NBP: – 12% in June

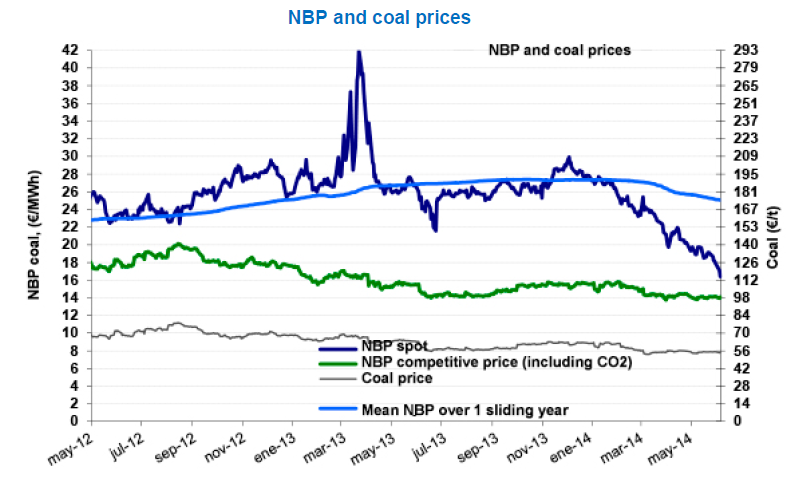

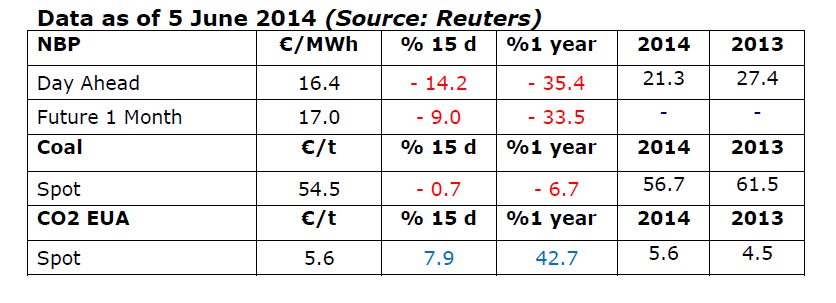

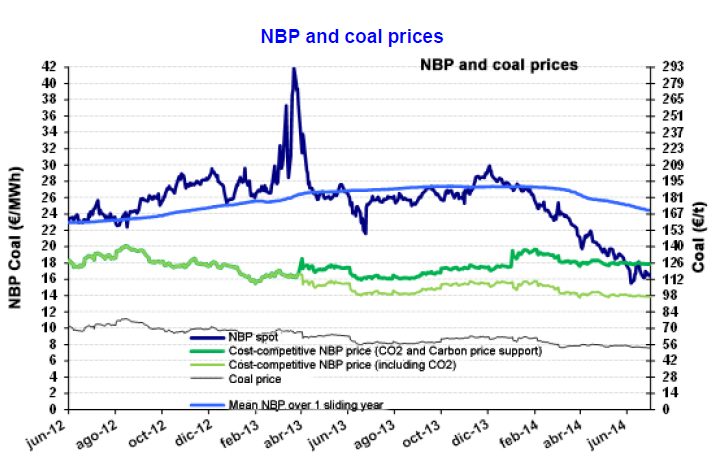

The average NBP price in June stood at €16.8/MWh (US$6.7/MBtu), down 12% on the previous month and down 31% compared with the same month last year. The price of NBP is at its lowest since mid-2010 – and is now cost-competitive with coal in the electricity sector. This means equivalent production costs, factoring in the price of CO2 at €6/tonne, as well as the Carbon Price Support (CPS) effect. Introduced in April 2013 (at £4.9/TCO2), it has been at £9.5/TCO2 since April, significantly increasing the cost of using coal to generate electricity. The cost increase is around €11/MWh, as opposed to €4/MWh for a gas-fired power plant.

The average NBP price in June stood at €16.8/MWh (US$6.7/MBtu), down 12% on the previous month and down 31% compared with the same month last year. The price of NBP is at its lowest since mid-2010 – and is now cost-competitive with coal in the electricity sector. This means equivalent production costs, factoring in the price of CO2 at €6/tonne, as well as the Carbon Price Support (CPS) effect. Introduced in April 2013 (at £4.9/TCO2), it has been at £9.5/TCO2 since April, significantly increasing the cost of using coal to generate electricity. The cost increase is around €11/MWh, as opposed to €4/MWh for a gas-fired power plant.