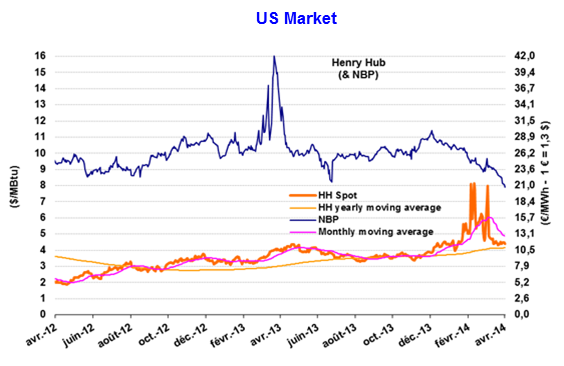

NBP: very pronounced downward trend

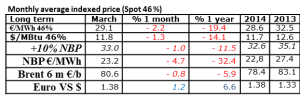

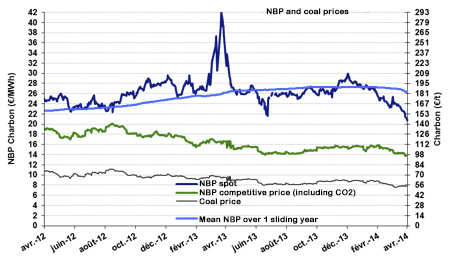

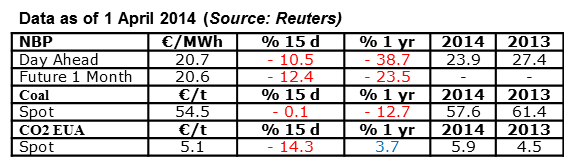

The NBP price in March stood at €23.2/MWh (US$9.4/MBtu), 4.7% down from February and 13.6% down from January. The first listing for the month of April was at €20.7/MWh (US$8.4/MBtu), 10.8% below the average for March. These are relatively low levels which mark a return to the listings seen in 2011. However, the market is not expecting to fall dramatically over the summer, and a mean price of €20.9/MWh is forecast for NBP. Several factors seem to be behind this downward trend. Demand continues to be weak in the UK – 79 Gm3 in 2013, as opposed to 99 Gm3 in 2010. This is also the case for the 28 countries that make up the European Union – consumption in 2013 was at 462 Gm3 (source: Eurogas), down 13% (70 Gm3) compared with 2010. The competitive price with coal, estimated at €14/MWh, is also considerably lower than the current price. And the price of Brent is falling, now standing at less than US$106/b.

The NBP price in March stood at €23.2/MWh (US$9.4/MBtu), 4.7% down from February and 13.6% down from January. The first listing for the month of April was at €20.7/MWh (US$8.4/MBtu), 10.8% below the average for March. These are relatively low levels which mark a return to the listings seen in 2011. However, the market is not expecting to fall dramatically over the summer, and a mean price of €20.9/MWh is forecast for NBP. Several factors seem to be behind this downward trend. Demand continues to be weak in the UK – 79 Gm3 in 2013, as opposed to 99 Gm3 in 2010. This is also the case for the 28 countries that make up the European Union – consumption in 2013 was at 462 Gm3 (source: Eurogas), down 13% (70 Gm3) compared with 2010. The competitive price with coal, estimated at €14/MWh, is also considerably lower than the current price. And the price of Brent is falling, now standing at less than US$106/b.

Conversely, the dispute between Ukraine and Russia is one of the factors which may potentially push prices up. One of the consequences of this dispute has been the withdrawal of the rebates that had been granted to the Ukraine in December. As of April, the price of gas has been fixed at US$385.5/1000 m³, or €25.5/MWh. The rebate of US$100/1000 m³ being withdrawn (2010 compensation linked to the Sebastopol port being used) would result in a price of US$485/1000 m³, or €32/MWh. In the event of bills not being paid, the Russian gas supply is likely to be disrupted. By making the most effective use of Russia’s capacity to bypass the Ukraine, the residual transit would involve volumes of around 46 Gm3/year, i.e., 10% of the EU28’s total consumption.

Ukraine in December. As of April, the price of gas has been fixed at US$385.5/1000 m³, or €25.5/MWh. The rebate of US$100/1000 m³ being withdrawn (2010 compensation linked to the Sebastopol port being used) would result in a price of US$485/1000 m³, or €32/MWh. In the event of bills not being paid, the Russian gas supply is likely to be disrupted. By making the most effective use of Russia’s capacity to bypass the Ukraine, the residual transit would involve volumes of around 46 Gm3/year, i.e., 10% of the EU28’s total consumption.

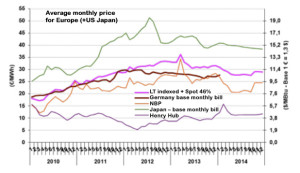

Indexed European price (46% spot): slightly down

The European price (46% spot) stood at €29.1/MWh (US$11.8/MBtu) in March, down by nearly 2.2% on the previous month, a decline that is in line with the fall in the price of NBP (-4.7% in March). Current predictions, which are once again down for Brent (US$105.6/b for 2014, 2.7% lower than 2013) and NBP (€22.8/MWh, down 16.7%), are for a long-term fall of 10% across 2014 as a whole.

The European price (46% spot) stood at €29.1/MWh (US$11.8/MBtu) in March, down by nearly 2.2% on the previous month, a decline that is in line with the fall in the price of NBP (-4.7% in March). Current predictions, which are once again down for Brent (US$105.6/b for 2014, 2.7% lower than 2013) and NBP (€22.8/MWh, down 16.7%), are for a long-term fall of 10% across 2014 as a whole.

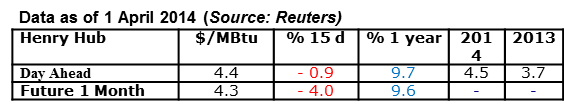

US market (Henry Hub): the fall in prices continues

The average price stood at US$4.9/MBtu in March, having fallen from nearly US$8 at the start of the month. The general trend is, however, downwards, with prices of US$4.3 expected for this summer. Stocks, which currently stand at around 25 Gm3, are 20 to 40 Gm3 lower than the average minimum/maximum over 5 years. But circumstances appear favourable for building them up to the 110 Gm3 that we usually have at the start of the winter. Indeed, the most recent statistics from the Department of Energy report a new increase in shale gas production. Production stood at 28.4 Gm3 for the month of February – 5 Gm3 more in a year (an increase of 34 Gm3 to 324 Gm3 over a sliding year).

The average price stood at US$4.9/MBtu in March, having fallen from nearly US$8 at the start of the month. The general trend is, however, downwards, with prices of US$4.3 expected for this summer. Stocks, which currently stand at around 25 Gm3, are 20 to 40 Gm3 lower than the average minimum/maximum over 5 years. But circumstances appear favourable for building them up to the 110 Gm3 that we usually have at the start of the winter. Indeed, the most recent statistics from the Department of Energy report a new increase in shale gas production. Production stood at 28.4 Gm3 for the month of February – 5 Gm3 more in a year (an increase of 34 Gm3 to 324 Gm3 over a sliding year).

By Guy Maisonnier