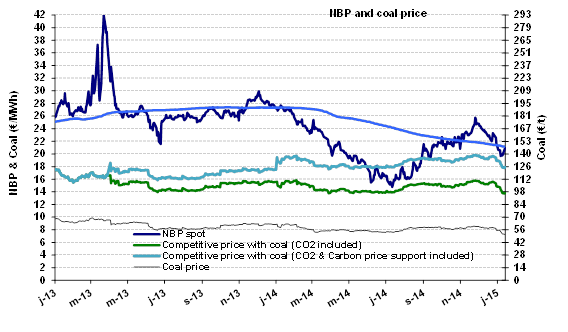

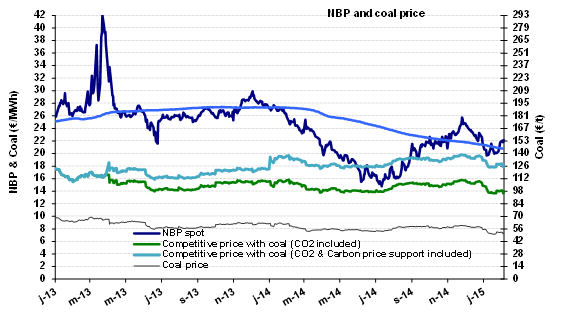

NBP: under temporary pressure, hovering at about $7/MBtu

Due to falling temperatures and delivery constraints, the NBP price has been oriented upwards since the end of January: it rose by more than 9% over two weeks, to about €22/MWh ($7.4/MBtu). However, the overall trend is down. The monthly average for January was €20.5/MWh ($7.0/MBtu), i.e. 11% below the average for December. This general movement is reflected in the 12-month moving average, which is now standing at €20.5/MWh ($7.0/MBtu) after steadily falling since last March (€27/MWh ;$10.8/MBtu). The market is anticipating lower prices in the upcoming months: €19.9/MWh ($6.7/MBtu) next summer and €22.8/MWh ($7.7/MBtu) next winter. These trends are consistent with the current conditions on the market, marked by less pressure on the LNG, coal and oil markets. Given the quantities of LNG available in Asia, the spot prices are coming into convergence with the European market at around $7/MBtu, which encourages the purchase of European LNG. As for oil, the upward shift in the oil price observed since February 2 won’t be changing the downtrend on the natural gas market.

Due to falling temperatures and delivery constraints, the NBP price has been oriented upwards since the end of January: it rose by more than 9% over two weeks, to about €22/MWh ($7.4/MBtu). However, the overall trend is down. The monthly average for January was €20.5/MWh ($7.0/MBtu), i.e. 11% below the average for December. This general movement is reflected in the 12-month moving average, which is now standing at €20.5/MWh ($7.0/MBtu) after steadily falling since last March (€27/MWh ;$10.8/MBtu). The market is anticipating lower prices in the upcoming months: €19.9/MWh ($6.7/MBtu) next summer and €22.8/MWh ($7.7/MBtu) next winter. These trends are consistent with the current conditions on the market, marked by less pressure on the LNG, coal and oil markets. Given the quantities of LNG available in Asia, the spot prices are coming into convergence with the European market at around $7/MBtu, which encourages the purchase of European LNG. As for oil, the upward shift in the oil price observed since February 2 won’t be changing the downtrend on the natural gas market.