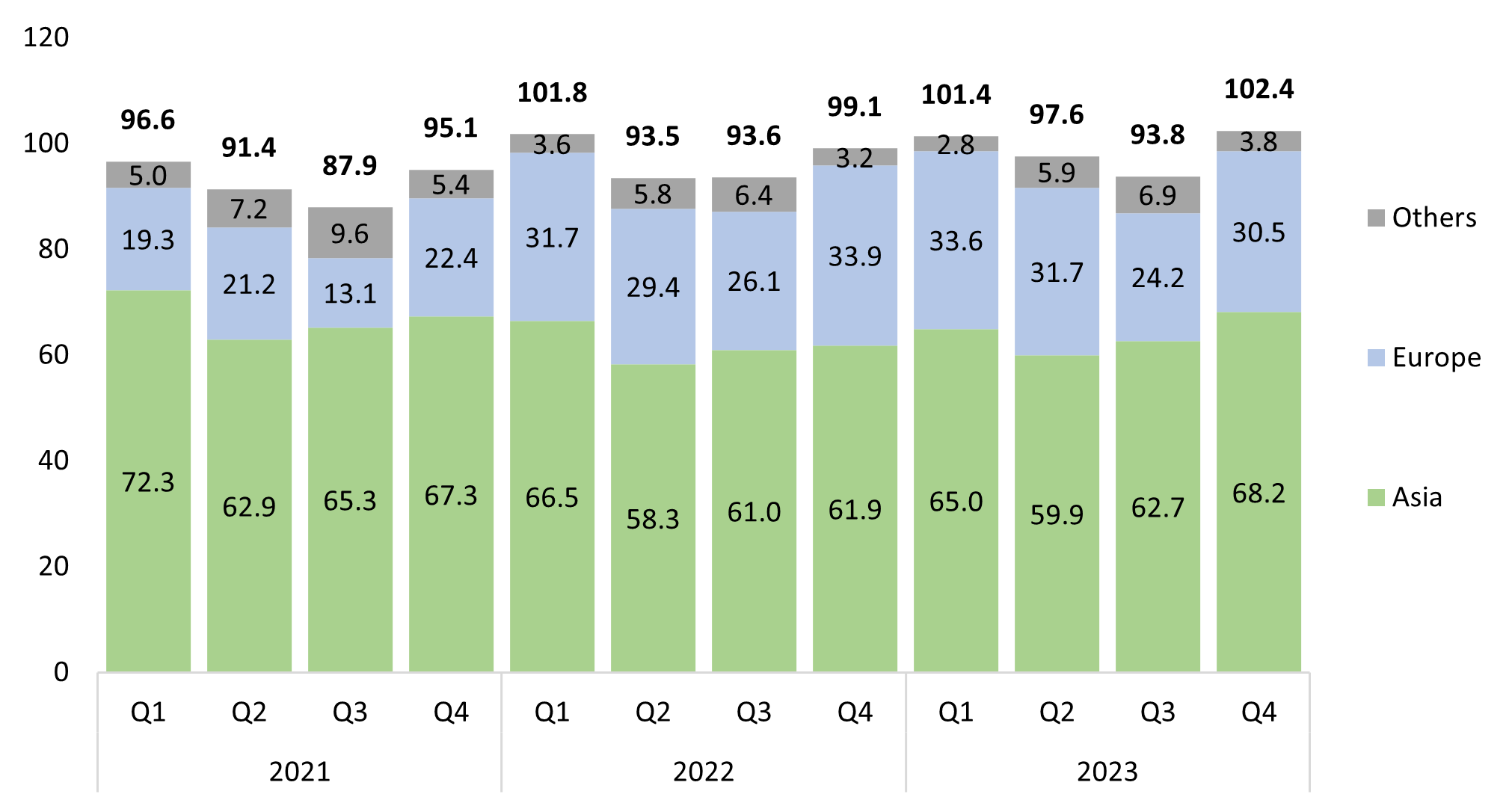

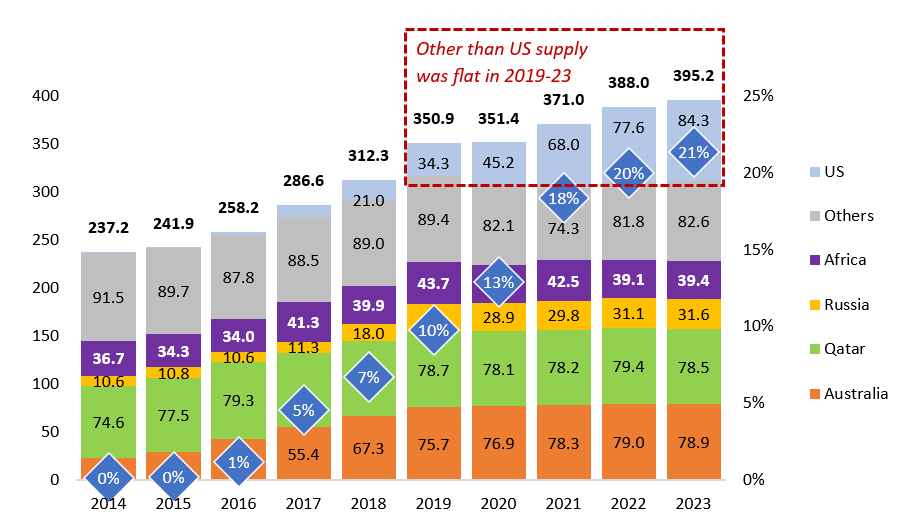

In a less tight marked environment than in 2022, the global LNG market reached a new high in 2023, totalling 395.2 mt, an increase of 2% yoy. While European demand, including the United Kingdom and Türkiye, saw a marginal decline of 1% or 1.2 mt, the Asia-Oceania region experienced a modest growth, with imports climbing by 3% or 8 mt.

Global LNG imports in 2021-2023 by quarter, mt

In 2023, European LNG demand was broadly stable, but this stability masks a significant redistribution of LNG flows within Europe, with LNG imports shifting from Atlantic-facing countries like the UK, France, and Spain to others, notably the Netherlands and Germany. This change was spurred by the development of new LNG import capacities in these countries, allowing for direct deliveries and reducing dependency on neighbouring countries for LNG reception.

European dependency on US LNG strengthened further, with the US share in European LNG imports rising to 47% (compared to 44% in 2022) In 2023, Europe maintained its position as the top market for US-origin LNG, commanding a 67% share. This underscores Europe’s growing reliance on American LNG amidst broader geopolitical and market shifts.

China overtook Japan to become the largest LNG importer in 2023, a rank it had attained in 2021 but lost in 2022. Despite a robust increase in local natural gas production and an uptick in Russian pipeline supplies, China’s LNG imports grew by 7.6 mt, reaching 70.5 mt, though still 10% below the record 2021 level.

Global LNG supply by source in 2014-2023, mt and US share, %

Thailand posted the second-largest demand growth in Asia, primarily fuelled by its increasing LNG-to-power needs. The country saw an impressive year-on-year growth of approximately 40% in LNG imports, which equates to an additional 3.2 mt, totalling 11.3 mt. Over the last two years (2021-2023), Thailand has been the number one LNG growth centre in Asia and has doubled its imports since 2021.

China’s and Thailand’s imports growth was partly offset by a decline in demand from Japan and South Korea (-5.9 and -2.2 mt, respectively).

On the exports side, in 2023 alone, the United States contributed 6.7 mt to the global LNG supply growth, increasing exports to 84.3 mt and becoming the world’s largest LNG exporter ahead of Australia (78.9 mt) and Qatar (78.5 mt).

Conversely, Egypt saw the most significant drop in LNG exports both in absolute and relative terms among exporting countries. Due to a decrease in local production, Cairo saw its exports cut in half, resulting in a reduction of 3.4 mt, marking a significant shift in its export capabilities.

Source: CEDIGAZ Monthly LNG Trade Database

DOWNLOAD THE REPORT: Global LNG trade update (Q4 2023)