Highlights from the latest update of Cedigaz’ Worldwide UGS Database.

No significant changes compared with 2015, except in Europe

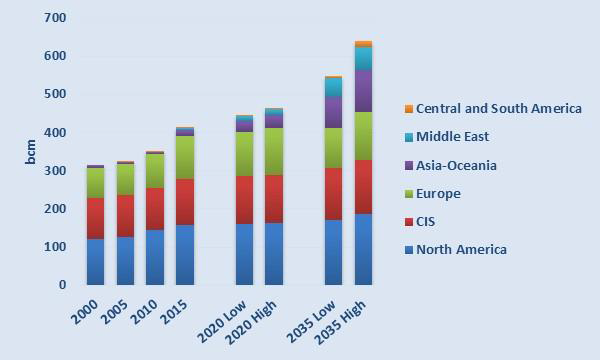

As of end 2016, there were 672 underground gas storage (UGS) facilities[1] in operation in the world, representing a working gas capacity of 424 billion cubic meters (bcm), or 12% of 2016 world gas consumption. The number of storage facilities has decreased (680 UGS in 2015), mainly due to closure/mothballing of UGS in the United States and Europe. However, the global working capacity has slightly increased (+11 bcm) driven by expansions in the Commonwealth of Independent States (CIS), the Middle East and China. In Europe, storage capacity has continued its decline. Working gas capacity decreased by 5.8 bcm due to the closure of storage facilities in Germany, Ireland and the UK. The temporary closure of the Rough depleted field was confirmed as a permanent one in June 2017. This sharply reduces the UK storage capacity, and especially its seasonal storage capacity.