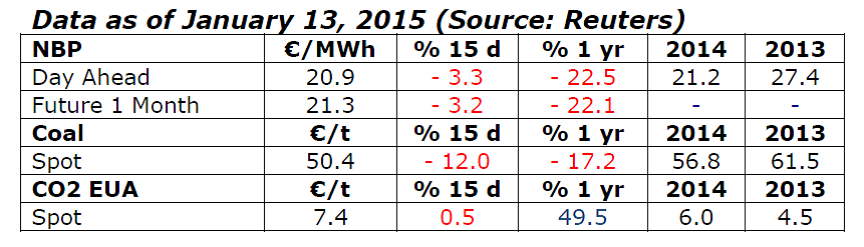

NBP: Downswing since end November

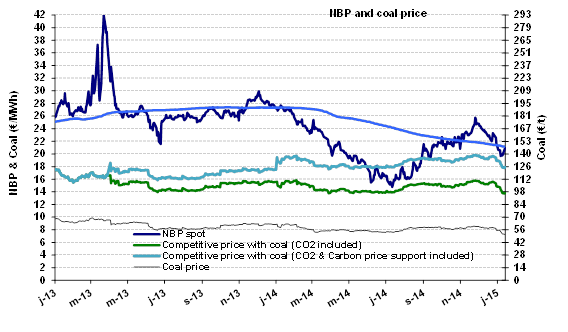

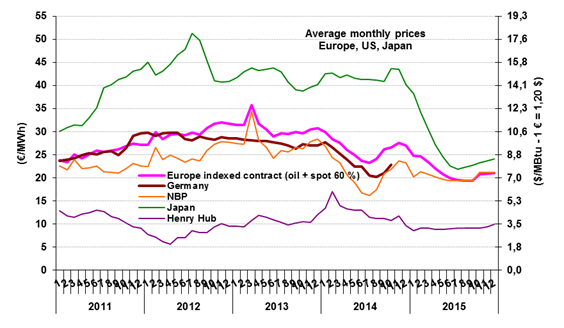

The NBP price stood at €23.2/MWh ($8.4/MBtu) in December, having fallen by 2% in one month and by 18% compared to December 2013 (€28.3/MWh). On November 25, despite the Norwegian disruptions favoring an upturn, the NBP began to slide, descending from €25.7/MWh ($9.4/MBtu) to €20/MWh ($7/MBtu) in the first few days of January. The reasons for this downtrend are the mild weather conditions, the non-impact (so far) of the Russo-Ukrainian crisis and changes on the energy scene. The coal price dropped 15% in one month, from €59/t in early December to its present level of €50/t. Asian LNG finds itself below $10/MBtu, compared to $15/MBtu in October. Finally, the oil price is in free fall, down by 56% between June ($112/b) and January (with a monthly average of $49/b and a price on January 13 of $45/b). Brent forward prices are expected to average $52 in 2015, which, if accurate, would bring European prices in 100%-oil indexed contracts below €19/MWh ($6.6/MBtu) by next summer. NBP prices for summer 2015 are currently in line with these levels.

The NBP price stood at €23.2/MWh ($8.4/MBtu) in December, having fallen by 2% in one month and by 18% compared to December 2013 (€28.3/MWh). On November 25, despite the Norwegian disruptions favoring an upturn, the NBP began to slide, descending from €25.7/MWh ($9.4/MBtu) to €20/MWh ($7/MBtu) in the first few days of January. The reasons for this downtrend are the mild weather conditions, the non-impact (so far) of the Russo-Ukrainian crisis and changes on the energy scene. The coal price dropped 15% in one month, from €59/t in early December to its present level of €50/t. Asian LNG finds itself below $10/MBtu, compared to $15/MBtu in October. Finally, the oil price is in free fall, down by 56% between June ($112/b) and January (with a monthly average of $49/b and a price on January 13 of $45/b). Brent forward prices are expected to average $52 in 2015, which, if accurate, would bring European prices in 100%-oil indexed contracts below €19/MWh ($6.6/MBtu) by next summer. NBP prices for summer 2015 are currently in line with these levels.

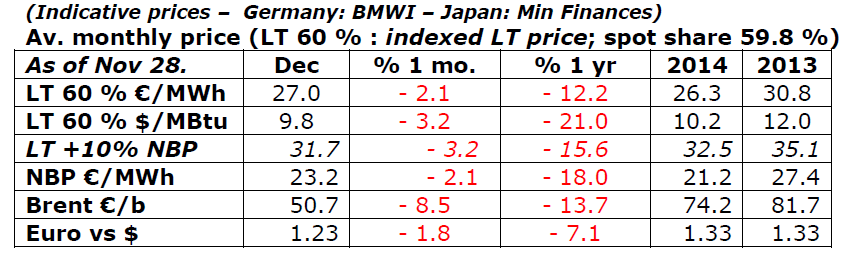

Indexed European price (60% spot indexation): A decline

In December, the indicative European price (the “LT 60%”) stood at €27/MWh ($9.4/MBtu), more than 2% lower than in November. The “LT 60%” does not yet reflect the oil price downtrend (the Brent price expressed in dollars fell by 44% between June and December). There are several reasons for this: 1/ the NBP spot price rose by 38% during the same period; 2/ the euro has lost 10% of its value since June, the effect of which is to limit variations in prices expressed in dollars; 3/ the LT price is based on six-month averages for petroleum product prices, which attenuates variations. Averaged over six months, the Brent price in euros has only lost 6% since June. The effects of the oil and NBP downtrends on the LT 60% price will be progressive. On the basis of present trends, the latter could reach €19.3/MWh ($6.7/MBtu) by August, i.e. down 30% compared to December.

In December, the indicative European price (the “LT 60%”) stood at €27/MWh ($9.4/MBtu), more than 2% lower than in November. The “LT 60%” does not yet reflect the oil price downtrend (the Brent price expressed in dollars fell by 44% between June and December). There are several reasons for this: 1/ the NBP spot price rose by 38% during the same period; 2/ the euro has lost 10% of its value since June, the effect of which is to limit variations in prices expressed in dollars; 3/ the LT price is based on six-month averages for petroleum product prices, which attenuates variations. Averaged over six months, the Brent price in euros has only lost 6% since June. The effects of the oil and NBP downtrends on the LT 60% price will be progressive. On the basis of present trends, the latter could reach €19.3/MWh ($6.7/MBtu) by August, i.e. down 30% compared to December.

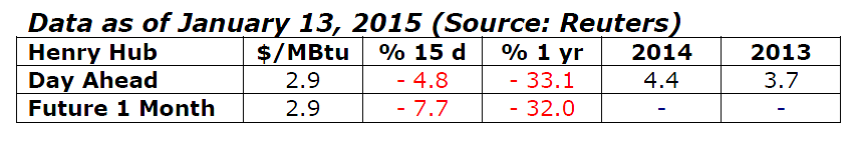

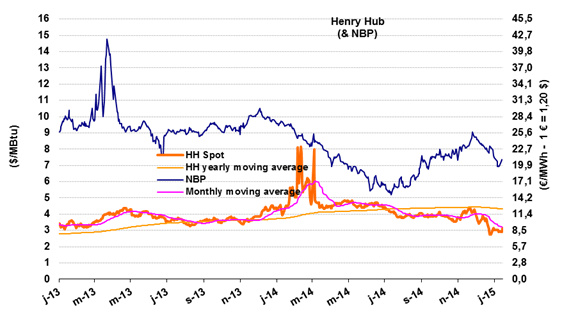

The U.S. market (Henry Hub): A sharp drop

After oscillating around $4/MBtu since July, the HH price lost 17% in December ($3.4/MBtu) and an additional 12% with the first January quotes ($3/MBtu) as a result of the mild winter and given the market outlook. The DOE now expects consumption to remain stable in 2015 (765 Gm3 or 73.8 bcfd) and has revised its production forecasts upwards (+15 Gm3): output is now expected to increase by 3% to nearly 750 Gm3 (72.2 bcfd). The futures markets have adjusted, anticipating a price of $3/MBtu in 2015, which is $1 less than last October’s quotes for the same year.

After oscillating around $4/MBtu since July, the HH price lost 17% in December ($3.4/MBtu) and an additional 12% with the first January quotes ($3/MBtu) as a result of the mild winter and given the market outlook. The DOE now expects consumption to remain stable in 2015 (765 Gm3 or 73.8 bcfd) and has revised its production forecasts upwards (+15 Gm3): output is now expected to increase by 3% to nearly 750 Gm3 (72.2 bcfd). The futures markets have adjusted, anticipating a price of $3/MBtu in 2015, which is $1 less than last October’s quotes for the same year.

By Guy Maisonnier, Senior Economist – IFPEN