The latest statistics of the International Gas Association CEDIGAZ indicate that natural gas has pursued steady expansion. CEDIGAZ Survey Natural Gas in the World 2017 confirms the first estimates published early May, showing a 1.6% growth in global gas consumption in 2016, which is in line with the past five-year average. In recent years, the role of natural gas in the energy mix has slightly progressed, against the background of falling coal consumption and rising renewable energy production. Natural gas is expected to pursue similar growth trend in the short and medium term in the context of the energy transition towards an increasingly renewable-based, efficient and sustainable energy system.

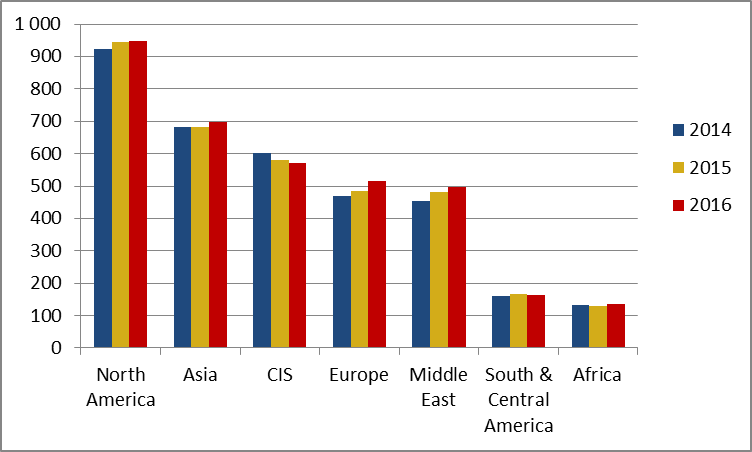

Since 2015, European gas consumption has returned to growth, mainly due to cold weather and coal to gas switching in the power sector. In 2016, Europe contributed for the largest part of the global consumption growth, as EU gas consumption soared 7.4% to 460 bcm. Consumption also increased significantly in Asia (+ 17 bcm) and the Middle East (+ 17 bcm). Reversely, consumption fell in South & Central America (- 2.4%) and the CIS (- 1.6%) amid poor economic conditions. Global consumption is boosted by emerging economies (chiefly China), which recorded a 3% growth in 2016 and 2015.

Evolution of world gas consumption by region (bcm)

Source: Cedigaz

Excluding total storage variations, global gas supply edged up 0.2% to 3502 bcm in 2016. Marketed production marked an abrupt halt in 2016 after a gradual growth of almost 2%/year on average over the five previous years. This break is mainly attributed to the US, where gas production fell for the first time since the US shale revolution began as gas (and oil) prices fell. This decline was offset by a continued strong growth in the Middle East and Asia-Oceania. Global production of unconventional gas surged 5.3% to 817 bcm and North America still covers more than 85% of the world total.

World gross natural gas production increased at a higher rate than marketed production, up 0.6% to 4384 bcm. Significant increases were observed in the volumes of reinjected gas (+ 1.2%), flaring/venting (+ 2.2%) and shrinkage (+ 3%), this latter results from the extraction of liquids, processing and field operations.

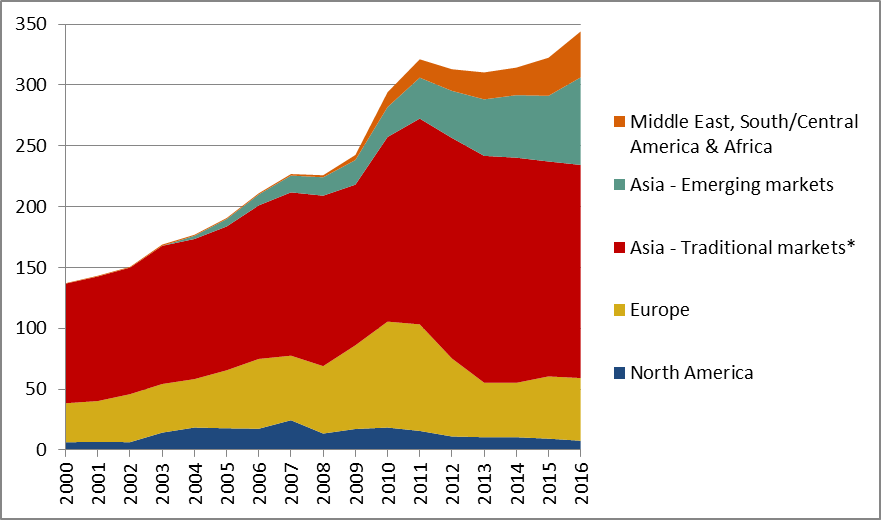

International natural gas trade accelerated in 2016, up 6.2% to 1107 bcm, addressing regional imbalances (Europe) and local gas shortages. This expansion was fuelled by both pipeline trade (+ 6.1%) and LNG flows (+ 6.4%). 2016 was the first year of the LNG supply surge that most market analysts predicted. Interregional (long-distance) trade grew faster by 7.2% to 478 bcm, on rising Russia’s exports to Europe. European dependence on extra-regional imports rose 3 points, while that of Asia inched down as intra-regional LNG supply picked up (Australia).

Evolution of net LNG imports by geographic zone (bcm)

*Japan, South Korea and Taiwan

*Japan, South Korea and Taiwan

Source: Cedigaz

In 2016, international gas prices followed a downtrend, reflecting an increase in available supply, together with a moderate growth in global gas demand. Weak market fundamentals and low oil prices led to both a reduction in international gas prices and a convergence among regional benchmarks. Northeast Asia has showed a price premium as the much-anticipated LNG supply increase has been consumed by Asian markets before it reaches Europe.

For more information: contact@cedigaz.org

Our website: https://www.cedigaz.org/

Cedigaz is an international association with around 80 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.