A once-in-a lifetime growth over this decade

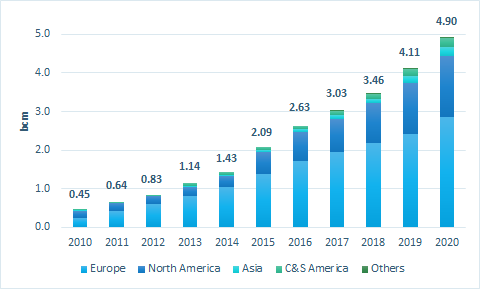

Despite the pandemic and its impact on supply chains and fuel demand in the transportation sector, the RNG sector has been resilient. Global RNG production was up 20% in 2020 to 5 billion cubic metres (bcm). It has more than doubled since 2015. There were 1,161 biogas upgrading facilities operating in the world at the end of 2020, with a production capacity of 800,000 Nm3/h (or 6.7 bcm/y), ensuring healthy growth going forward. The market remains dominated by Europe, but the United States, which became the world’s leading producer in 2019, ahead of Germany, continues to register significant growth. In other regions, biomethane production is still limited but is taking off in Brazil, Canada, China and India.

Global RNG production (2010-2020)

2021 and the beginning of 2022 saw events that will profoundly and durably impact the biomethane sector:

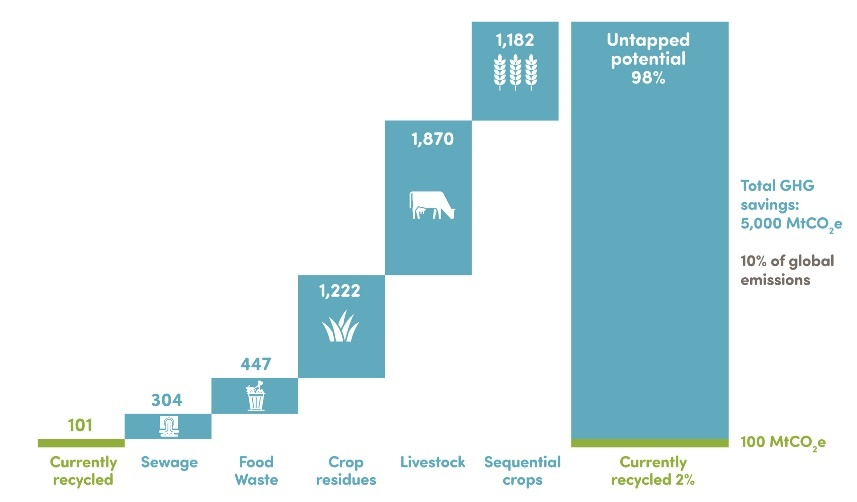

- At COP26 in Glasgow, more than 100 countries signed the Global Methane Pledge to collectively reduce methane emissions in the energy, agriculture and waste management sectors by at least 30% by 2030. The focus on methane emissions is a game changer for the biogas/biomethane industry. Fully deployed, anaerobic digestion (AD) could deliver 50% of the Global Methane Pledge.

Potential of global organic wastes to reduce GHG emissions (Source: Word Biogas Association)

- Russia’s invasion of Ukraine has heightened the issue of security of supply. With elevated energy commodity prices, several countries around the world are reassessing the role of RNG in their energy mix. Indeed, RNG provides a near-term solution to insulate economies from high energy prices and to increase security of supply as the technology is available now for full deployment of the sustainable potential. On 8 March 2022, the European Commission released the REPowerEU plan to reduce the dependency of the European Union on Russian energy imports, starting with gas. Among the actions proposed by the Commission, Europe will scale up its biomethane production to 35 bcm/y by 2030, diversifying away from Russian gas supplies.

Combined with these strong policy drivers, market drivers are also expanding RNG demand across sectors.

- RNG is in demand by a wide range of customers all over the world, driven by the need to rapidly decarbonise hard-to-abate sectors, as well as the highly developed gas grids in North America and Europe.

- The use of RNG as a transport fuel is leading demand growth, driven by regulations to incorporate a growing percentage of biofuels in the transportation sector.

- The production of hydrogen is emerging as a new outlet for RNG

- Energy majors accelerated their investments in the RNG sector in 2021

- RNG is attracting new sources of capital, with a growing trend towards the financing of RNG plants and related infrastructure by private equity investors.

Driven by these policy and market drivers, the global biomethane market is set for a once-in-a lifetime growth over this decade and could reach 100 bcm by 2030

ABOUT THE REPORT

CEDIGAZ published a comprehensive report on global biomethane (also known as RNG) in 2019, together with an extensive database on biogas upgrading facilities around the world. Annual reports and databases update the 2019 report.

This 2022 annual report focuses on recent trends in global biomethane in 2020, 2021 and the beginning of 2022.

The associated database includes data by country from 2010 to 2020 on production, number of biogas upgrading facilities and their capacity.

The report looks at these metrics and analyses global and regional trends that have occurred over the recent months in the marketplace, policies, and major markets. At time of writing, Russia invaded Ukraine with a tragic impact for Ukrainian people and severe impacts on the global and European economies, notably on the energy scene. This has led us to review the report and include a more in-depth analysis of biomethane development in Europe and its potential for scaling up production by 2030.

Sylvie Cornot-Gandolphe – CEDIGAZ

April 2022 – 59 pages PDF format

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG, low-carbon gases and unconventional gas in an exhaustive and critical way.