CEDIGAZ, the International Gas Association, has just released its « Medium and Long Term Gas and LNG Outlook 2023 », which provides projections on natural gas and low-carbon gases markets to 2050.

CEDIGAZ Reference Scenario assumes a strong acceleration of the energy transition towards a low-carbon economy, incorporating specific government targets and CO2 emissions reduction commitments, corresponding to a global warming of 2.1 °C by 2100. The evolution of the world energy mix is driven by strong energy efficiency improvements, a fast expansion of clean electrification and low-carbon technologies. CEDIGAZ 2.1 °C Scenario highlights that natural gas and low-carbon gases will play an important role in a context of the decarbonization of the world energy system. Natural gas will be gradually supplanted by low-carbon gases in OECD markets, whereas in non-OECD markets, especially in Asia, both natural gas and low-carbon gases will grow significantly in the long term. Additional investments in new international gas and LNG projects are required to meet future global demand. Achieving carbon neutrality, energy security and sustainability will mean profound changes in global gas dynamics and a rebalancing of global gas flows towards Asia. Decarbonization efforts imply the reduction of all GHG, including methane emissions, along the whole international supply chains. The expansion of low-carbon gases, especially hydrogen, requires a supportive and appropriate political and regulatory framework as well as an adaptation of natural gas infrastructure to a future low-carbon economy.

- Natural gas and low-carbon gases will play an important role to meet the challenges of the energy trilemma

- CEDIGAZ Scenario involves a strong acceleration of the energy transition towards a low carbon economy.

- CEDIGAZ expects large scale clean electrification of end use with a significant development of renewables (wind & solar) and low carbon technologies, like hydrogen and CCUS.

- Energy consumption is expected to grow by 9% from 2021 to 2050, corresponding to a modest growth rate of 0.3%/year over the 20-year period.

- Economic and demographic growths are outweighed by significant improvements in energy efficiency, reflecting in a 2.4% decline in global energy intensity.

- CO2 emissions will fall by almost 40% from 2021 to 2050 to approximately 21 Gt in 2050, resulting in temperature rising by 2.1°C in 2100.

- Fossil fuels will account for less than half of the world energy mix by 2050, compared to a 77% share in 2021.

- Natural gas will continue to play an important role in the energy transition, accounting for around 20% of the energy mix by 2050. By contrast, the share of coal collapses from 26% in 2021 to 8% in 2050, while the share of oil falls from 29% to 20%.

- Natural gas will play a crucial role in the energy transition, in particular in the power and industry sectors by replacing more polluting fossil fuels.

- Renewable energy supply (wind & solar, hydro & bioenergy) will expand fast, accounting for 44% of the world energy mix in 2050, against 22% in 2030 and 18% in 2021.

- Nuclear will play a growing role: its share in world energy supply grows from 5% in 2021 to 9% in 2050.

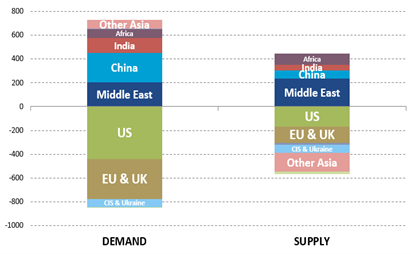

Non-OECD natural gas markets will continue to expand to 2050, while natural gas demand in OECD markets will fall strongly along a low-carbon pathway.

- Natural gas demand will grow by 0.6%/year over 2021-2030, will plateau over 2030-2035 before declining in the longer term. The 2050 level, reaching 3900 bcm, is 3% below the 2021 level and 8% below the 2030 level.

- Non-OECD Asian markets represent the key growth natural gas market, followed far behind by the Middle East and Africa.

- At the national level, the largest growths in volume terms over the 2021-2050 period are expected in China and India. China will outpace the United States and Russia to become the largest gas consuming country.

- Reversely, a strong reduction in natural gas demand is expected in the EU & UK (- 4.7%/year), as well as in the United States (- 2.4%/year) and Japan (- 2.6%/year). CEDIGAZ Scenario sees the Fit for 55 target for EU natural gas demand achieved in 2030 and the strong decline trend to continue afterwards.

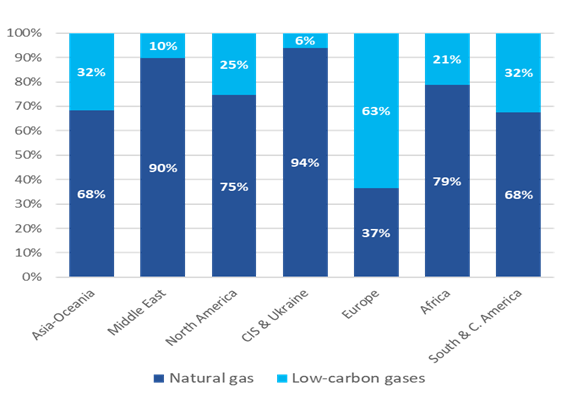

- Low-carbon gases (including biomethane and low carbon hydrogen) will grow strongly in relative terms at a rate of 22%/year by 2050.

- Adding low-carbon gases, total gases demand grows by 1%/year to 2050. Low-carbon gases will account for 27% of total gases demand in 2050, including a 22% share for low-carbon hydrogen (green/blue).

- The growth of low carbon hydrogen demand will be limited and concentrated in Europe and North America by 2030, before a global more rapid development at scale afterwards.

- Over the 2021-2030 period, the United States is by far the fastest producing market, accounting for almost two-thirds of the global incremental natural gas supply. US natural gas production is then expected to plateau over 2030-2035 before declining. The cut of US natural gas production in the long term is a result of the reduction of local natural gas demand, whereas a growing share of natural gas supply is exported.

- Natural gas production in the Middle East will continue to grow strongly in the long term and the region will become the largest natural gas producing centre in 2050.

- In CEDIGAZ Scenario, the Russian-Ukrainian conflict has a long term negative impact on Russian natural gas production dedicated to pipeline natural gas and LNG exports to Europe.

Figure 1: Variations in natural gas supply and demand by market (bcm)

2021-2050

Source: CEDIGAZ Medium and Long Term Gas & LNG Outlook 2023

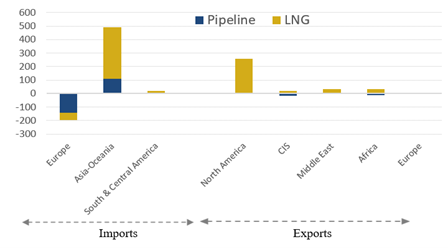

- LNG trade will play a fast-growing role in global natural gas supply, driven by non-OECD Asia on the demand side, and the United States on the supply side.

- Net Inter-regional (long distance) trade is forecast to grow by 1.5%/year to 2050, accounting for a growing share of world natural gas supply.

- In terms of exports, North America will considerably increase its market share in inter-regional gas trade from 15% in 2021 to 39% in 2050, whereas that of the CIS will fall from 47% to 31%.

- In terms of imports, the share of Europe will collapse from 47% in 2021 to 15% in 2050, whereas that of Asia will surge from 41% to 82%. reflecting a profound shift of global trade flows towards the Pacific Basin.

- LNG expands rapidly to the detriment of pipeline gas. The share of LNG in net inter-regional flows will progress from 51% in 2021 to 72% in 2050.

- The Russian-Ukrainian conflict leads to a rebalancing of global gas flows towards Asia.

- Total LNG demand will grow by 4.5%/year to 2030, driven by both Europe and Asia. Over 2030-2050, LNG demand growth will be concentrated in China, India and other Asian emerging markets, while LNG demand in Europe will decline strongly.

- The growth in global LNG supply will be largely dominated by the United States in both the medium and long term, as this country will benefit from an abundant low-cost LNG surplus.

- The global LNG market will remain tight over 2022-2027, especially if current post-FID Russian LNG projects are hampered. Investment in new international LNG projects is needed to meet a growing global supply gap post-2027-28.

Figure 2: Structure of gases demand by region in 2050

Source: CEDIGAZ Medium and Long Term Gas & LNG Outlook 2023

Figure 3: Variations in net inter-regional natural gas trade by region (bcm)

Source: CEDIGAZ Medium and Long Term Gas & LNG Outlook 2023

For more information: contact@cedigaz.org

Cedigaz is an international association with members all over the world, created in 1961 by a group of international gas companies and the IFP Energies nouvelles (IFPEN). Dedicated to gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, renewables gases (biogas & hydrogen), LNG and unconventional gas in an exhaustive and critical way.