In 2014, the purchase of Repsol’s LNG assets in Peru and Trinidad and Tobago brought Shell an additional 4.3 mmtpa in liquefaction capacity and strengthened its global leadership in the LNG upstream sector. With the $70 billion takeover of BG, the Anglo-Dutch major is about to become the unquestionable leader, thanks to the world’s largest and most diverse portfolio. BG’s contracts will provide the company with an unprecedented coverage of global markets, but Shell has to keep developing LNG projects, as the medium- and long-term production of BG’s assets is uncertain.

Natural Gas Market - Page 18

International Gas Prices – April 3 , 2015

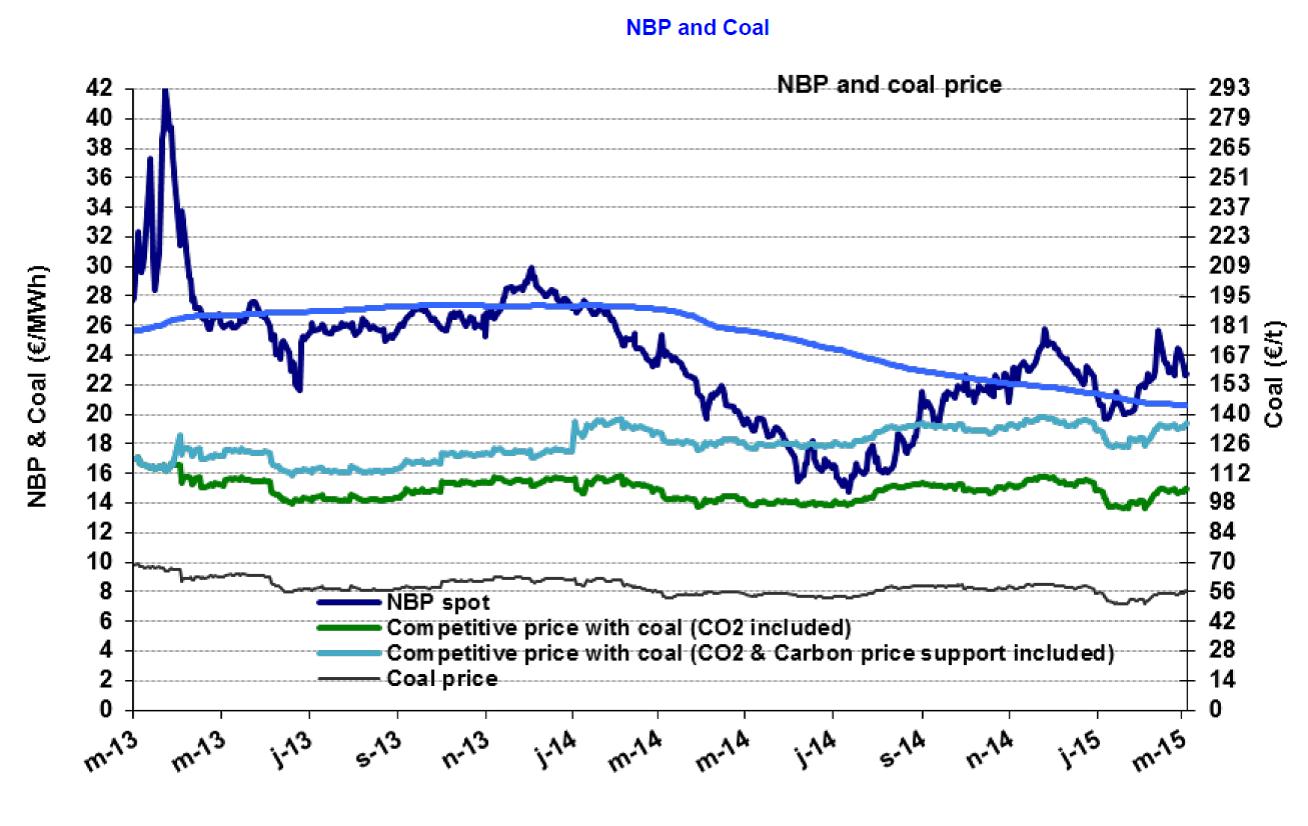

NBP: Long-term and spot prices converging in 2015?

The NBP price averaged €22.3 /MWh ($7.1/MBtu) in March, down 4.5% over February. The average for winter 2014-15 was roughly the same (€22.5/MWh), lower by 16% than that of the previous winter. So concerns over supply (Russia versus Ukraine, uncertainty over Groningue, the storage capacity at Rought) have not had a structural effect on prices.

The NBP price averaged €22.3 /MWh ($7.1/MBtu) in March, down 4.5% over February. The average for winter 2014-15 was roughly the same (€22.5/MWh), lower by 16% than that of the previous winter. So concerns over supply (Russia versus Ukraine, uncertainty over Groningue, the storage capacity at Rought) have not had a structural effect on prices.

In upcoming months, the market is anticipating an average price of €21.5/MWh ($6.7/MBtu) for next summer and €24/MWh ($7.6/MBtu) for next winter. Based on the current forecasts, these levels are moving towards convergence with the prices of oil-indexed contracts. If the trend persists and convergence occurs, this would represent a break with the situation observed since 2009. Between 2009 and 2014, the indexed prices served as a ceiling for the NBP, whose prices were systematically lower.

International Gas Prices – March 5 , 2015

NBP: Under temporary pressure

The NBP price averaged €23.4/MWh ($7.8/MBtu) in February, up nearly 14% compared to January. Two factors exerted upward pressure. First, taking the NBP to €25.7/MWh on Feb. 12, was the Dutch debate over Groningen and its level of production (66% of the country’s total) for 2015 and 2016. The latter was cut to 39.4 bcm from the initial target of 42.5 bcm, like in 2014. Proposals of 35 and 30 bcm were also heard. It was agreed to set the level at 16.5 bcm for first half 2015. Secondly, the negotiations between Russia and Ukraine in late February, with threats of cutting off gas deliveries, also gave cause for concern. The fact that a trilateral meeting took place and a prepayment was made in early March, even if it was small ($15 M for about 50bcm), slightly alleviated market pressure. In early March, the pressure lifted slightly and prices fell to €22.9 /MWh ($7.5/MBtu), 2% lower than in January. The market anticipated an average summer price of €21.6/MWh ($7/MBtu).

The NBP price averaged €23.4/MWh ($7.8/MBtu) in February, up nearly 14% compared to January. Two factors exerted upward pressure. First, taking the NBP to €25.7/MWh on Feb. 12, was the Dutch debate over Groningen and its level of production (66% of the country’s total) for 2015 and 2016. The latter was cut to 39.4 bcm from the initial target of 42.5 bcm, like in 2014. Proposals of 35 and 30 bcm were also heard. It was agreed to set the level at 16.5 bcm for first half 2015. Secondly, the negotiations between Russia and Ukraine in late February, with threats of cutting off gas deliveries, also gave cause for concern. The fact that a trilateral meeting took place and a prepayment was made in early March, even if it was small ($15 M for about 50bcm), slightly alleviated market pressure. In early March, the pressure lifted slightly and prices fell to €22.9 /MWh ($7.5/MBtu), 2% lower than in January. The market anticipated an average summer price of €21.6/MWh ($7/MBtu).