NBP: Under temporary pressure

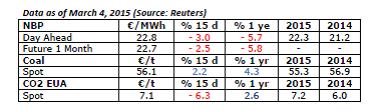

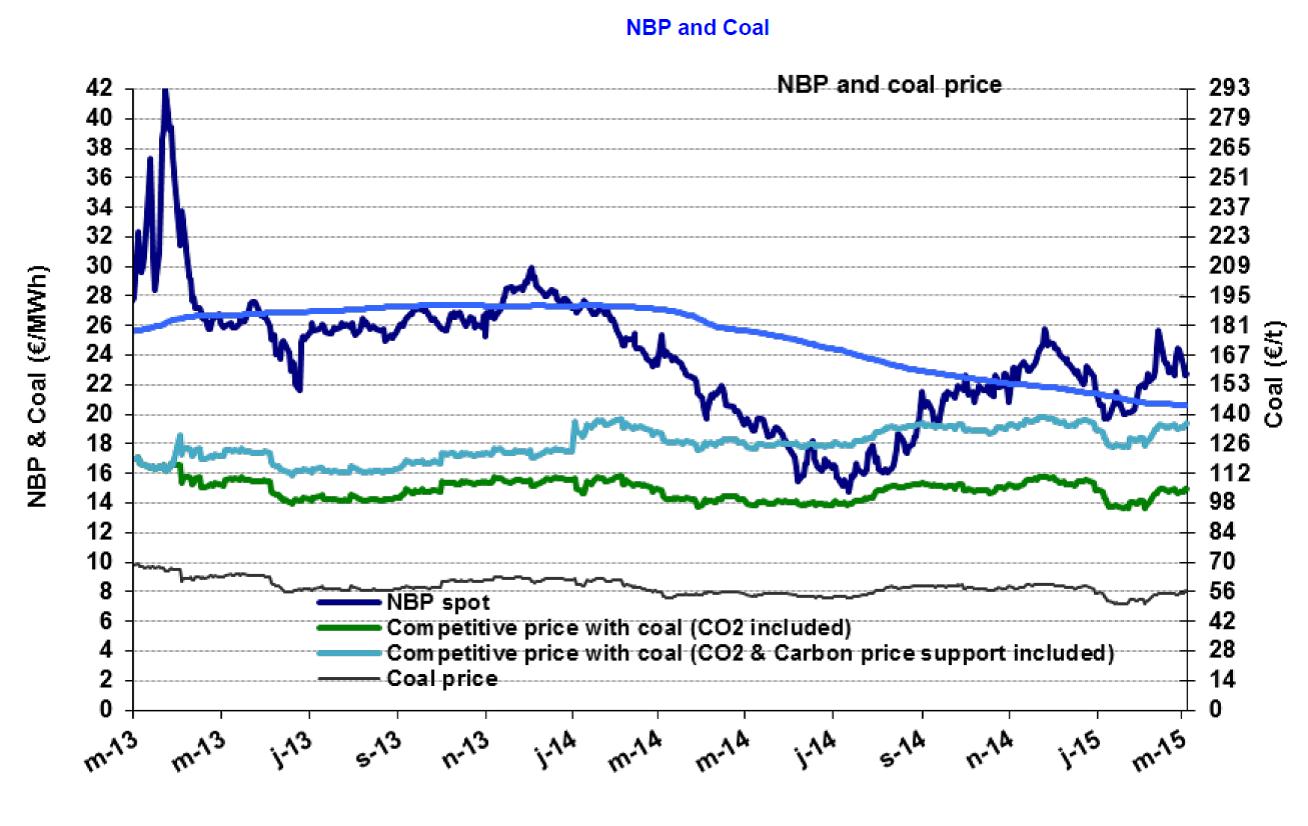

The NBP price averaged €23.4/MWh ($7.8/MBtu) in February, up nearly 14% compared to January. Two factors exerted upward pressure. First, taking the NBP to €25.7/MWh on Feb. 12, was the Dutch debate over Groningen and its level of production (66% of the country’s total) for 2015 and 2016. The latter was cut to 39.4 bcm from the initial target of 42.5 bcm, like in 2014. Proposals of 35 and 30 bcm were also heard. It was agreed to set the level at 16.5 bcm for first half 2015. Secondly, the negotiations between Russia and Ukraine in late February, with threats of cutting off gas deliveries, also gave cause for concern. The fact that a trilateral meeting took place and a prepayment was made in early March, even if it was small ($15 M for about 50bcm), slightly alleviated market pressure. In early March, the pressure lifted slightly and prices fell to €22.9 /MWh ($7.5/MBtu), 2% lower than in January. The market anticipated an average summer price of €21.6/MWh ($7/MBtu).

The NBP price averaged €23.4/MWh ($7.8/MBtu) in February, up nearly 14% compared to January. Two factors exerted upward pressure. First, taking the NBP to €25.7/MWh on Feb. 12, was the Dutch debate over Groningen and its level of production (66% of the country’s total) for 2015 and 2016. The latter was cut to 39.4 bcm from the initial target of 42.5 bcm, like in 2014. Proposals of 35 and 30 bcm were also heard. It was agreed to set the level at 16.5 bcm for first half 2015. Secondly, the negotiations between Russia and Ukraine in late February, with threats of cutting off gas deliveries, also gave cause for concern. The fact that a trilateral meeting took place and a prepayment was made in early March, even if it was small ($15 M for about 50bcm), slightly alleviated market pressure. In early March, the pressure lifted slightly and prices fell to €22.9 /MWh ($7.5/MBtu), 2% lower than in January. The market anticipated an average summer price of €21.6/MWh ($7/MBtu).

The “euro effect,” which pushed up the $/€ conversion of international prices, should be stressed. By way of an example: in June, $7/MBtu was worth €17.7/MWh at an exchange rate of $1.35; today, it’s worth €21.6/MWh at the current exchange rate of $1.1 (€/$: -17% in 8 months).

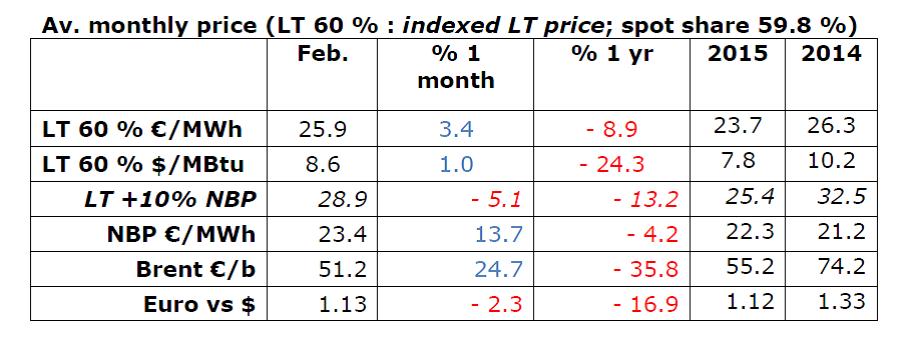

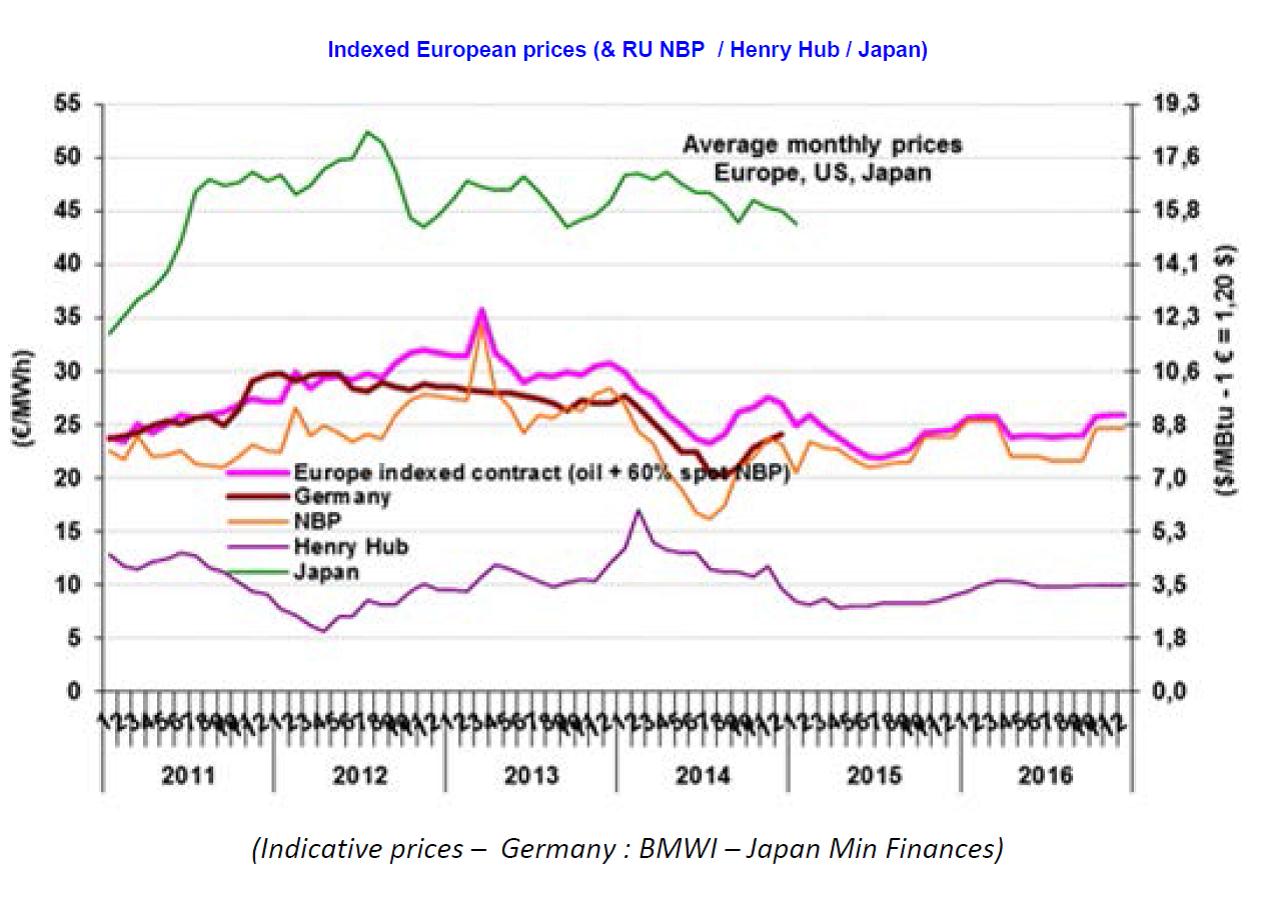

Indexed European price: upswing, probably temporary

In February, the indicative European price (LT 60%) stood at €25.9/MWh ($8.6/MBtu), up 3.4% over January, the result of an uptrend on spot markets (NBP: +13.7%) curbed by the oil price downswing. Whereas the Brent rose 22% in February, the average 6-month price was down 9% (-23% in one year).

In February, the indicative European price (LT 60%) stood at €25.9/MWh ($8.6/MBtu), up 3.4% over January, the result of an uptrend on spot markets (NBP: +13.7%) curbed by the oil price downswing. Whereas the Brent rose 22% in February, the average 6-month price was down 9% (-23% in one year).

Based on current expectations (with the Brent inching up to $66/b by end 2015, the NBP at €22.3/MWh for the next few months and the euro at $1.10), the LT 60% price could decline to €22/MWh ($7.1/MBtu) by July before rising to around €24/MWh by year end. Naturally, this scenario is subject to change as a function of variations in the economic, geopolitical and/or weather conditions.

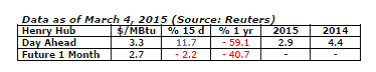

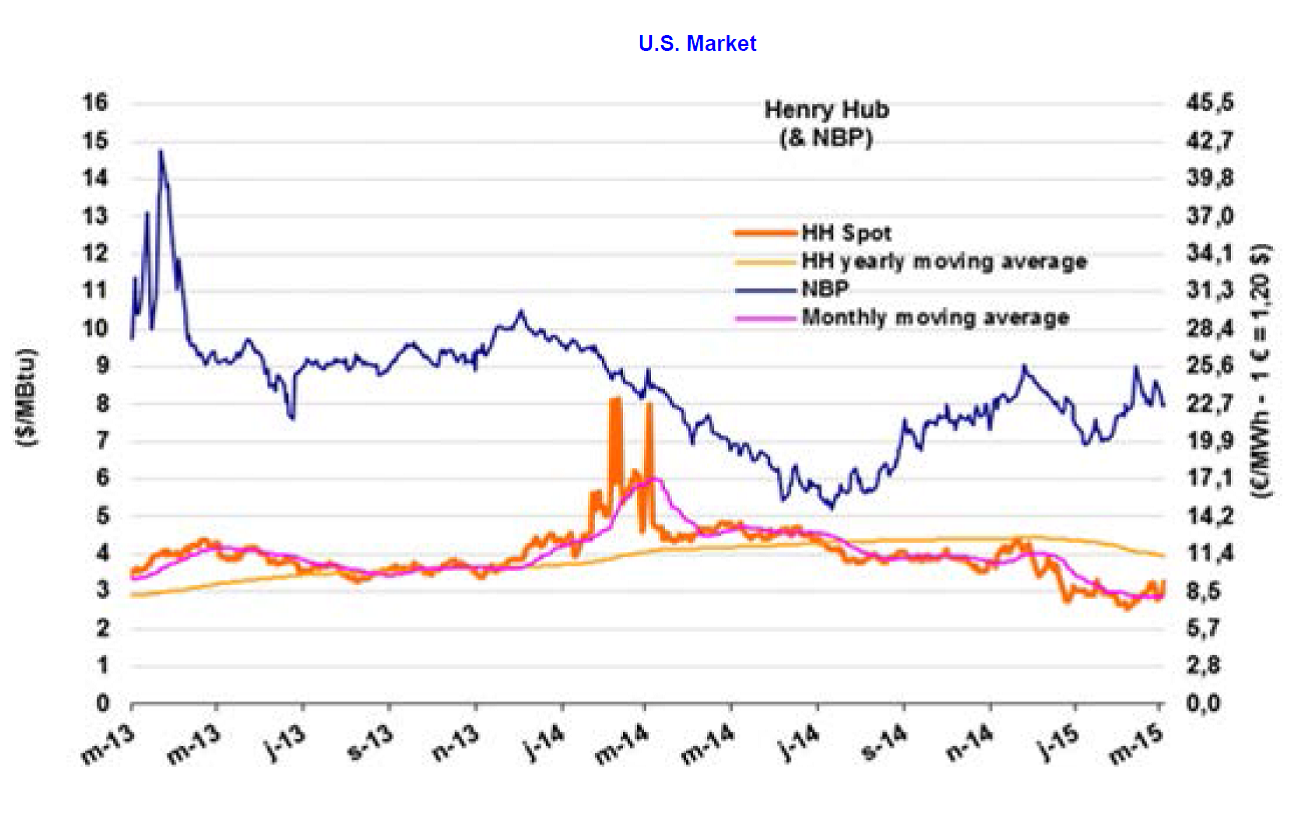

The U.S. market (Henry Hub): an upward correction

Averaging $2.9/MBtu in February, the HH was down over January (- 4.1%), its movement highly volatile (between $2.6 and 3.2/MBtu). It peaked around February 25 due to weather conditions, especially in the northeast of the country. The DOE noted extreme prices in certain areas ($23 in Boston on the 13th; $38 in New York). The first March quotations are up by nearly 7% ($3/MBtu), but still 38% lower than the previous year. In the next few months, the price should fall below $3 due to increased shale gas output, which reached 39.5 bcf/d (408 bcm/yr) in January (51% of the output anticipated for 2015).

Averaging $2.9/MBtu in February, the HH was down over January (- 4.1%), its movement highly volatile (between $2.6 and 3.2/MBtu). It peaked around February 25 due to weather conditions, especially in the northeast of the country. The DOE noted extreme prices in certain areas ($23 in Boston on the 13th; $38 in New York). The first March quotations are up by nearly 7% ($3/MBtu), but still 38% lower than the previous year. In the next few months, the price should fall below $3 due to increased shale gas output, which reached 39.5 bcf/d (408 bcm/yr) in January (51% of the output anticipated for 2015).

By Guy Maisonnier, Senior Economist – IFPEN