Global gas market fundamentals have trended upward in 2017. Global natural gas consumption rose by 3.3% to reach a new peak of 3640 bcm in 2017, according to CEDIGAZ First Estimates (May 2018). Macroeconomic factors (abundant natural gas supply, economic growth) contributed to this bullish trend. Regulatory and policy factors also explained this performance. Considering the average growth of 1.5%/year of the five previous years, the 2017 performance looks impressive.

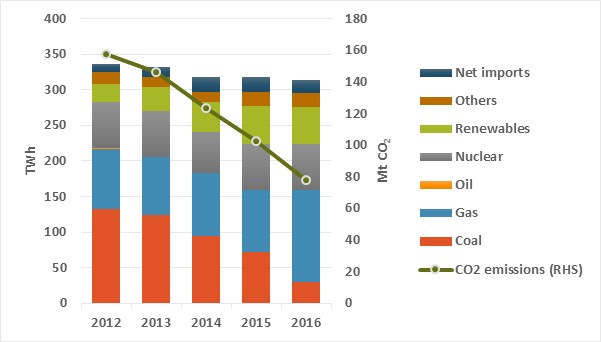

The biggest story of the gas markets in 2017 was the huge growth in Chinese demand (+ 15%; + 30 bcm). This achievement mainly resulted from the ongoing intensification of environmental policy, enhancing coal-to-gas switching. The Middle East and Africa both also posted strong increases, at 4.8% and 6.7% respectively, aided by improving infrastructure, incremental CCGT generating capacity and availability of gas (Iran, Egypt…). In Europe (Turkey included), natural gas consumption was up 4.8%, helped by both the competitiveness of gas relative to coal and the weakness in nuclear and hydro energy. In the CIS, natural gas consumption returned to growth in Russia, driven by heating and the resumption of industrial activity. In the opposite direction, consumption was sluggish in North America (United States) and South & Central America. In the United States, gas consumption posted an unusual drop in 2017 (- 1.4%), following seven years of strong growth, amid higher natural gas prices. Natural gas consumption in the power sector fell by more than 7% as the strong expansion of renewables affected gas position in the power merit order.