NBP: A return of the 2014 scenario?

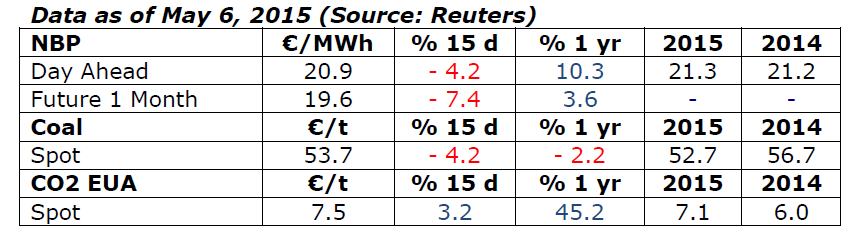

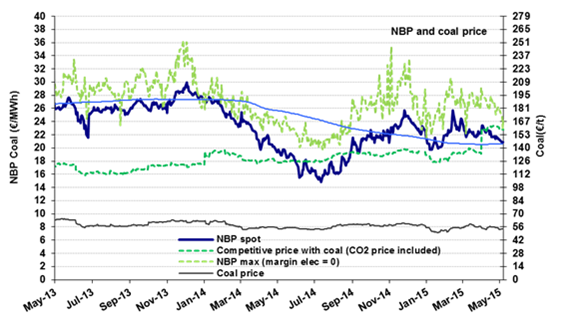

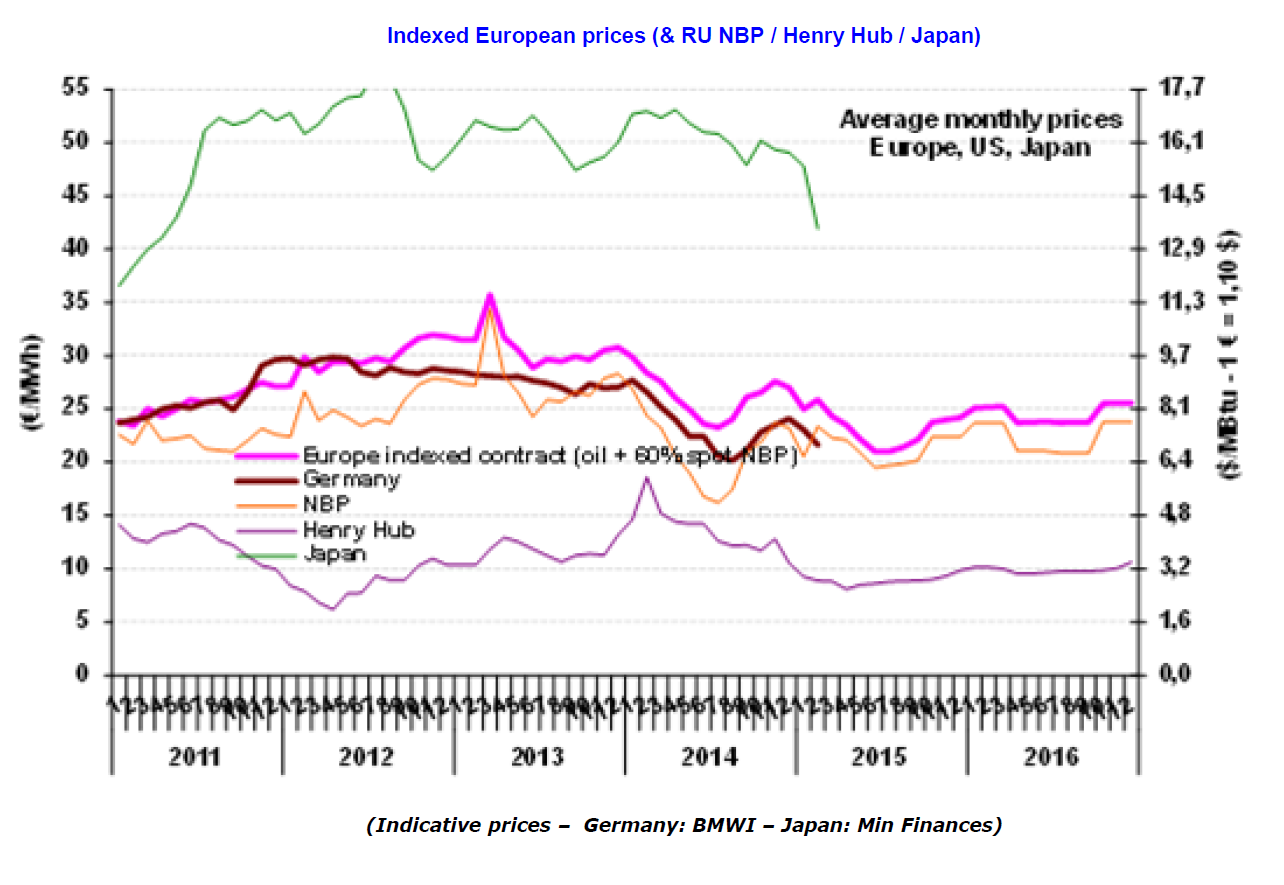

The NBP price averaged €22.1/MWh ($7.0/MBtu) in April, down by 1% over March. There is greater downward pressure on the quotations for early May, which are at €20.9/MWh ($6.8/MBtu), close to the levels predicted by the markets for this summer (€20.4/MWh on average). A return of the 2014 scenario, with its sharp drop in prices during the summer (€16-17/MWh between June and August 2014) remains possible this year: demand is lower than in the past, especially in the power sector (20 bcm since 2012 compared to 30-35 bcm before then; the market share for natural gas has fallen from 41% in 2011 to 29%; renewable energies are up from 9 to 17%).

The NBP price averaged €22.1/MWh ($7.0/MBtu) in April, down by 1% over March. There is greater downward pressure on the quotations for early May, which are at €20.9/MWh ($6.8/MBtu), close to the levels predicted by the markets for this summer (€20.4/MWh on average). A return of the 2014 scenario, with its sharp drop in prices during the summer (€16-17/MWh between June and August 2014) remains possible this year: demand is lower than in the past, especially in the power sector (20 bcm since 2012 compared to 30-35 bcm before then; the market share for natural gas has fallen from 41% in 2011 to 29%; renewable energies are up from 9 to 17%).

A decrease in the NBP would mean relatively low prices expressed in dollars given the current weakness of the euro (now worth $1.1 compared to $1.35 last summer). A price of €17/MWh is equivalent to $5.6/MBtu at the current exchange rate of $1.12 as opposed to $6.7/MBtu last year. This scenario could imply the return of a significant gap between the NBP and the LNG prices. The latter range from $6.5 to 7.5/Mbtu depending on the region.

As for next winter, the market is forecasting that the NBP price will rise by €23/MWh ($7.7/MBtu). This increase, usual for winter, is due in part to expectations that the oil price will trend upwards ($70/b at year-end versus $59 in April for the Brent).

Indexed European price: Still going down

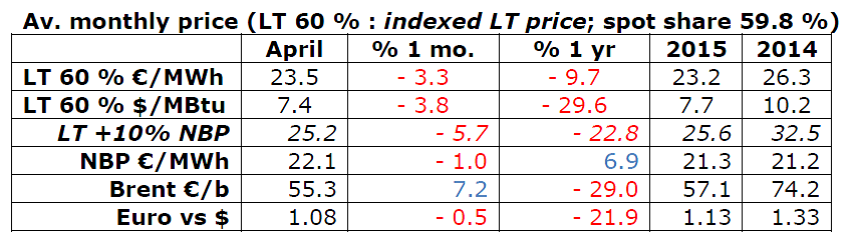

In April, the indicative European price (LT 60%) stood at €23.5/MWh ($7.4/MBtu), which is 3.3% lower than in March. Judging by the spot price trends for gas, it could drop to €21/MWh ($7.0/MBtu) during the summer then rise to about €24/MWh ($8.0/MBtu) by the end of the year. This forecast is based on the new market uptrends affecting the oil price and the euro ($70/b and $1.14, respectively, by year-end). Influenced by the geopolitical context and the market equilibrium, the Brent has seen a sharp increase since mid-March (+$14 to $66/b).

In April, the indicative European price (LT 60%) stood at €23.5/MWh ($7.4/MBtu), which is 3.3% lower than in March. Judging by the spot price trends for gas, it could drop to €21/MWh ($7.0/MBtu) during the summer then rise to about €24/MWh ($8.0/MBtu) by the end of the year. This forecast is based on the new market uptrends affecting the oil price and the euro ($70/b and $1.14, respectively, by year-end). Influenced by the geopolitical context and the market equilibrium, the Brent has seen a sharp increase since mid-March (+$14 to $66/b).

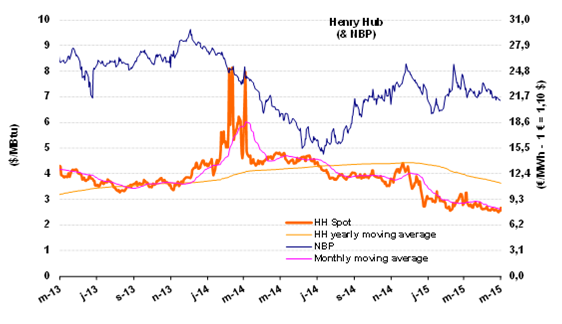

The U.S. market (Henry Hub): Low prices

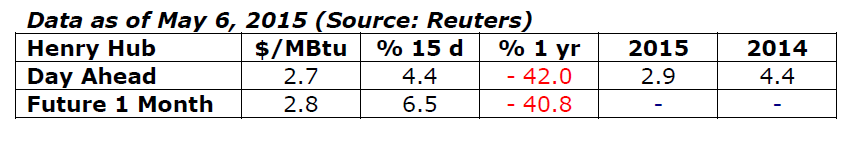

The Henry Hub has gone up significantly in the last few days after hitting $2.5/MBtu on April 27, equivalent to the prices observed in May 2012. That year, the record low was posted in mid-April ($1.94/MBtu). However, the market is not anticipating a similar scenario. On the contrary, prices are expected to rise progressively to about $3/MBtu by year-end. This being said, the average price for 2015 will be very low, close to the 2012 level ($2.8/MBtu). This situation is due to the expected increases in U.S. gas production. The EIA estimates that the volume for 2015 will be exceptional, at 766 bcm (74.1 bcfd). This is 40 bcm more than in 2014 and 160 additional bcm over 5 years, equivalent to the 2014 output of Iran or Qatar.

The Henry Hub has gone up significantly in the last few days after hitting $2.5/MBtu on April 27, equivalent to the prices observed in May 2012. That year, the record low was posted in mid-April ($1.94/MBtu). However, the market is not anticipating a similar scenario. On the contrary, prices are expected to rise progressively to about $3/MBtu by year-end. This being said, the average price for 2015 will be very low, close to the 2012 level ($2.8/MBtu). This situation is due to the expected increases in U.S. gas production. The EIA estimates that the volume for 2015 will be exceptional, at 766 bcm (74.1 bcfd). This is 40 bcm more than in 2014 and 160 additional bcm over 5 years, equivalent to the 2014 output of Iran or Qatar.

By Guy Maisonnier, Senior Economist – IFPEN