NBP: – 8% in early April compared to the March average

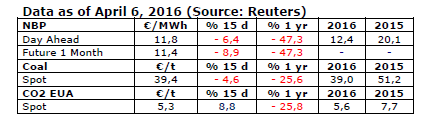

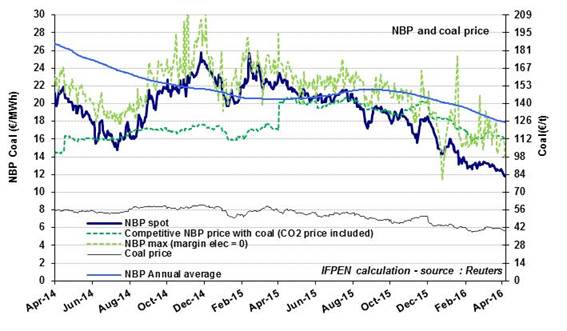

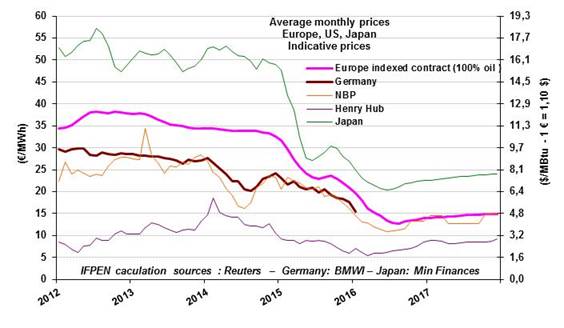

The winter season for the gas industry (October 2015 to March 2016) closed with the NBP price very low at €15.4 /MWh ($4.9/MBtu), which is 30 to 46% lower than for the three previous winters. The downtrend that started in early 2015 resulted from a relatively abundant supply and a decline in the prices of contracts 100% indexed on oil. In fact, these prices defined the NBP trend. The decline continued in the first April quotations (-8% compared to March) as the NBP dropped below the €12/MWh ($4/MBtu) mark. The markets are expecting a minimum price of €11/MWh ($3.7/MBtu) during the summer. The fact that the volumes stored in Europe are relatively large partly explains the absence of price pressure.

The winter season for the gas industry (October 2015 to March 2016) closed with the NBP price very low at €15.4 /MWh ($4.9/MBtu), which is 30 to 46% lower than for the three previous winters. The downtrend that started in early 2015 resulted from a relatively abundant supply and a decline in the prices of contracts 100% indexed on oil. In fact, these prices defined the NBP trend. The decline continued in the first April quotations (-8% compared to March) as the NBP dropped below the €12/MWh ($4/MBtu) mark. The markets are expecting a minimum price of €11/MWh ($3.7/MBtu) during the summer. The fact that the volumes stored in Europe are relatively large partly explains the absence of price pressure.

For next winter, the markets are anticipating a slight upward pressure, with the NBP prices nearing those of 100%-oil-indexed contracts at about €14/MWh ($4.7/MBtu). The price will be influenced by the severity of the weather conditions and by the gas consumption of the electricity sector. Gas enjoys an advantage over coal, because the Carbon Tax Support (CTS) was fixed at €25 TCO2 a year ago.

Coal’s share of electricity production fell to 21% in 2015, compared to an average of more than 30% since 2000. The share of gas stabilized at 29%, ending the decline observed between 2008 (46%) and 2013 (27%), due in large part to the rise of renewable energies (22%, up from 4% in 2008). This rise occurred to the detriment of gas, which was less competitive than coal owing to the absence of an adequate CO2 tax during this period. The current level of the tax has put an end to this situation. While favorable from the environmental standpoint, it presents the downside of weighing on industrial competitiveness.

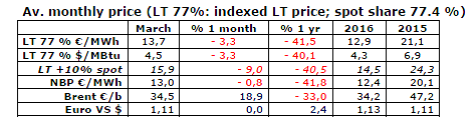

Indexed European prices: down 3.3% in March

In March, the indicative European price (LT 77%) stood at €13.7/MWh ($4.5/MBtu), down by nearly 3.3% in a month and by 40% in a year. It could sink to €11.4/MWh ($3.8/MBtu) next summer before climbing to €13.5-14/MWh ($4.5-4.7/MBtu) by year end.

In March, the indicative European price (LT 77%) stood at €13.7/MWh ($4.5/MBtu), down by nearly 3.3% in a month and by 40% in a year. It could sink to €11.4/MWh ($3.8/MBtu) next summer before climbing to €13.5-14/MWh ($4.5-4.7/MBtu) by year end.

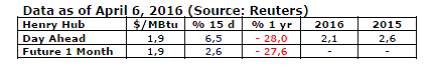

The U.S. market (Henry Hub): up in March

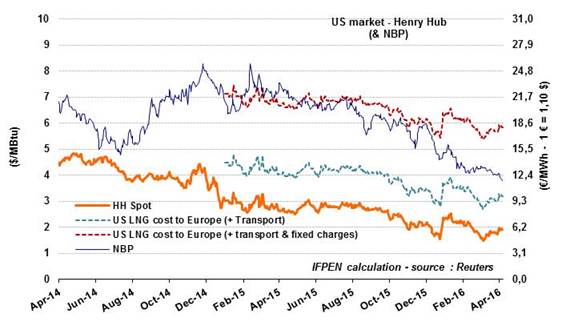

The Henry Hub price, which hit a low of $1.5/MBtu in early March, has risen steadily since then. In the first quotations for the month of April, it stood at $1.9/MBtu versus a March average of $1.7/MBtu. Futures are looking up, especially for the approach of winter, with a price of $2.7/MBtu anticipated for December.

The Henry Hub price, which hit a low of $1.5/MBtu in early March, has risen steadily since then. In the first quotations for the month of April, it stood at $1.9/MBtu versus a March average of $1.7/MBtu. Futures are looking up, especially for the approach of winter, with a price of $2.7/MBtu anticipated for December.

These prices, while relatively low, cannot ensure the competitiveness of U.S. gas (on a full cost basis) destined for European or Asian spot markets. With the Henry Hub at $2/MBtu, this would only be possible at prices of about $6 and 7.3/MBtu, respectively.

By Guy Maisonnier – Senior Economist – IFPEN