European LNG net imports grew by 16.6% in 2015

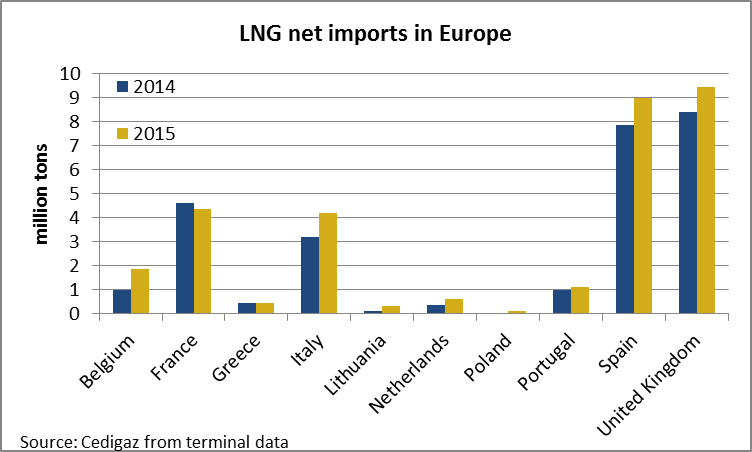

In 2015, LNG net imports grew by 16.6% in Europe as demand for natural gas grew in the region. As a consequence of more deliveries (+1.8 Mt) and less reloads (-2.68 Mt), net imports increased by 4.47 Mt up to 31.35 Mt. Except in France, where gross imports decreased from 5.07 Mt to 4.77 Mt while re-expors slightly decreased (-0.03 Mt), and in Greece, where imports were flat at around 0.45 Mt, net imports increased everywhere because of various factors.

In 2015, LNG net imports grew by 16.6% in Europe as demand for natural gas grew in the region. As a consequence of more deliveries (+1.8 Mt) and less reloads (-2.68 Mt), net imports increased by 4.47 Mt up to 31.35 Mt. Except in France, where gross imports decreased from 5.07 Mt to 4.77 Mt while re-expors slightly decreased (-0.03 Mt), and in Greece, where imports were flat at around 0.45 Mt, net imports increased everywhere because of various factors.

In the Iberian peninsula, LNG demand was boosted by higher demand for natural gas in the power sector as droughts reduced the availability of hydropower and a heatwave in the summer increased gas consumption in the power sector. In Spain, where LNG net imports grew to 8.96 Mt in 2015, demand for natural gas for power generation increased by 18.1% year-on-year from January to November while hydropower output decreased by 26.5% year-on-year from January to October. In Portugal, net imports also grew to 1.12 Mt (+16.2%).

In Italy, imports increased to 4.18 Mt (+31.8%) as Edison leveraged its 4.6 mmtpa long-term contract it has signed with Rasgas to regasify natural gas from Qatar in the Adriatic LNG terminal. The contract, which is oil-indexed, offered competitive prices compared to Italian spot prices: Qatari LNG landed price stood at $8.41/mmbtu in January and continuously declined throughout the year down to $5.17/mmbtu in October. In France, higher imports from Norway by pipeline and higher withdrawal from storages met the increased demand for natural while LNG net imports decreased.

In Northwest Europe, where gas markets are more liquids than in other parts of the region, LNG net imports grew significantly. In the United Kingdom, where the South Hook terminal received about 20% more LNG (all coming from Qatar), net imports grew by 12.4% to 9.43 Mt. Such an increase was consistent with British growing demand for natural gas in 2015, as lower than average temperatures boosted domestic demand by 14% year-on-year from January to September. In Belgium and in the Netherlands, net imports grew respectively by 89.7% to 1.86 Mt and 71.6% to 0.6. Belgium importers took advantage of the low oil-linked price of LNG from Qatar and could easily find a market as the output of the neighboring Groningen field decreased. In the Netherlands, 2015 saw a strong increase in the reloading business as Gate LNG terminal reloaded 28 ships, including 14 large LNG carriers and 14 small-scale carriers.

In Lithuania, the LNG terminal in Klaipeda, operated below its capacity and unloaded 0.32 Mt. In Poland, the Świnoujście LNG terminal received its commissioning cargo from Qatar in December 2015.

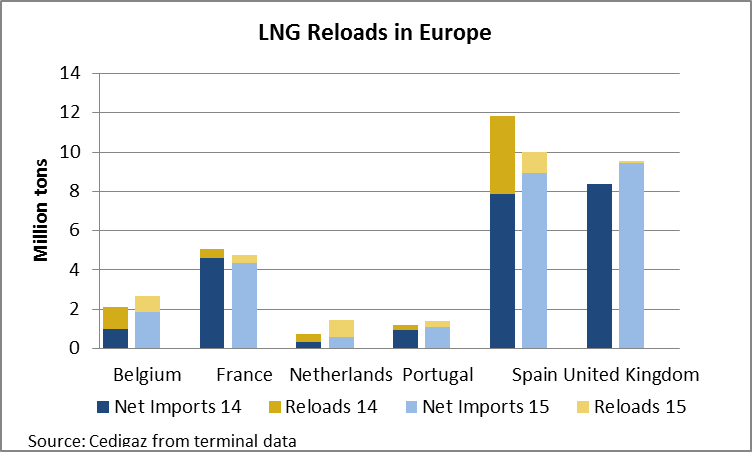

Spain pulled down European reloads

After collapsing in the second half of 2014, the price difference between Asian and European LNG spot prices stayed low in 2015. Thus, while UK spot price averaged $6.51/mmbtu in 2015, Japan spot price averaged $7.5/mmbtu over the same period. With such a low difference, which was even below zero in February 2015, the reloading business became mostly uneconomic. In Spain, which reloaded about 3.99 Mt in 2014, LNG re-exports dropped to 1.05 Mt in 2015. Such a fall was explained by the collapse of re-exports to Asia and Americas which dropped respectively by 80.1% and 75% year-on-year from January to November.

After collapsing in the second half of 2014, the price difference between Asian and European LNG spot prices stayed low in 2015. Thus, while UK spot price averaged $6.51/mmbtu in 2015, Japan spot price averaged $7.5/mmbtu over the same period. With such a low difference, which was even below zero in February 2015, the reloading business became mostly uneconomic. In Spain, which reloaded about 3.99 Mt in 2014, LNG re-exports dropped to 1.05 Mt in 2015. Such a fall was explained by the collapse of re-exports to Asia and Americas which dropped respectively by 80.1% and 75% year-on-year from January to November.

However, Northwest Europe countries which received more LNG in 2015 than in 2014 also reloaded more. As the market was well supplied and prices were low in Europe, the UK and the Netherlands took advantage of the low price of the LNG they imported to re-exports to more attractive markets, including the Middle East and Latin America. The Netherlands sent large reloads to Argentina, Brazil, United Arab Emirates, Mexico, Jordan, South Korea, Egypt, and India and delivered small-scale reloads to Norway and Sweden.

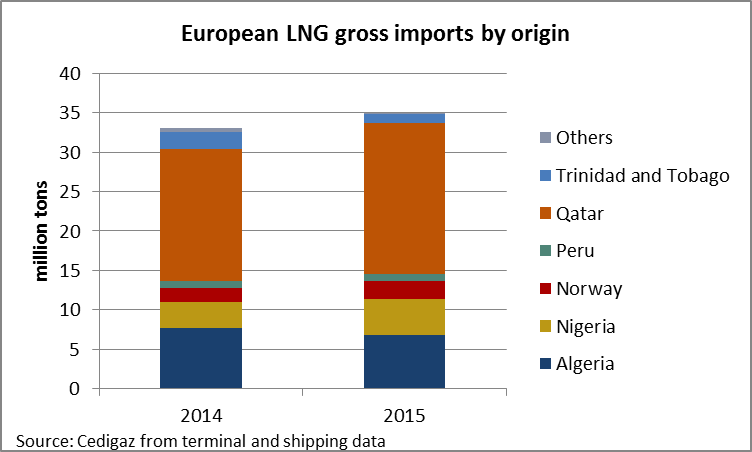

More gas from Qatar and Nigeria, less from Trinidad and Tobago and Algeria

As a consequence of the dropping demand in the Far East where spot prices collapsed and the lowering pressure on the global LNG market, large portfolio players diverted cargoes to closer markets where prices were also attractive. Thus, the origin of European LNG imports changed significantly in 2015 compared to the year before. Imports from Qatar, Europe’s first supplier, grew by 15% to 19.21 Mt and imports from Nigeria grew by 39% to 4.57 Mt while exports from these two countries to Asia dropped. Norway also exported more LNG to Europe, increasing its supply from 1.72 Mt in 2014 to 2.23 Mt in 2015.

As a consequence of the dropping demand in the Far East where spot prices collapsed and the lowering pressure on the global LNG market, large portfolio players diverted cargoes to closer markets where prices were also attractive. Thus, the origin of European LNG imports changed significantly in 2015 compared to the year before. Imports from Qatar, Europe’s first supplier, grew by 15% to 19.21 Mt and imports from Nigeria grew by 39% to 4.57 Mt while exports from these two countries to Asia dropped. Norway also exported more LNG to Europe, increasing its supply from 1.72 Mt in 2014 to 2.23 Mt in 2015.

Imports from Trinidad and Tobago reduced by half to 1.07 Mt as the output from the Atlantic LNG plant declined and was rather sent to regional buyers, in North and Latin America. LNG exports from Algeria to Europe also dropped significantly by 11.8% down to 6.79 Mt in 2015. It is worth noticing that most of the fall occurred in the first quarter of the year (-40.4% year-on-year) because of a two-month maintenance work at the Skikda plant and that it was offset by higher exports via pipeline to Spain and Italia.

Disclaimer: in this post, the analysis is based on terminals and shipping data. Figures may defer from previous analysis based on customs data. Europe refers to EU countries but Sweden and does not include Turkey.

By Louis Jordan, Junior Economist, Cedigaz