Asia: overall year-on-year stagnation amid weaker growth in China

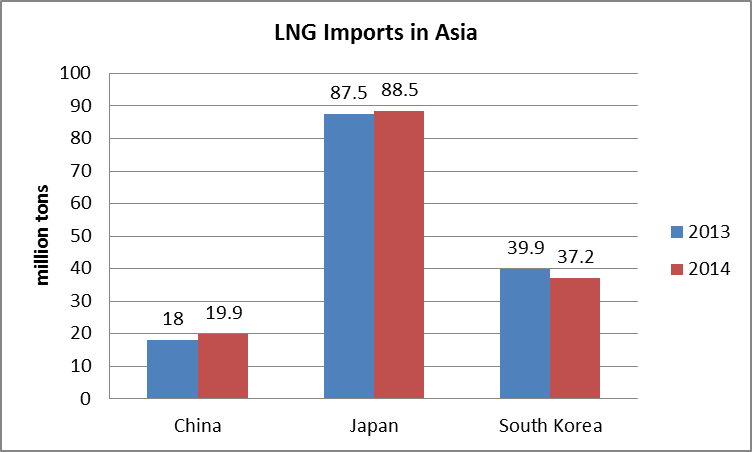

In Asia, the volume of LNG imported by the three largest consumers – Japan, South Korea and China – has stagnated overall, from 145.4 million tons in 2013 to 145.6 million tons in 2014. Japan imported 88.5 million tons in 2014 versus 87.5 million tons in the previous year, while South Korean imports decreased by 6.8% down to 37.2 million tons due to the restart of some nuclear plants, strong competition from coal and mild temperatures. Chinese imports growth has markedly decelerated to 10.4% versus 23% in 2013 and 20.3% in 2012.

In Asia, the volume of LNG imported by the three largest consumers – Japan, South Korea and China – has stagnated overall, from 145.4 million tons in 2013 to 145.6 million tons in 2014. Japan imported 88.5 million tons in 2014 versus 87.5 million tons in the previous year, while South Korean imports decreased by 6.8% down to 37.2 million tons due to the restart of some nuclear plants, strong competition from coal and mild temperatures. Chinese imports growth has markedly decelerated to 10.4% versus 23% in 2013 and 20.3% in 2012.

Europe (11 months): towards another year of declining LNG imports

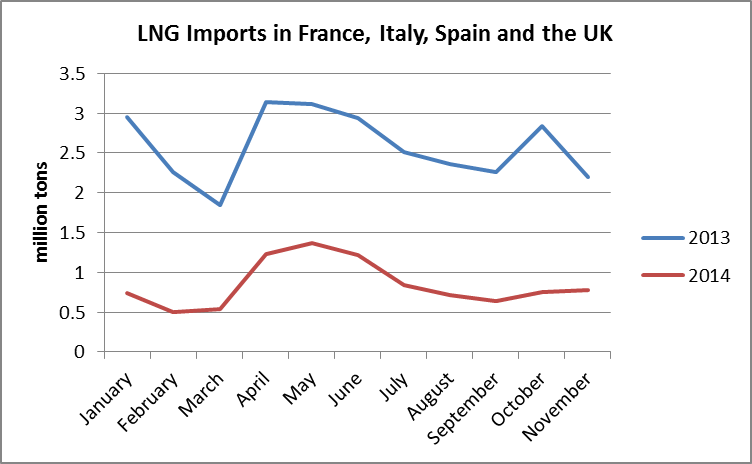

In Europe, LNG imports have fallen in the first eleven months of the year. The largest importers – France, Italy, Spain and the United Kingdom – received 24.3 million tons from January to November 2014 compared to 28.4 million tons for the same period a year before. This represents a 14.4% average decrease, but differences between countries are significant. In Italy, imports decreased by almost 50%, from 3.7 million tons in 2013 to 1.9 million tons in 2014 for the January to November period. In the United-Kingdom, imports have been only 6.7% lower, from 7.5 million tons to 7.0 million tons.

In Europe, LNG imports have fallen in the first eleven months of the year. The largest importers – France, Italy, Spain and the United Kingdom – received 24.3 million tons from January to November 2014 compared to 28.4 million tons for the same period a year before. This represents a 14.4% average decrease, but differences between countries are significant. In Italy, imports decreased by almost 50%, from 3.7 million tons in 2013 to 1.9 million tons in 2014 for the January to November period. In the United-Kingdom, imports have been only 6.7% lower, from 7.5 million tons to 7.0 million tons.

North America (11 months): LNG imports down to a trickle

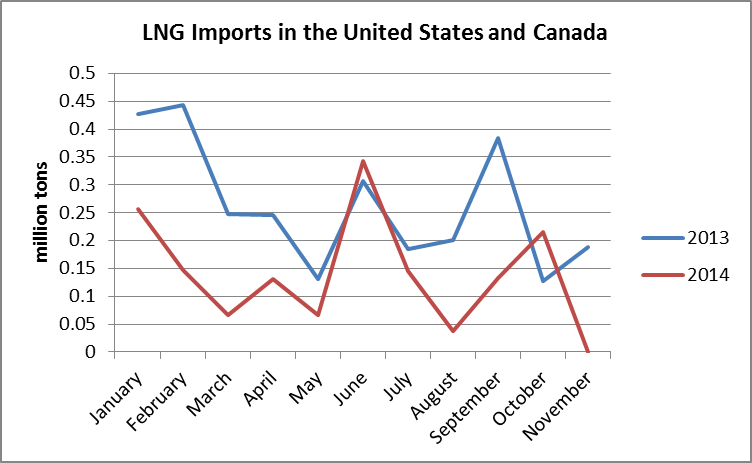

In North America, November was landmark as the United-States have not received any cargo for the first time since 1996. As increasing shale gas production is reducing the continent’s dependence on natural gas imports, Canadian and US LNG imports have reduced almost by half from 2.9 million tons in 2013 to 1.5 million tons in 2014 for the January to November period. These decreasing imports also mark the transition towards LNG exports, as the United-States is expected to send its first shipment from the Sabine Pass liquefaction plant at the end of 2015.

In North America, November was landmark as the United-States have not received any cargo for the first time since 1996. As increasing shale gas production is reducing the continent’s dependence on natural gas imports, Canadian and US LNG imports have reduced almost by half from 2.9 million tons in 2013 to 1.5 million tons in 2014 for the January to November period. These decreasing imports also mark the transition towards LNG exports, as the United-States is expected to send its first shipment from the Sabine Pass liquefaction plant at the end of 2015.

The LNG Monthly Bulletin is part of the LNG Service by Cedigaz.

by Louis Jordan, Junior Economist, Cedigaz