NBP: Strong upward pressure

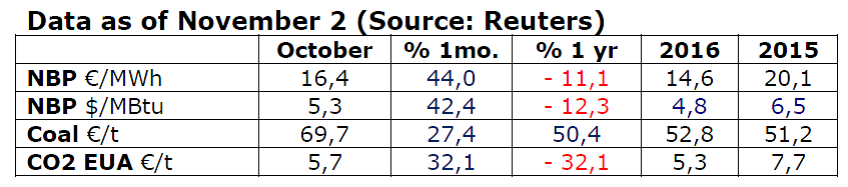

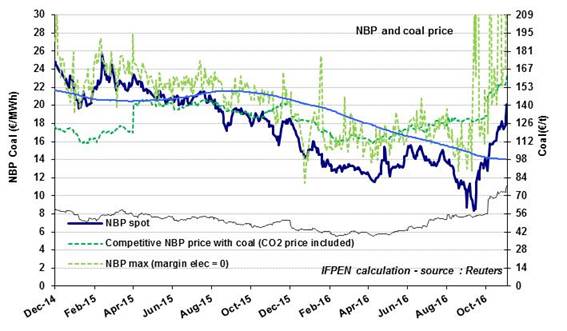

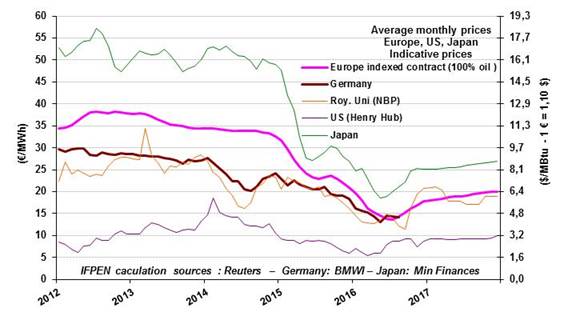

In October, the NBP price saw a spectacular 44% rise to €16.4/MWh ($5.3/MBtu). This is slightly higher than the price of oil-indexed contracts, a sign that the market is tightening. The NBP continued to climb in early November and now stands at about €20/MWh ($6.5/MBtu). With the slowdown in exports from the United Kingdom to Europe via the Interconnector, this phenomenon now affects all European gas prices.

In October, the NBP price saw a spectacular 44% rise to €16.4/MWh ($5.3/MBtu). This is slightly higher than the price of oil-indexed contracts, a sign that the market is tightening. The NBP continued to climb in early November and now stands at about €20/MWh ($6.5/MBtu). With the slowdown in exports from the United Kingdom to Europe via the Interconnector, this phenomenon now affects all European gas prices.

The factors in play include lower temperatures as well as the coal price hike (27% in October), which encourages recourse to gas. In addition, supply is tight on the electricity market due to the closing of nuclear power plants in France, interconnected with all of its European neighbors. Having surpassed the price of long-term contracts, the NBP is nearing the levels that encourage LNG deliveries. The LNG market is also tightening, with prices in Asia currently at about $7/MBtu.

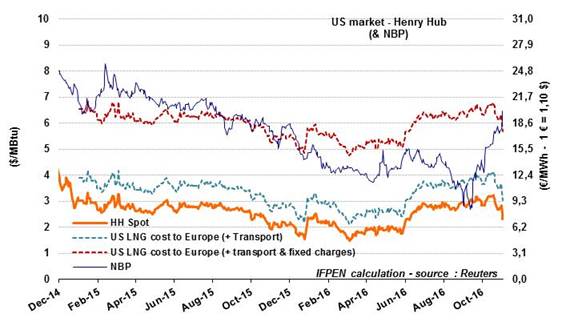

The markets expect NBP prices to remain high all winter at about €21/MWh ($6.8/MBtu). These conditions would favor U.S. exports to Europe as the European price is expected to be higher than the full cost of delivered U.S. LNG.

Indexed European prices: higher this winter

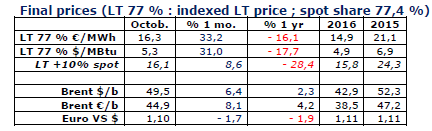

In October, the indicative European price (LT 77%) averaged €16.3/MWh ($5.3/MBtu), up by more than 30% in one month as a result of the surge in European spot prices.

In October, the indicative European price (LT 77%) averaged €16.3/MWh ($5.3/MBtu), up by more than 30% in one month as a result of the surge in European spot prices.

The LT 77% price could slightly exceed €20/MWh ($6.6/MBtu) during the winter. This is higher than the price of 100% oil-indexed contracts, estimated at €18/MWh ($5.9/MBtu). The latter have benefited from falling oil prices (now at about $45/b, i.e. $4 less than in October). This sharp decline is due to uncertainty as to whether OPEC will actually enforce its preliminary agreement to cut production (to be decided on November 30).

U.S. market (Henry Hub): down in November

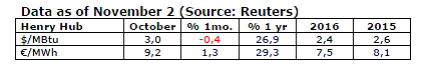

The first November quotations showed a sharp drop in the Henry Hub price, stable in October at $3/MBtu. Compared to the October average, it fell 23%, reaching $2.3/MBtu on November 2. The main reason is that, on October 20, the Climate Prediction Center predicted higher-than-normal temperatures this winter for much of the United States. If this forecast is accurate, the draws on gas stocks, which currently stand at the same record high levels as in 2015, would be light. Due to the mild weather conditions of last winter 2015-16, the price averaged $2/MBtu, with a low of $1.5/MBtu in early March. This winter, weather conditions will once again have a great impact on U.S. gas prices.

The first November quotations showed a sharp drop in the Henry Hub price, stable in October at $3/MBtu. Compared to the October average, it fell 23%, reaching $2.3/MBtu on November 2. The main reason is that, on October 20, the Climate Prediction Center predicted higher-than-normal temperatures this winter for much of the United States. If this forecast is accurate, the draws on gas stocks, which currently stand at the same record high levels as in 2015, would be light. Due to the mild weather conditions of last winter 2015-16, the price averaged $2/MBtu, with a low of $1.5/MBtu in early March. This winter, weather conditions will once again have a great impact on U.S. gas prices.

For now, the impact on the 2017 average has been minor. It stands at $3/MBtu on the market, down by $0.3 in less than one month.

By Guy Maisonnier – Senior Economist – IFPEN