The International Association Cedigaz has just released its report “GLOBAL BIOMETHANE MARKET 2021 ASSESSEMENT” showing that the overall momentum of Renewable Natural Gas is accelerating.

This report updates the 2019 CEDIGAZ’s comprehensive study on global biomethane (also known as renewable natural gas, RNG). It focuses on biogas upgrading and looks at key developments in the marketplace, policies, and major markets. The main outcome is summarized below.

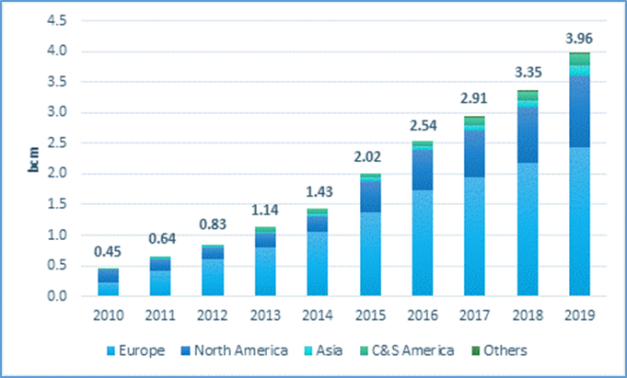

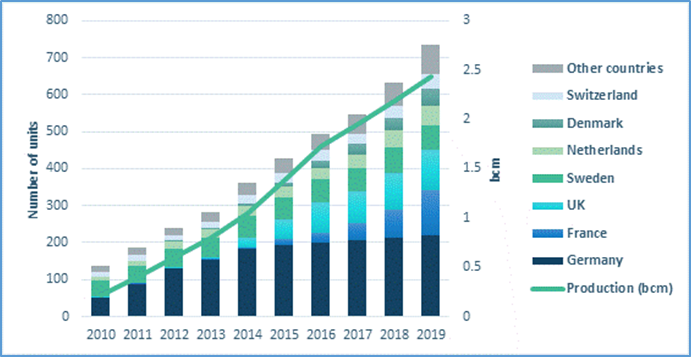

Global RNG production reached 4 bcm in 2019, a doubling since 2015 (fig.1). There are now close to 1,000 biogas upgrading plants operating in the world. The market remains dominated by Europe (2.4 bcm, fig.2), but the United States is catching up rapidly and, in fact, has become the world’s leading producer (1.1 bcm), ahead of Germany. In other regions, biomethane production is still limited (0.4 bcm collectively), but the market is taking off in Brazil, Canada, China and India.

Fig.1: Global RNG production (2010-2019) |  Fig.2: Europe – Nb of units by country and total RNG production |

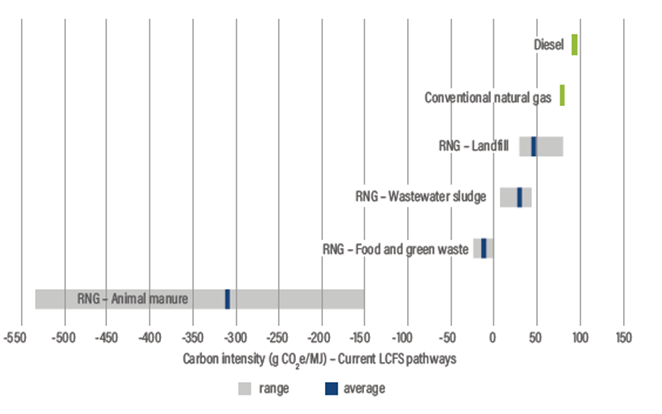

Recent years have seen significant shifts in terms of key sources of demand and market drivers. Hard-to-abate sectors (road transportation, shipping, heat) are becoming the focus of support policies, while cost reduction in wind and solar power generation makes the use of biomethane in the power sector less attractive, except for providing flexibility. RNG is more and more recognized for its key role in decarbonizing (fig.3) and bringing sustainability in the agriculture and waste sectors and is increasingly included in climate policies targeting these sectors.

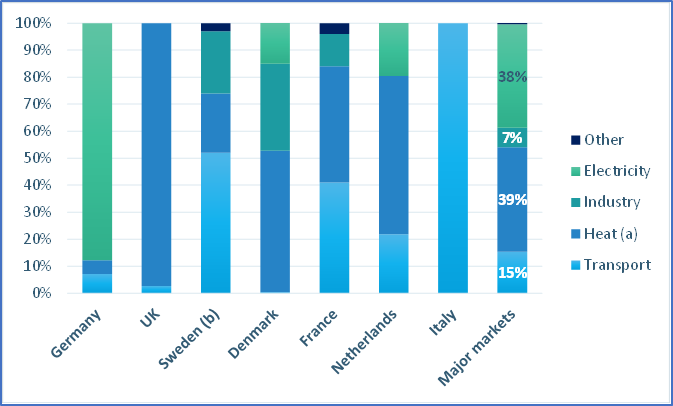

Fig.3: Carbon intensity of RNG feedstock, CARB 2020 |  Fig.4: RNG use by sector in major European markets in 2019 |

Four key trends have emerged that will drive an exponential growth of RNG demand in this decade.

- RNG is in demand by a wide range of customers (fig.4) all over the world, such as cities, major corporations, large fleet owners, the steel industry, even the shipping industry. Energy utilities have started offering RNG to their customers. This demand is driven by the need to meet decarbonization goals rapidly, amid rising environmental, social, and governance (ESG) concerns and customer preference.

- The use of RNG as a transport fuel is leading demand growth. Global use of RNG in the sector reached 1.5 bcm in 2019, up 40% over 2018. In this sector, RNG can make a real difference with even “carbon negative” emissions.

- Oil majors are entering the sector. As broader ESG motivations and GHG emission reduction goals expand, there is increasing investment from oil majors in RNG production and fuelling infrastructure. This trend is significant as majors will enable the RNG market to scale up dramatically, RNG production costs to decrease, and RNG to expand its global reach and use in the transportation sector.

- RNG is attracting new sources of capital. Green funds are launched to finance RNG projects.

RNG demand is ramping up quickly, and growth is accelerating. The global market is called for an exponential growth in this decade and could reach more than 100 bcm by 2030 (all technologies, including gasification). This would represent close to 3% of global gas demand, and much more in some regions.

In Europe, there are now 20 countries producing RNG. The number of biomethane plants has doubled over the past five years, showing the fast development of the sector. Recent growth has been driven by France, Denmark, the Netherlands, Italy, and the United Kingdom. The share of RNG in gas grids is already significant in the Nordic countries (20‑30%). At European level, it is expected to reach 8% on average by 2030, corresponding to around 35 bcm.

In North America, US production is growing at an annual rate of 35%, boosted by policy support at state level targeting the use of RNG as a transport fuel. RNG production mainly comes from landfill gas, which has the lowest production cost. However, dairy farms constitute the majority of projects currently under construction. Despite their higher production costs, these projects get strong regional incentives due to their high GHG emission reduction potential. In Canada, economic recovery plans and the recent proposed rules for a national Clean Fuel Standard will drive growth in the sector.

China and India, given their huge feedstock potential and growing energy needs, are the most promising markets. Today, RNG is still in the early stage of development in both countries. In China, despite investment by the central government, the market has not developed as expected. China has revised its production targets downwards (20 bcm by 2030, instead of 30 bcm planned previously). But China has also adopted a new policy to guide the large-scale industrialization of the sector and is reviewing its support policy.

India is moving towards its ambitious goal to build 5,000 RNG plants by 2024, corresponding to 21 bcm/y. Since the beginning of 2020, the government has accelerated the development of the sector, approved some 1,500 projects across the country, and expedited financial assistance to new projects.

In Brazil, RNG production is on the verge of an exponential growth driven by the huge biomass and organic waste available, policy support (RenovaBio program) and the opening of the gas market.

Sylvain Serbutoviez, Cedigaz

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.