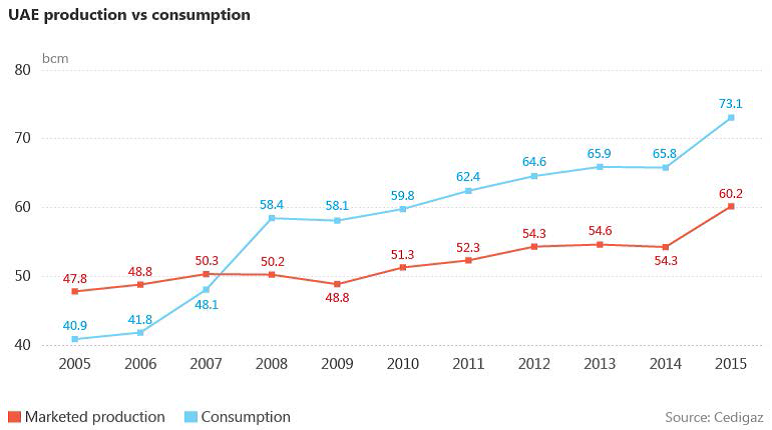

The United Arab Emirates (UAE) is one of the world’s longest-established LNG exporters. But despite holding the world’s sixth largest gas reserves, LNG imports into the federation increased at an impressive rate since 2010, when the Jebel Ali floating terminal in Dubai started up. With gas representing more than 90% of the power fuel mix, LNG purchases have been key to fill a widening supply deficit in order to match rapidly growing gas-to-power demand. Today, LNG remains at the heart of the UAE’s strategy to meet rising energy consumption and support economic and industrial expansion in times of reduced oil income and budgetary constraints. Cedigaz’s latest report examines the risks and opportunities inherent to this strategy and asks whether it is viable in the medium to longer term.

The United Arab Emirates (UAE) is one of the world’s longest-established LNG exporters. But despite holding the world’s sixth largest gas reserves, LNG imports into the federation increased at an impressive rate since 2010, when the Jebel Ali floating terminal in Dubai started up. With gas representing more than 90% of the power fuel mix, LNG purchases have been key to fill a widening supply deficit in order to match rapidly growing gas-to-power demand. Today, LNG remains at the heart of the UAE’s strategy to meet rising energy consumption and support economic and industrial expansion in times of reduced oil income and budgetary constraints. Cedigaz’s latest report examines the risks and opportunities inherent to this strategy and asks whether it is viable in the medium to longer term.

CEDIGAZ Insights - Page 10

Post COP21- What does the future hold for gas in Southeast Asia?

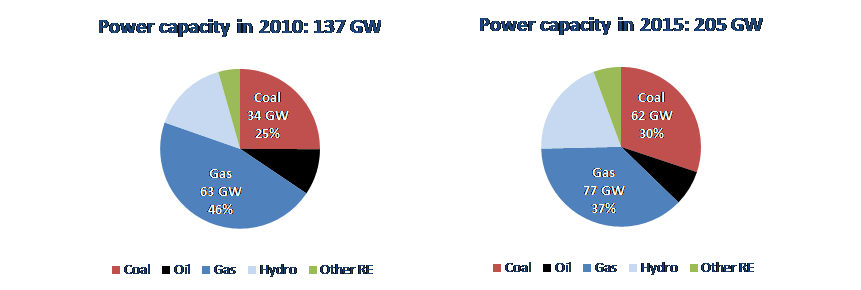

Today, Southeast Asia is again in front of great changes in its energy mix. To meet surging demand, the region must secure a reliable and affordable energy supply. It must also limit the environmental pressures associated with energy consumption. The power sector is fundamental to these changes. Driven by rapid economic growth, demographic and urbanization trends, and the extension of access to modern electricity to larger segments of rural populations, electricity demand is expected to almost triple by 2040.  While natural gas still dominates the regional electricity mix, a shift to coal has been observed since the end of the 2000s driven by the availability of coal in the region and its lower cost than competing fuels. In the short to medium term, this trend is going to continue: there are around 35 GW of coal-based capacity under construction in the region, most of them to be completed by 2020. In addition, there is a huge number of permitted and announced coal-fired power plants in the pipeline, which means that the dominance of coal may continue well after 2020. In the World Energy Outlook 2016 of the International Energy Agency (New Policies Scenario), coal becomes the first source of electricity generation by 2040, despite the increase in electricity generation from renewables. In contrast, the contribution of gas to electricity generation falls by 2040.

While natural gas still dominates the regional electricity mix, a shift to coal has been observed since the end of the 2000s driven by the availability of coal in the region and its lower cost than competing fuels. In the short to medium term, this trend is going to continue: there are around 35 GW of coal-based capacity under construction in the region, most of them to be completed by 2020. In addition, there is a huge number of permitted and announced coal-fired power plants in the pipeline, which means that the dominance of coal may continue well after 2020. In the World Energy Outlook 2016 of the International Energy Agency (New Policies Scenario), coal becomes the first source of electricity generation by 2040, despite the increase in electricity generation from renewables. In contrast, the contribution of gas to electricity generation falls by 2040.

A lot of hot air? – To what extent could gas lose ground in the heating market in Europe

According to the latest CEDIGAZ report, the gas for heating market in Europe, for many years a stable and growing demand source, is on the cusp of significant change, which is likely to lead to major declines over the coming decades. Key uncertainties remain over the pace and extent of these declines, and gas utilities would be well advised to prepare for changes by involvement in district heating and other technologies which maintain gas as part of a lower carbon heating future.

Natural gas is the dominant fuel for heating residential and commercial properties in the EU, providing 47% of both input energy and useful heat in 2013. However, gas for heating faces major challenges in coming decades due to calls for greater energy efficiency and decarbonisation of the heating sector. Although, in the mid-term , expansion of CHPs and DHNs provide some opportunities for gas, long-term forecasts show gas demand for heating declining over the period to 2050, but there are significant variations in the future levels from a business as usual scenario which sees gas demand at 165 bcm in 2050 (compared to 195 bcm in 2013) to a high energy efficiency scenario which at only 44 bcm.