NBP: drop in July, but market concerns

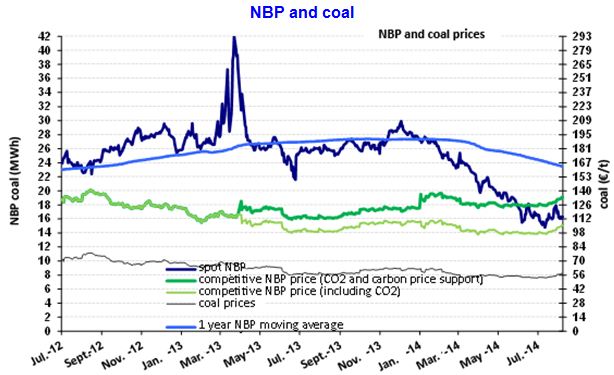

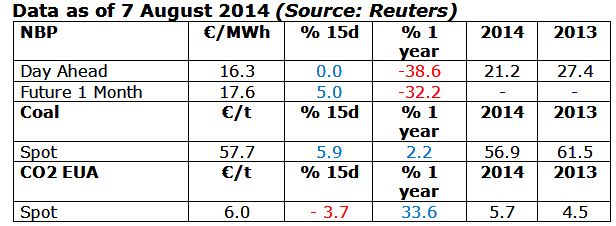

The average NBP price for July was €16.2/MWh ($6.4/MBtu), 3.6% less than the previous month and 37% less than the same month last year. The NBP was marked by relatively high volatility, around +/-10%. It fell to a low of €14.8/MWh ($5.9/MBtu) on 11 July before climbing to nearly €18/MWh ($7.0/MBtu) on 28 July. This increase coincided with rising tensions between Russia and the Western countries, with stiffer sanctions imposed by the US on 16 July and then by the Europeans on 28 July. However, it should be noted that pressure remains moderate for now. In fact, the NBP is significantly lower than it was during the past three summers (€21 to €26/MWh on average).

The average NBP price for July was €16.2/MWh ($6.4/MBtu), 3.6% less than the previous month and 37% less than the same month last year. The NBP was marked by relatively high volatility, around +/-10%. It fell to a low of €14.8/MWh ($5.9/MBtu) on 11 July before climbing to nearly €18/MWh ($7.0/MBtu) on 28 July. This increase coincided with rising tensions between Russia and the Western countries, with stiffer sanctions imposed by the US on 16 July and then by the Europeans on 28 July. However, it should be noted that pressure remains moderate for now. In fact, the NBP is significantly lower than it was during the past three summers (€21 to €26/MWh on average).

Future trends remain very uncertain given the many possible scenarios regarding Ukraine (whether or not gas transit via Ukraine will be impacted, Russian exports disrupted, etc.). Relative to the beginning of July, the market is gradually adjusting the trends for the coming months upwards, particularly for the winter. Future prices are now around €27/MWh from December to next March. These levels, currently in line with the average for the winter of 2013/2014 (€26.2/MWh), are gradually taking into account the idea of a possible crisis scenario.

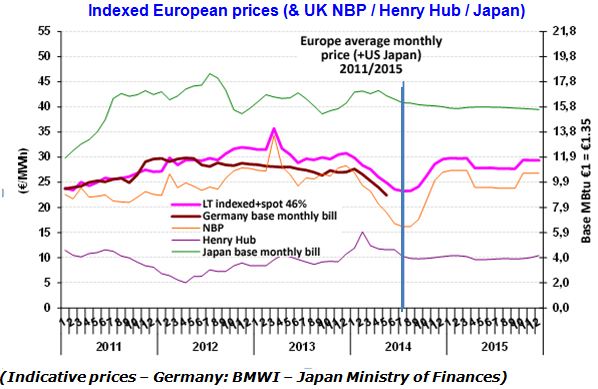

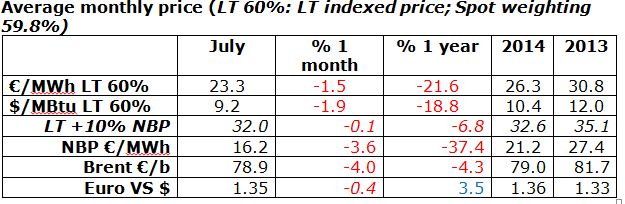

Indexed European price (60% spot): -1.5% in July

The European indicative price will now consist of a higher spot weighting (60%), in line with the formula adopted in France and the reality of markets increasingly influenced by spot prices, much like the German import price.

consist of a higher spot weighting (60%), in line with the formula adopted in France and the reality of markets increasingly influenced by spot prices, much like the German import price.

This new LT 60% benchmark price was €23.3/MWh ($9.2/MBtu) in July, compared to €25.7/MWh for the LT 46%. An upward trend is anticipated over the next few months (€29.6/MWh in December) as a result of the expected growth in the NBP spot price. However, the drop in oil prices (Brent at $106.8/b in July and $111.8/b in June) has had little impact since it is partly offset by the fall of the euro ($1.33 in August vs. $1.38 in March and April).

This new LT 60% benchmark price was €23.3/MWh ($9.2/MBtu) in July, compared to €25.7/MWh for the LT 46%. An upward trend is anticipated over the next few months (€29.6/MWh in December) as a result of the expected growth in the NBP spot price. However, the drop in oil prices (Brent at $106.8/b in July and $111.8/b in June) has had little impact since it is partly offset by the fall of the euro ($1.33 in August vs. $1.38 in March and April).

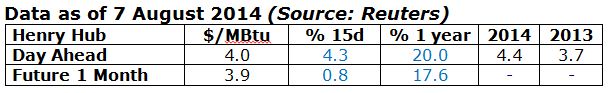

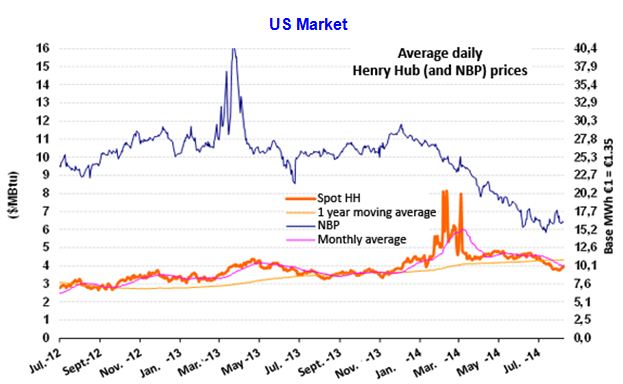

US market (Henry Hub): downward adjustments

The average HH price fell sharply in July to $4.1/MBtu (-11% from June), a trend that is continuing for the initial August prices ($3.9/MBtu on average). Forward markets have followed suit, with the average 2015 price now estimated at $4/MBtu compared to $4.2 a month ago. This easing pressure is the result of high production levels and moderate demand in the electricity sector in July. This enabled a significant amount of gas to be added to the stocks which, at the end of July, were only between 12 and 26 Gm3 (430/900 BCF) below the five-year minimum and maximum.

The average HH price fell sharply in July to $4.1/MBtu (-11% from June), a trend that is continuing for the initial August prices ($3.9/MBtu on average). Forward markets have followed suit, with the average 2015 price now estimated at $4/MBtu compared to $4.2 a month ago. This easing pressure is the result of high production levels and moderate demand in the electricity sector in July. This enabled a significant amount of gas to be added to the stocks which, at the end of July, were only between 12 and 26 Gm3 (430/900 BCF) below the five-year minimum and maximum.