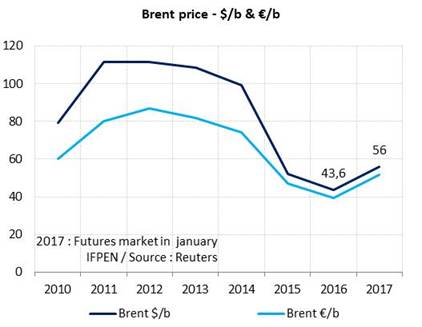

Brent: $50 to 60/b in 2017 (2016: $43.6/b) Futures market in January

For the last six months, the estimated Brent price for 2017 has been in the $50-56/b range, up from $43.6/b in 2016, i.e. a potential gain of between 16 and 30%. This market scenario is based on the following assumptions for 2017: oil demand will rise significantly (+1.3 Mb/d according to the International Energy Agency), observance of the OPEC/non-OPEC output agreement of 2016 will be fairly good, and production in Libya, Nigeria and the United States will see a slight increase (+0.3 Mb/d). It is not clear whether all three of these assumptions will hold true. If the agreement is strictly upheld without a notable increase in U.S. supplies, the resulting pressure would most likely push the price past $60/b. Inversely, if the agreement is not well observed and U.S. supplies increase sharply between now and the end of 2017, the price could end up below $50/b. Both of these contrasting scenarios are credible, so the oil price volatility seen in 2016 will probably continue this year. NBP: €16-19/MWh for 2017 (€14.4/MWh; $4.7/MBtu in 2016) Natural Gas prices

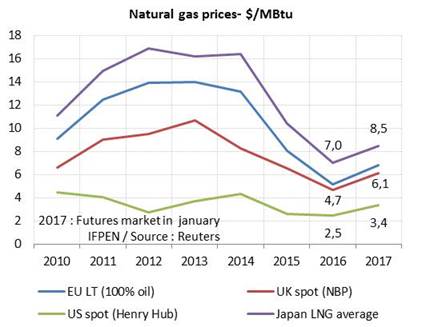

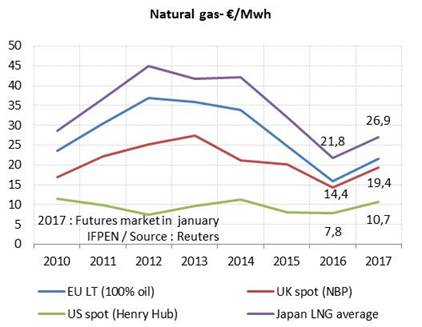

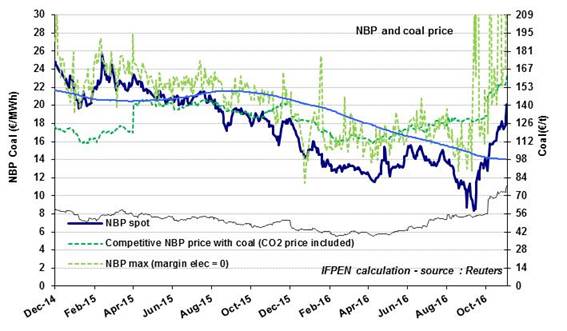

The 2017 gas market price in the United Kingdom (NBP) should be between €16 and 19/MWh ($5-6/MBtu), versus €14/MWh ($4.7/MBtu) in 2016, i.e. a gain of between 11 and 33%. Since 2013 (€27/MWh; $10/MBtu), the gas price has steadily dropped for different reasons: economic growth has been sluggish, coal was more competitive than gas until 2015, the winter of 2015-16 was mild, and the oil price fell in 2015 and 2016. These factors drove the gas price to an especially low level in 2016. For 2017, the markets are forecasting prices of about €21/MWh ($6.5/MBtu) for winter and €18/MWh ($5.6/MBtu) for summer. The actual level will depend on the stocks draw (a function of winter weather conditions) and on the oil price. Indexed European prices: €18-22/MWh in 2017 (€15.9/MWh; $5.2/MBtu in 2016) Natural gas – Euros

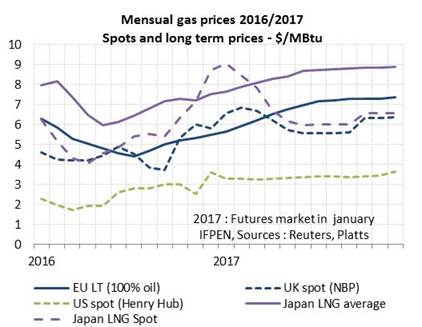

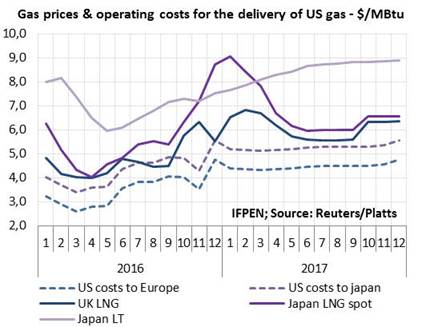

In Europe, the price of 100% oil-indexed contracts could gain between 13 and 37% in 2017. The upper limit value is based on mid-January forecasts for the Brent price ($56/b) and the euro ($1.07). This type of contract is used less and less in Europe. In France, for instance, it is estimated that nearly 80% of contracts are now indexed to market prices (short-term, spot or equivalent). Nevertheless, oil-indexed contracts continue to have an influence, serving as a yardstick for prices in a tight market. This occurs in winter, when spot prices for gas are likely to approach or exceed long-term prices, depending on the severity of the weather conditions. On the other hand, spot prices in summer are generally lower than the indexed prices. The indexed prices in Asia could reach €27/MWh in 2017 ($8.5/MBtu) compared to €21.8/MWh ($7.1/MBtu) in 2016. Unlike in Europe, long-term oil-indexed contracts still represent a preponderant share of supplies: 70% in 2014, according to the EIA. The historic purchasers of LNG are trying to renegotiate the historic formulas applied to long-term contracts. They wish to improve the coefficients linking the price of gas to that of oil and strengthen references to spot market quotations. They are also seeking larger spot-based deliveries, especially from the United States. These short-term prices came under fairly strong pressure between December and January, reaching $9/MBtu, thus exceeding the price of long-term contracts. The markets expect demand to fall off in the spring, at which time the gap between European and Asian spot prices should narrow?. Henry Hub: $3-3.5/MBtu in 2017 ($2.5/MBtu in 2016) Mensual gas prices 2016-2017 In the United States, it is thought that the Henry Hub price for 2017 will be in the $3-3.5/MBtu range. Compared to the 2016 price of $2.5/MBtu (€7.8/MWh), this would represent a progression of between 19 and 37%. 2016 was marked by a drop in production and cold winter conditions making it necessary to draw on stocks. These two factors explain why the price rose during the year. For 2017, the production increase should be absorbed by growth in demand and, especially, in exports (+15 bcm for LNG). This should lead to a downdraw estimated at 10 bcm, like in 2016 but in contrast with year-end 2015, when there was an accumulation of stocks (+21 bcm). The U.S. price, expected to come under pressure for these reasons, remains fairly low compared to the prices in Europe and Asia. In any case, the projected stock level is a parameter that will help determine the equilibrium price for the United States. The impact of gas and coal price trends on the cost of electricity in Europe

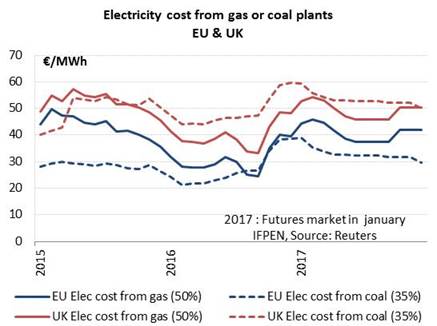

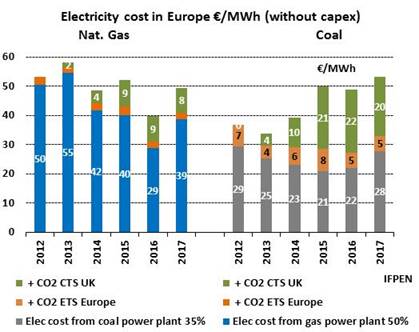

Along with higher gas prices, the markets expect 2017 to bring a sharp increase in the coal price, whose annual average should jump from $59/t to 76/t. However, the coal price is expected to decline steadily throughout the year. These two energies play a significant role in the formation of the electricity price. In the United Kingdom, the price is primarily based on the maximum cost of producing electricity from coal or gas. The parameters are a bit more complex in France or Germany. One must also account for the fact that different CO2 prices are retained: €5/TCO2 for Europe versus €26/TCO2 for the U.K. (including the carbon tax). Since the carbon tax doubled in April 2015, it has ensured that gas is competitive with coal in the U.K., which will continue in 2017. On the Continent, however, gas will be less competitive than coal. One notes that the carbon tax increases the cost of generating electricity, which is why electricity market prices are higher in the United Kingdom (€50/MWh in 2016) than on the European continent (€30/MWh in Germany and €34/MWh in France). Report on U.S. LNG

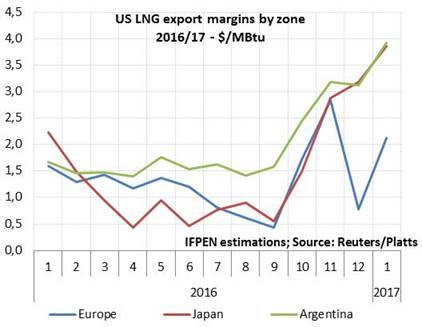

In 2016, about 60% of U.S. LNG exports went to South America, followed by the Middle East (20%), Asia (14%) and Europe (6%). U.S. LNG exporters could get higher margins in South America, which explains this breakdown. In 2017, U.S. LNG exports should be around 15 bcm. Like last year, the margins will determine the destination of these quantities, still marginal in the market as a whole. The first indications based on market price forecasts give the European market a slight advantage. However, said advantage is not decisive and things can change in the course of the year. For now, there is no clear connection between regional prices and the cost of delivered U.S. LNG, including shipping. But eventually, given the build-up of U.S. exports, some think that a reference price will gradually be set for each region based on the delivery cost of U.S. LNG, including shipping. It would have to correspond to the last volume required to balance the market, i.e. the “cargo of last resort” (the marginal supply). This is not going to happen anytime soon, unless, perhaps, if a period of low demand occurs, especially in summer. And, looking at the near future, this scenario doesn’t seem credible on an annual basis, not unless a particularly mild winter occurs and demand for LNG slumps. The prices for 2017 reflect past and present trends in forward prices as of end January, but are not forecasts and should not be considered as such. Economic, climate-related and/or geopolitical factors can have a strong impact on future trends.

By Guy Maisonnier – Senior Economist – IFPEN |

Natural Gas Market - Page 9

The latest statistics of the International Gas Association CEDIGAZ show a continued slowdown in gas demand growth

CEDIGAZ’ Natural Gas in the World 2016 report confirms the provisional estimates published early May, showing a moderate natural gas demand growth in 2015 for the third year in a row. Global gas consumption grew by 1.5%, still below the ten-year growth rate of +2.2% despite low gas prices. The global marketed natural gas production growth was again led by the United States (shale gas).

Like in 2014, the natural gas expansion was constrained by some demand side factors which have offset the impact of low gas prices: intense competition with cheaper coal (and oil in China) in both industrialized and emerging markets, the development of nuclear and renewables, as well as increased energy efficiency, weak power generation growth and the sluggish economic context.

International Gas Prices – November 7 , 2016

NBP: Strong upward pressure

In October, the NBP price saw a spectacular 44% rise to €16.4/MWh ($5.3/MBtu). This is slightly higher than the price of oil-indexed contracts, a sign that the market is tightening. The NBP continued to climb in early November and now stands at about €20/MWh ($6.5/MBtu). With the slowdown in exports from the United Kingdom to Europe via the Interconnector, this phenomenon now affects all European gas prices.

In October, the NBP price saw a spectacular 44% rise to €16.4/MWh ($5.3/MBtu). This is slightly higher than the price of oil-indexed contracts, a sign that the market is tightening. The NBP continued to climb in early November and now stands at about €20/MWh ($6.5/MBtu). With the slowdown in exports from the United Kingdom to Europe via the Interconnector, this phenomenon now affects all European gas prices.