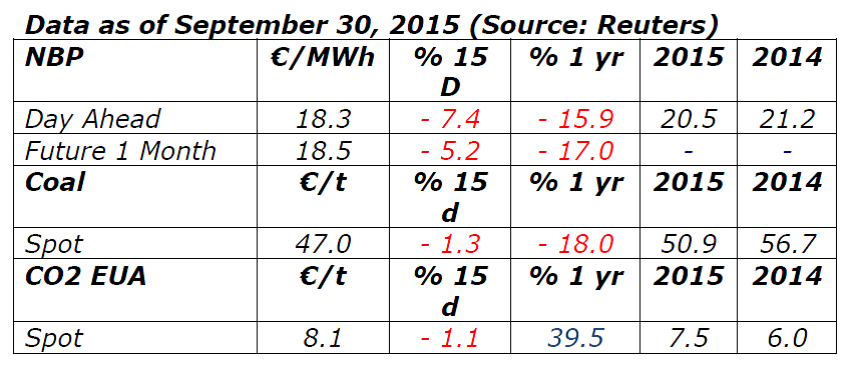

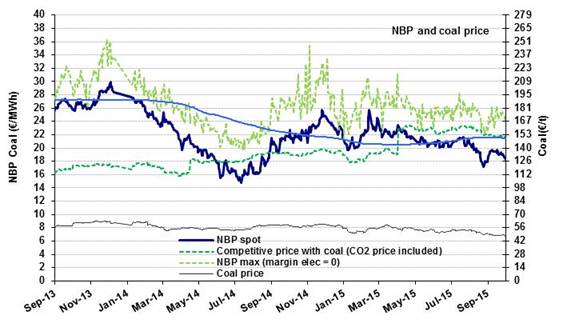

NBP: prices historically low

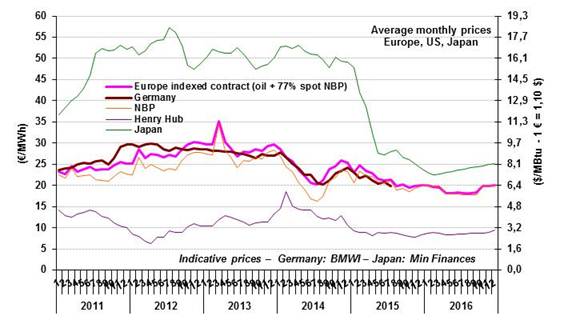

The NBP price for September averaged €19.2/MWh ($6.3/MBtu), down 8% compared to September 2014. The markets anticipated that, barring exceptional phenomena (weather or other), next winter’s average prices would be about the same: €19.5/MWh ($6.4/MBtu). For summer 2016, the price is expected to be under €18/MWh ($5.9/MBtu). Several factors account for this situation of prices that are historically low compared to the trends since 2011.

The NBP price for September averaged €19.2/MWh ($6.3/MBtu), down 8% compared to September 2014. The markets anticipated that, barring exceptional phenomena (weather or other), next winter’s average prices would be about the same: €19.5/MWh ($6.4/MBtu). For summer 2016, the price is expected to be under €18/MWh ($5.9/MBtu). Several factors account for this situation of prices that are historically low compared to the trends since 2011.

First of all, the gas balance sheets for the UK and for Europe generally show that demand has been rising for a year (an increase of about 4%), but remains at levels that are very modest, lower than in 2010 by 26% for the UK and 20% for Europe). In addition, global European production is stabilizing: the decrease in Dutch output is offset by the increase in Norway’s output since the end of 2014. UK production has held steady since 2013. Among the other factors, mention should be made of the low level of energy prices generally. In Asia, the LNG price of $7/MBtu is an indicator of a plentiful supply. The coal price continues to slide, standing at €47/t versus €56/t in 2014. Also falling, the price of oil is expected to hit $53/b in 2016 compared to $67 as forecast in June.

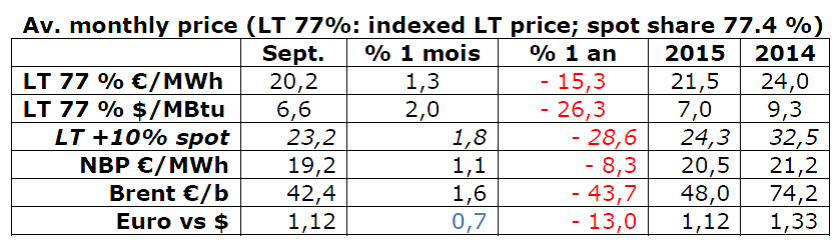

Indexed European price: a downward trend

In September, the indicative European price (LT 77%) stood at €20.2/MWh ($6.6/MBtu), up 1.3% compared to the previous month but down 15% year-on-year. The current forecasts for 2016 for the NBP price (€18.9/MWh) and that of Brent ($53/b) would yield LT prices of between €18 and 20/MWh ($6-6.6/MBtu) next year. However, many uncertainties remain, especially for the oil market, currently influenced by gloomy economic forecasts. It is still possible for a gradual upward readjustment to occur if the oil supply is less abundant than expected.

In September, the indicative European price (LT 77%) stood at €20.2/MWh ($6.6/MBtu), up 1.3% compared to the previous month but down 15% year-on-year. The current forecasts for 2016 for the NBP price (€18.9/MWh) and that of Brent ($53/b) would yield LT prices of between €18 and 20/MWh ($6-6.6/MBtu) next year. However, many uncertainties remain, especially for the oil market, currently influenced by gloomy economic forecasts. It is still possible for a gradual upward readjustment to occur if the oil supply is less abundant than expected.

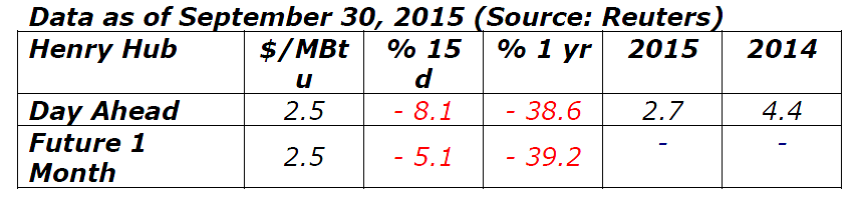

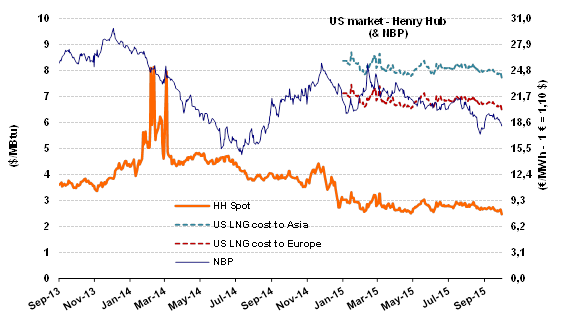

The U.S. market (Henry Hub): downward pressures

The Henry Hub averaged $2.6/MBtu in September, i.e. about 4% lower than last summer’s prices ($2.8/MBtu). On forward markets, forecasts for 2016 are also down to $2.8/MBtu compared to $2.9 a month ago. This remains consistent with EIA forecasts anticipating that supply and demand will be in balance on the U.S. market: consumption of 790 bcm and output of 785 bcm, with a production increase over 3 years of 100 bcm (a volume equivalent to the Norwegian output). However, these forecasts for 2016 could be thrown off due to the weakness of the drilling business (-30% between 2014 and 2015).

The Henry Hub averaged $2.6/MBtu in September, i.e. about 4% lower than last summer’s prices ($2.8/MBtu). On forward markets, forecasts for 2016 are also down to $2.8/MBtu compared to $2.9 a month ago. This remains consistent with EIA forecasts anticipating that supply and demand will be in balance on the U.S. market: consumption of 790 bcm and output of 785 bcm, with a production increase over 3 years of 100 bcm (a volume equivalent to the Norwegian output). However, these forecasts for 2016 could be thrown off due to the weakness of the drilling business (-30% between 2014 and 2015).

Presently, based on current prices, the cost of LNG exported to Europe and Asia would be about $6.5 and $7.7/MBtu respectively, slightly higher than the local spot prices. The first deliveries are expected at year-end.