Amidst the gas supply crisis aftermath in Europe and with global spot gas prices remaining in the double-digit range for the past years, the EastMed natural gas sector has been attracting growing attention from major producers, investors, and potential gas buyers. With vast reserves amounting to trillions of cubic meters, the EastMed countries hold the potential to bolster their own energy security and expand global gas export capabilities alleviating pressure in the tight gas market.

The latest CEDIGAZ report “East Mediterranean Natural Gas Markets-2023: in Search of Development Pathways” authored by Alexander Kislov and Gina Cohen, presents a thorough analysis of the development of the EastMed natural gas province, examining the most recent advancements in Egypt, Israel, Türkiye, Cyprus, Jordan, and Lebanon, and perspectives of new large-scale gas exports projects. While the future of the EastMed natural gas province is contingent on various factors, the detailed information and complete data presented in the report provide an opportunity to outline the potential outcomes and contours of the EastMed puzzle.

Understanding the EastMed natural gas province is akin to navigating a complex jigsaw puzzle, involving interests of states and private companies, geopolitical considerations, and infrastructure capacities. The complexity of the economic and political landscape is further complicated by significant shifts in countries switching between net-importer and net-exporter roles, presenting diverse patterns in the development of their gas balances, as well as of inter-state relationships.

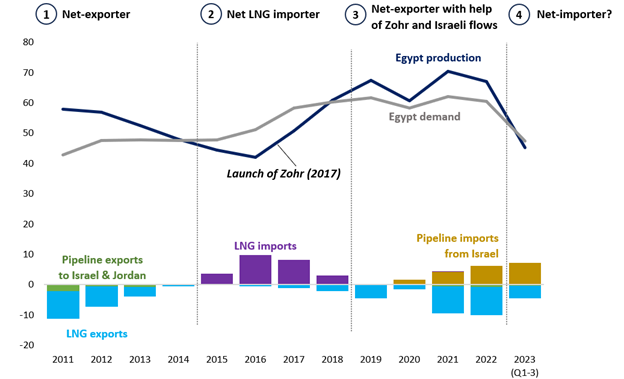

Egypt, largest market in the region, experienced fluctuations in its natural supply. It shifted from a net gas exporter to a net LNG importer in 2015 and back to net exports in 2019, benefitting from Zohr field output and increased imports of Israeli gas. However, the evolving situation in Egypt, marked by sliding production from Zohr and rising local consumption, led to the underutilization of Egypt’s LNG export plants in 2023, despite the increased flow of affordable Israeli pipeline gas.

Egypt natural gas market development key stages 2011-2023 (Q1-Q3), bcm

Over the past decade, Israel‘s offshore sector has transformed into an exploration and production hotspot. As of 2023, Israeli gas exports are meeting the bulk of Jordan‘s demand and are supporting Egypt’s gas balance. Israel possesses substantial gas reserves exceeding 1 tcm, enabling the potential for increased exports to both regional and global markets.

Both local and global entities have investment plans aimed at further unlocking Israel’s natural gas reserves. In view of the recent Israeli-Hamas conflict, those plans might be delayed, but are unlikely to be abandoned: Chevron affirmed its commitment to pursuing expansion plans for gas developments despite the conflict, while BP confirmed that its joint bid with ADNOC to acquire a 50% stake in Israeli gas producer NewMed Energy remained on track.

Map of Israel’s key gas fields & export pipelines, Egypt, Jordan LNG infrastructure

With Israel’s gas demand secured, the future developments revolve around how Israel can facilitate the path for its abundant gas reserves to reach the global gas market. One of the options considered is increasing Israeli gas exports to Egypt, subsequently exporting LNG via Egyptian LNG plants.

The partners of the Leviathan field are also exploring the project of using an FLNG facility, which would grant the ability to make market arbitrages and export gas to the fast-growing Asian market.

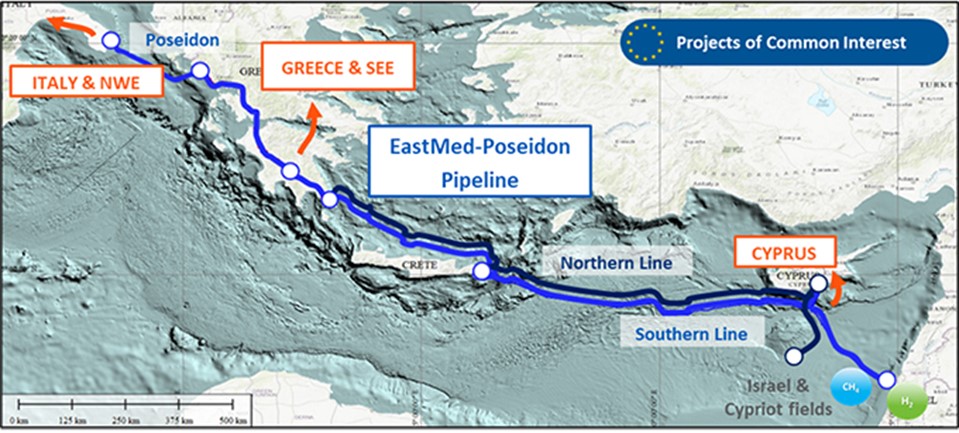

Simultaneously, IGI Poseidon, the operator of the proposed EastMed pipeline, completed FEED in 2023. On top of Israeli fields, the project might also tap into Cypriot reserves, and thus provide an impetus for Cyprus’s gas market development, which is just about to begin.

EastMed pipeline route

Within the EastMed region, Cyprus has been a bit of an outlier neither producing, importing, nor consuming gas. However, 2024 will hopefully witness a change: Cyprus is about to start importing LNG via a newly positioned FSRU and is due to move ahead with a development plan for its first discovery, Aphrodite, boosting about 100 bcm resources.

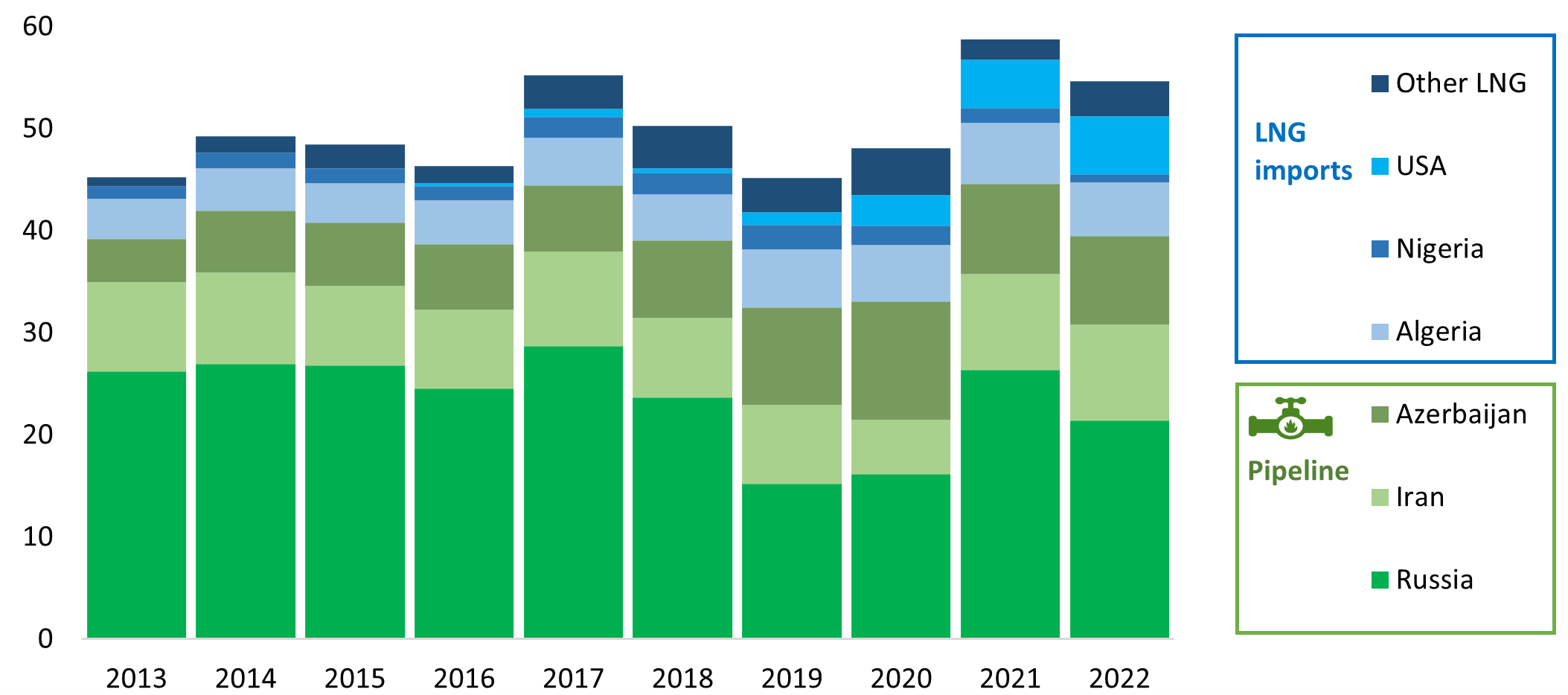

Finally, before the outbreak of the Israeli-Hamas conflict, there was momentum behind the project to build a pipeline from Israel to Türkiye, with President Erdogan at the time expressing intentions to advance the initiative. This pipeline would align with Türkiye’s aspirations to establish itself as a gas hub, leveraging its abundant natural gas infrastructure, diversified imports sources, operational interconnectors with mainland Europe’s gas markets. The repercussions of the Israel-Hamas conflict may temporarily defer the pipeline to Türkiye as a monetization option for Leviathan’s expansion project. However, it is worth noting that Israel-Türkiye relations have experienced significant fluctuations in the past, suggesting that the pipeline project could be reconsidered in the future.

Türkiye natural gas imports by supply country in 2013-2022, bcm

Irrespective of the chosen export project among those mentioned, the EastMed energy and geopolitical landscape would undergo significant transformation. Beyond export initiatives, potential changes could be driven by new offshore discoveries. Egypt, Israel, and Lebanon are actively inviting international majors to undertake offshore exploration, opening the path for discovering new fields.

The future trajectory of the EastMed gas market holds potential to profoundly reshape the region’s energy and geopolitical landscape. Furthermore, if the key stakeholders can align their interests and engage in a collaboration for a new export project, there is a promising outlook for EastMed to evolve into a prosperous natural gas province not only with regional but also global impact.

***

January 2024 – Format PDF – 50 pages

Contact us: contact@cedigaz.org

CEDIGAZ is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). CEDIGAZ collects and analyses worldwide economic information on natural and renewable gases in an exhaustive and critical way.