NBP:moderate prices with a substantial upward correction

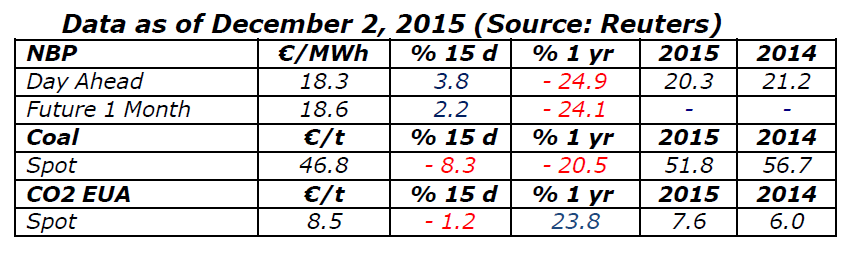

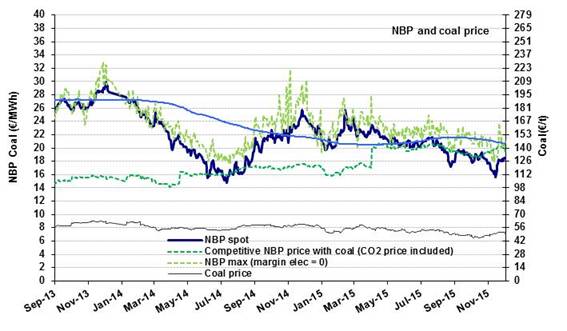

November 13 marked a break in the NBP’s ten-month downward trend. After hitting a low of €15.6/MWh ($4.9/MBtu), it climbed to €18.4/MWh ($5.7/MBtu), an increase of18%.The geopolitical context weighed on prices as tensions developed between Russia and two of its neighbors: Turkey (the summoning of the Russian ambassador on November 20 and the military incident of November 24) and Ukraine (deliveries were halted on November 24). But the pressure remains moderate, with the NBP price remaining below the threshold at which gas is competitive in the electricity production sector (in the vicinity of €20/MWh or $6.3/MBtu).

November 13 marked a break in the NBP’s ten-month downward trend. After hitting a low of €15.6/MWh ($4.9/MBtu), it climbed to €18.4/MWh ($5.7/MBtu), an increase of18%.The geopolitical context weighed on prices as tensions developed between Russia and two of its neighbors: Turkey (the summoning of the Russian ambassador on November 20 and the military incident of November 24) and Ukraine (deliveries were halted on November 24). But the pressure remains moderate, with the NBP price remaining below the threshold at which gas is competitive in the electricity production sector (in the vicinity of €20/MWh or $6.3/MBtu).

The NBP evolved in a relatively disturbed business environment. Due to the “Fed effect,” the euro is down significantly (–5.6%)since October, which makes products quoted in dollars more expensive. In November, coal rose by 2.9% in dollars and by 7.7%in euros, although it dropped sharply (-8%) on December 2. As for LNG, November brought a trend reversal with higher prices inAsia, which did not have any notable effect on the European market, showing that the latter remains slack.To top it off, oil continued to fall, bottoming out at $42/b(Brent), i.e. $6lower than its October average. To these uncertainties, one must add the weather forecasts for winter 2015-16.

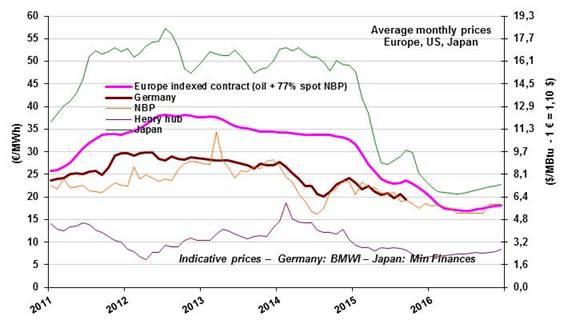

For now, the market is anticipating a loose market with prices of €18.4/MWh($5.7/MBtu)this winter and €17.2/MWh($5.4/MBtu) next summer.These numbers are in line with the forecasts for contracts 100% linked to oil. Since 2011, the prices available on the market have been lower than those set in these contracts.

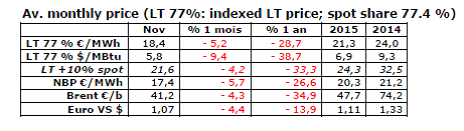

Indexed European prices continue to fall

In November, the indicative European price(LT77%)stood at €18.4/MWh($5.8/MBtu),down by5.2%in a month and29%in a year.TheLT price could slide to €17.2/MWh(€5.4/MBtu)by next July if the current trends (the NBP below €18/MWh;theBrentat $46/b) persist. This forecast is based on assumptions concerning the oil market whereby OPEC will probably refrain from reacting, Iran will make a gradual return and there will be a slight decrease in U.S. shale oil production.

In November, the indicative European price(LT77%)stood at €18.4/MWh($5.8/MBtu),down by5.2%in a month and29%in a year.TheLT price could slide to €17.2/MWh(€5.4/MBtu)by next July if the current trends (the NBP below €18/MWh;theBrentat $46/b) persist. This forecast is based on assumptions concerning the oil market whereby OPEC will probably refrain from reacting, Iran will make a gradual return and there will be a slight decrease in U.S. shale oil production.

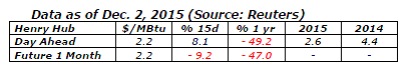

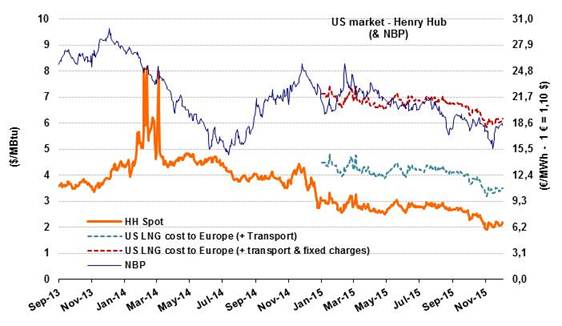

The U.S. market (Henry Hub):no upturn in sight

The Henry Hub averaged $2.1/MBtu in November. In other words, it was down again, this time by 11% in a month. The forecast for the 2016 price has been once again revised downward to $2.4, compared to $2.9 in September. These expectations follow from the context. First of all, production at shale basins has not slowed despite the decline in drilling (for gas, activity was down by 30% on average in 2015).

The Henry Hub averaged $2.1/MBtu in November. In other words, it was down again, this time by 11% in a month. The forecast for the 2016 price has been once again revised downward to $2.4, compared to $2.9 in September. These expectations follow from the context. First of all, production at shale basins has not slowed despite the decline in drilling (for gas, activity was down by 30% on average in 2015).

The U.S. EIA is predicting that total gas production will go up 2% next year, compared to 6% in 2015. Moreover, the high level of stocks, 16% above their five-year maximum, is a sign of an abundant supply that is weighing on prices. Expectations of a mild winter are also a contributing factor.