NBP: down in August and September, up in October

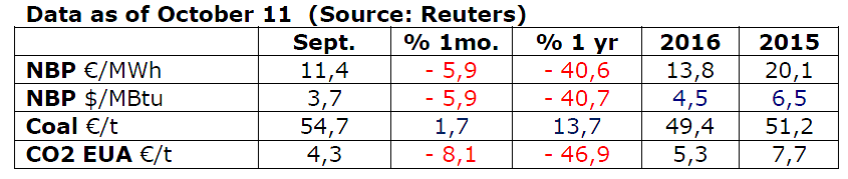

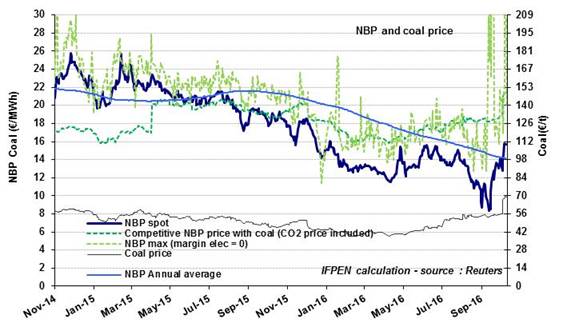

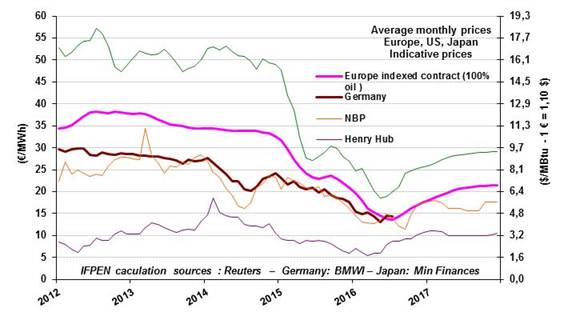

The slight pressure on the NBP price in the month of June has turned out to be transient, due to temporary supply constraints. Since then, it has fallen steadily, losing nearly 6% in July, 13% in August and another 6% in September. The September average was €11.4/MWh ($3.7/MBtu) compared to €14.8/MWh ($4.9/MBtu) in June, a drop of 23%.

The slight pressure on the NBP price in the month of June has turned out to be transient, due to temporary supply constraints. Since then, it has fallen steadily, losing nearly 6% in July, 13% in August and another 6% in September. The September average was €11.4/MWh ($3.7/MBtu) compared to €14.8/MWh ($4.9/MBtu) in June, a drop of 23%.

September saw strong volatility in the NBP price. Early in the month, it stayed within an extremely low range (€8.3 to 11.3/MWh), subject to significant variations in supply and demand. This temporary weakness in the price also reflected that the Interconnector was saturated during this period, preventing the export of surplus gas to the Continent. The NBP, tending to trend upward since September 14, remained very volatile at €12 to 14/MWh ($3.9 to 4.6/MBtu).

In the first quotations in October, the uptrend of late September seemed to continue and even steepen as the NBP moved up from €12.7 to 15.7/MWh ($4.2 to 5.2/MBtu).

The markets are expecting the NBP price to rise in the next few months and, over the winter, to reach levels close to the long-term oil-indexed gas contract prices, currently estimated to be around €18/MWh ($5.9/MBtu) for January 2017. Naturally, this projection is subject to change depending on supply-demand equilibrium conditions.

One noteworthy factor is that the general energy context, now undergoing major change, is likely to favor an uptrend or at least support gas prices in Europe. This is true both for the oil price (now > $50/b) and the coal price (+20% in October). On the other hand, the upsurge in U.K. electricity prices since September 12 (peaking at €180/MWh on the 14th) seems to be the result of conjunctural factors (maintenance at power plants). Another factor is the strong depreciation in the pound sterling, down 18% since the June 23 referendum on the Brexit. This will have an equivalent impact on the NBP price, expressed in £.

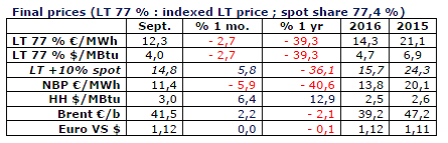

Indexed European prices: a rise expected for winter

In September, the indicative European price (LT 77%) stood at €12.3/MWh ($4.0/MBtu), falling by nearly 3% in one month. The expected increases in the spot gas price and the oil price should boost the price of LT 77%. The effective implementation of OPEC’s agreement in principle will be decisive in orienting the prices of oil and of 100% oil-indexed gas contracts. Following this agreement, the oil price saw a marked increase and now stands at about $50/b and at $55/b for 2017. On this basis, the LT 77% price would reach €18/MWh ($5.9 $/MBtu) in the course of next winter.

In September, the indicative European price (LT 77%) stood at €12.3/MWh ($4.0/MBtu), falling by nearly 3% in one month. The expected increases in the spot gas price and the oil price should boost the price of LT 77%. The effective implementation of OPEC’s agreement in principle will be decisive in orienting the prices of oil and of 100% oil-indexed gas contracts. Following this agreement, the oil price saw a marked increase and now stands at about $50/b and at $55/b for 2017. On this basis, the LT 77% price would reach €18/MWh ($5.9 $/MBtu) in the course of next winter.

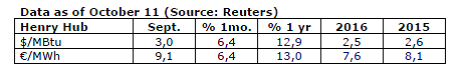

The U.S. market (Henry Hub): a 6% increase in September

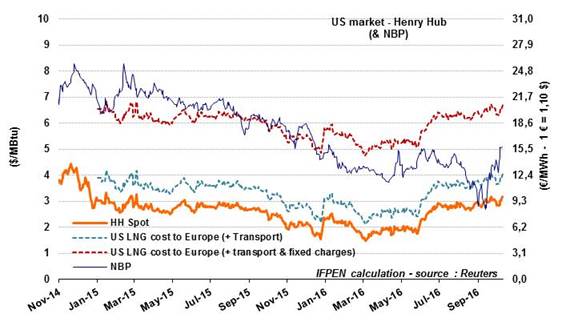

The Henry Hub, relatively stable in July and August at $2.8/MBtu, gained 6% in September to reach $3/MBtu on average. The markets are foreseeing slightly higher prices for 2017 (between $3.2 and 3.6/MBtu).

The Henry Hub, relatively stable in July and August at $2.8/MBtu, gained 6% in September to reach $3/MBtu on average. The markets are foreseeing slightly higher prices for 2017 (between $3.2 and 3.6/MBtu).

In addition to the weather conditions, the gas balance will obviously play a major role in determining the actual gas price. The latest EIA projection for 2017 calls for low growth in demand (1%) and a 2.8% increase in net production (787 Gm3). This outlook may be optimistic, in light of the very low level of drilling activity. Moreover, the latest EIA numbers show that shale gas production has been trending downward since the beginning of the year.

For LNG, the EIA anticipates that sales will rise in 2017 to 16 Gm3 (compared to 5 Gm3 in 2016). More than 50% of the first deliveries were made to South America. Relatively few cargo shipments are headed for Europe, for reasons of low profitability.

By Guy Maisonnier – Senior Economist – IFPEN