focus on blue hydrogen (notably in Alberta around the Edmonton hydrogen hub), while eastern provinces, rich in hydro and renewables, mostly focus on green hydrogen.

- At the end of 2023, 9 clean hydrogen projects were under construction, with a combined production capacity of 173 ktH2/y by 2025 and 38 projects were at various stages of development, representing a combined production capacity of 4 MtH2/y.

- Canada intends to become one of the top global exporters of clean hydrogen and a technology supplier of choice. The first projects to export clean ammonia to Europe and Asia are being developed, with exports expected to start in 2025, Regionally, British Columbia, with its proximity to East Asia, could be the export hub for Canadian hydrogen exported to Asia, while Atlantic Canada (particularly Newfoundland and Labrador and Nova Scotia) could be the export hub for Canadian hydrogen exported to Europe.

- The hydrogen demand opportunities identified in the Strategy are diverse and include decarbonization of oil refineries/heavy oil upgraders, petrochemicals production, steel and cement production, mobility, power generation, and industrial and buildings heat. In a Transformative scenario assessing future potential hydrogen growth, Canada’s hydrogen demand could be up to 4 MtH2/y by 2030, and up to 20 MtH2/y by 2050, delivering up to 30% of end-use energy by 2050.

- Currently, most large clean hydrogen projects are dedicated to refining/petrochemicals and there has been little incentives so far to develop clean hydrogen in other applications. However, as the federal government has recently introduced new regulations and incentives to drive hydrogen demand, 2024 is expected to be a milestone year for investments in clean hydrogen in Canada.

Map 1: Provincial map of lead hydrogen mid-term production and end-use

By Sylvie Cornot-Gandolphe for CEDIGAZ

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and renewable gases (hydrogen and biomethane) in an exhaustive and critical way.