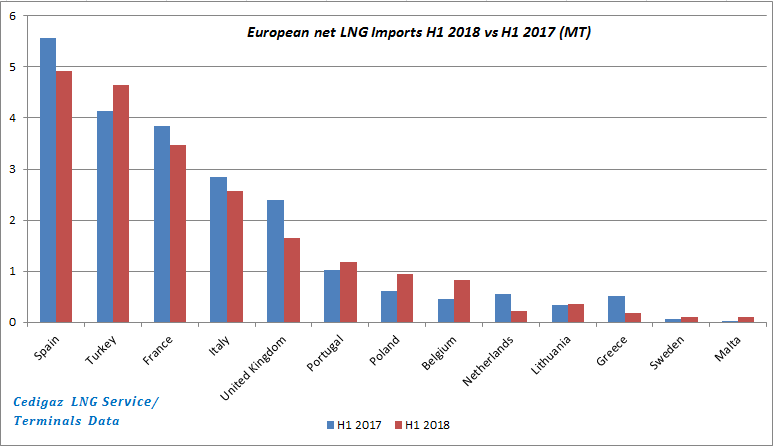

European net LNG imports in H1 2018 did not sustain the growth momentum which was seen in 2017 (nearly 5% Y-o-Y growth in H1 2017) as total LNG net imports fell by 5% (-1.21 MT YoY) to reach 21.2 MT. This trend was mainly the result of higher re-exports, which went up 1.1 MT YoY, and strong declines in net LNG imports in Spain, the UK and France.

In Southern Europe, net LNG imports were down 8.7% to 12.1 MT, as imports in France, Spain and Italy declined. LNG imports in Spain declined by 12 % (-0.65 MT), counterbalanced by pipeline imports from Algeria which grew 18% compared to last year. Spanish LNG imports from Peru were down by 0.88 MT and this was partially offset by increased purchases from Trinidad and Tobago (+0.67 MT). In France, re-exported volumes surged by 0.72MT YoY, resulting in a 10% decline (-0.4 MT) in net LNG imports. The re-exported cargoes from France landed mainly in Asia (China, South Korea, India) and the Middle East (Kuwait). In Italy, LNG imports were down by 10% (-0.28 MT) as the power sector gas demand weakened in H1 2018, while hydroelectric power generation increased. Portugal was the only Southern European country where LNG imports were up, albeit marginally (+ 0.15 MT).

Figure 1: European LNG Importers in H1’18 (net of re-exports)

In Northwest Europe, net LNG imports were down 19% to 2.82 MT as net imports in the UK and the Netherlands decreased by 0.74MT and 0.33 MT. In the UK, imports from Qatar were down substantially (-1.4 MT) as many cargoes from Qatar were diverted into the premium Asian market. China, which continued to lead Asian LNG demand growth, increased imports from Qatar by 39%. As LNG imports declined, the UK imported more natural gas via the Interconnector as domestic demand increased in the first months of the year, driven by heating needs. LNG imports in the Netherlands were down on account of higher re-exports (+0.3 MT). The re-exported cargoes from the Netherlands went to Japan, South Korea, India and Pakistan.

In South Eastern Europe, net LNG imports were down 4% (- 0.2 MT YoY) as LNG imports in Greece fell 0.32 MT. This decline was offset by an increase in pipeline imports from Russia. Inversely, net LNG imports in Turkey were up by 12% (0.5 MT) to reach 4.65MT in H1 2018 as the power sector gas demand increased by 8%. Additionally, pipeline gas imports in Turkey were down 2% in the first four months of 2018 which might have influenced the evolution of LNG imports.

In central Europe, Poland increased net LNG imports in H1 2018 by 0.33 MT to 0.95 MT as supply from Qatar increased following a supplementary deal signed with Qatargas in 2017, which came into effect in 2018.

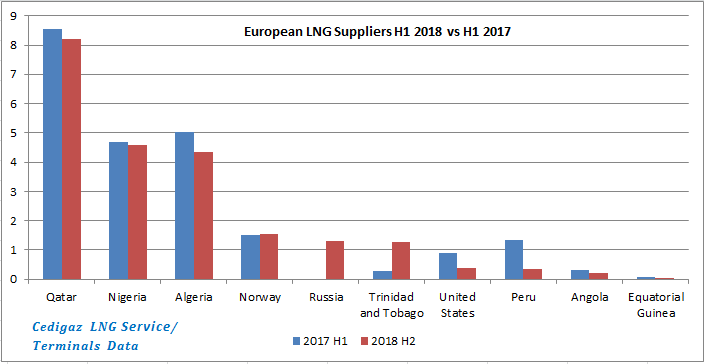

Figure 2: European LNG Suppliers in H1’18

The top three LNG suppliers to Europe remained unchanged from last year, i.e. Qatar, Nigeria and Algeria. However their combined export volumes dropped 6% (-1MT YoY). Russia emerged as a new LNG supplier in Europe as the Yamal LNG project started operations in December 2017. There was a significant decline (-1MT YoY) in LNG deliveries from Peru, which was nearly offset by a gain from Trinidad & Tobago. US LNG exports to Europe plummeted by 0.5 MT as the US exported most (62%) of its LNG to Asia where US exports went up by nearly 3MT.

Re-exports which were nearly dormant last year have picked up in H1 2018 as higher LNG prices have created arbitrage opportunities for European Importers, which re-exported mainly to the Asian region. European LNG demand for the second half of this year will depend on a number of factors, including but not limited to, power sector gas demand, the weather, energy prices and competitiveness of LNG versus pipeline imports.

By Amit Rao – Analyst – CEDIGAZ

For more information: contact@cedigaz.org

Our website: https://www.cedigaz.org/

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.