NBP: under temporary pressure, hovering at about $7/MBtu

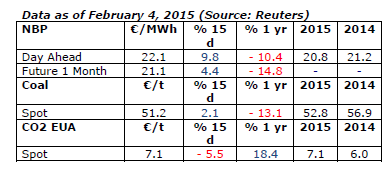

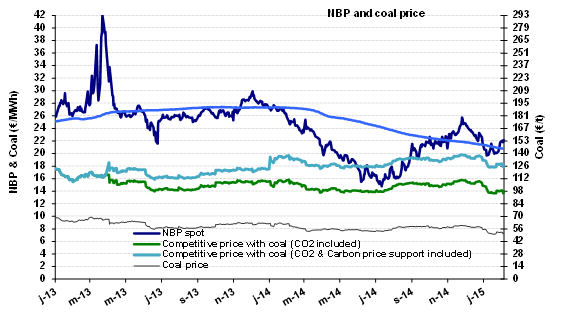

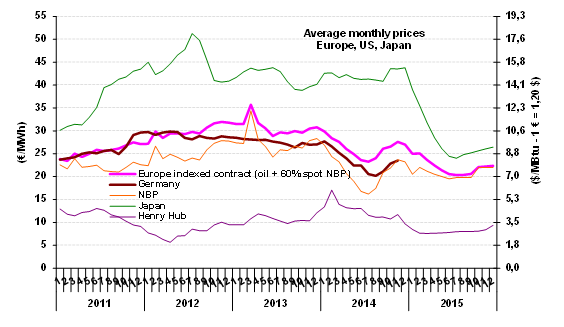

Due to falling temperatures and delivery constraints, the NBP price has been oriented upwards since the end of January: it rose by more than 9% over two weeks, to about €22/MWh ($7.4/MBtu). However, the overall trend is down. The monthly average for January was €20.5/MWh ($7.0/MBtu), i.e. 11% below the average for December. This general movement is reflected in the 12-month moving average, which is now standing at €20.5/MWh ($7.0/MBtu) after steadily falling since last March (€27/MWh ;$10.8/MBtu). The market is anticipating lower prices in the upcoming months: €19.9/MWh ($6.7/MBtu) next summer and €22.8/MWh ($7.7/MBtu) next winter. These trends are consistent with the current conditions on the market, marked by less pressure on the LNG, coal and oil markets. Given the quantities of LNG available in Asia, the spot prices are coming into convergence with the European market at around $7/MBtu, which encourages the purchase of European LNG. As for oil, the upward shift in the oil price observed since February 2 won’t be changing the downtrend on the natural gas market.

Due to falling temperatures and delivery constraints, the NBP price has been oriented upwards since the end of January: it rose by more than 9% over two weeks, to about €22/MWh ($7.4/MBtu). However, the overall trend is down. The monthly average for January was €20.5/MWh ($7.0/MBtu), i.e. 11% below the average for December. This general movement is reflected in the 12-month moving average, which is now standing at €20.5/MWh ($7.0/MBtu) after steadily falling since last March (€27/MWh ;$10.8/MBtu). The market is anticipating lower prices in the upcoming months: €19.9/MWh ($6.7/MBtu) next summer and €22.8/MWh ($7.7/MBtu) next winter. These trends are consistent with the current conditions on the market, marked by less pressure on the LNG, coal and oil markets. Given the quantities of LNG available in Asia, the spot prices are coming into convergence with the European market at around $7/MBtu, which encourages the purchase of European LNG. As for oil, the upward shift in the oil price observed since February 2 won’t be changing the downtrend on the natural gas market.

Indexed European price (60% spot indexation): A sharp downturn

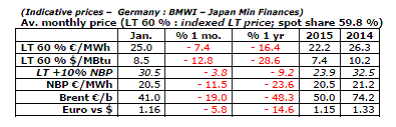

In January, the indicative European price (the LT 60%) stood at €25 /MWh ($8.5/MBtu), more than 7% lower than in December. The LT 60% price will gradually reflect the sharp drop in the oil price whose value, expressed in dollars, was 57% lower in January than in June (50% lower when expressed in euros). Given the impact of this downswing on drilling activity in the United States, the markets reacted strongly on February 2, with the Brent at $54/b compared to the January average of $47.7/b. This fairly violent reaction translates uncertainty as to the equilibrium price that would eliminate this year’s oversupply. The connection between the decline in prices and that of drilling in the U.S. (-23% since September) and, ultimately, that of U.S. production, remains uncertain. If one were to take the present Brent price of $57/b as the average for 2015 ($54/b a month ago) and the euro at $1.15, the LT 60% price would be €20.4/MWh ($6.9/MBtu) in August, i.e. 24% less than in December. The annual average for 2015 is currently estimated to be €22.2 /MWh ($7.4/MBtu), 15% below the 2014 average.

In January, the indicative European price (the LT 60%) stood at €25 /MWh ($8.5/MBtu), more than 7% lower than in December. The LT 60% price will gradually reflect the sharp drop in the oil price whose value, expressed in dollars, was 57% lower in January than in June (50% lower when expressed in euros). Given the impact of this downswing on drilling activity in the United States, the markets reacted strongly on February 2, with the Brent at $54/b compared to the January average of $47.7/b. This fairly violent reaction translates uncertainty as to the equilibrium price that would eliminate this year’s oversupply. The connection between the decline in prices and that of drilling in the U.S. (-23% since September) and, ultimately, that of U.S. production, remains uncertain. If one were to take the present Brent price of $57/b as the average for 2015 ($54/b a month ago) and the euro at $1.15, the LT 60% price would be €20.4/MWh ($6.9/MBtu) in August, i.e. 24% less than in December. The annual average for 2015 is currently estimated to be €22.2 /MWh ($7.4/MBtu), 15% below the 2014 average.

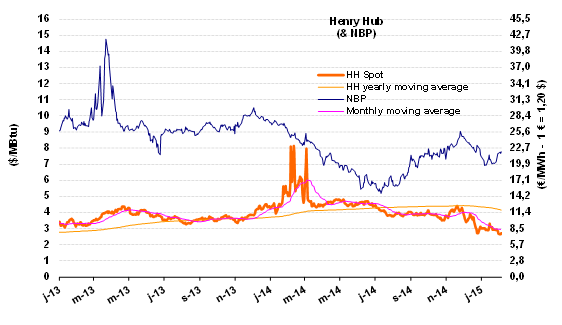

The U.S. market (Henry Hub): still going down

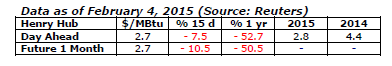

The HH price continued to slide in a movement that began last November. In early February, it was pegged at $2.7/MBtu, i.e. 35% lower than in November ($4.1/MBtu). In 2012, too, very low prices were reported in January, bottoming out at $2 in April. It took a year to return to $4. The forward markets are expecting a similar scenario with an average price of $2.8/MBtu for 2015.

The HH price continued to slide in a movement that began last November. In early February, it was pegged at $2.7/MBtu, i.e. 35% lower than in November ($4.1/MBtu). In 2012, too, very low prices were reported in January, bottoming out at $2 in April. It took a year to return to $4. The forward markets are expecting a similar scenario with an average price of $2.8/MBtu for 2015.

By Guy Maisonnier, Senior Economist – IFPEN