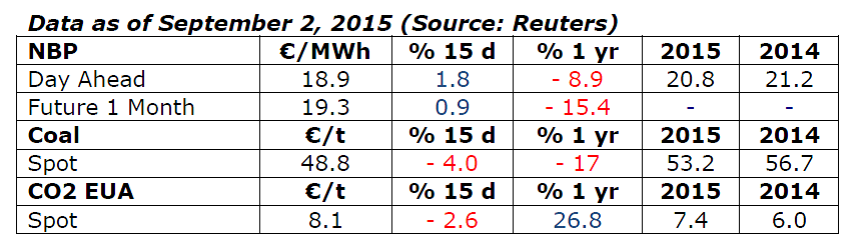

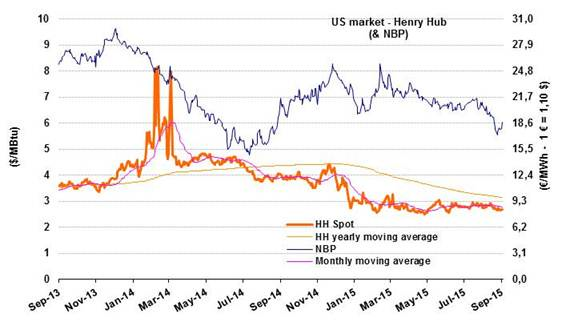

NBP: summer prices moderate, without sharp drops

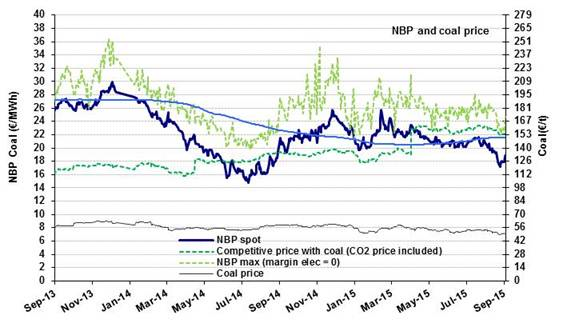

This summer, the average NBP price did not decline to the same extent as last year. In July, it even found itself under slight pressure: at €21.2/MWh ($6.8/MBtu), it was 2% higher than in June and 30% higher than in June of last year. During August, the price saw a fairly marked downtrend, hitting a low of €17.2/MWh on August 24 before rallying. The first September quotations, progressing due to sustained demand, were in the neighborhood of €18.9/MWh ($6.2/MBtu). These moderate values helped make natural gas more competitive in the electricity sector compared to coal, a phenomenon fostered since April by the increase in carbon tax support, now fixed at £18/TCO2 (about €24/TCO2). The result has been a fairly notable increase in gas consumption in this sector: 18% more in June on an annualized basis, as opposed to a 24% decrease for coal over the same period.

This summer, the average NBP price did not decline to the same extent as last year. In July, it even found itself under slight pressure: at €21.2/MWh ($6.8/MBtu), it was 2% higher than in June and 30% higher than in June of last year. During August, the price saw a fairly marked downtrend, hitting a low of €17.2/MWh on August 24 before rallying. The first September quotations, progressing due to sustained demand, were in the neighborhood of €18.9/MWh ($6.2/MBtu). These moderate values helped make natural gas more competitive in the electricity sector compared to coal, a phenomenon fostered since April by the increase in carbon tax support, now fixed at £18/TCO2 (about €24/TCO2). The result has been a fairly notable increase in gas consumption in this sector: 18% more in June on an annualized basis, as opposed to a 24% decrease for coal over the same period.

Looking to the months ahead, the market expects prices to remain within a fairly narrow range, i.e. between €21/MWh ($6.8/MBtu) during the winter and €19/MWh ($6.1/MBtu) next summer. These levels are in line with market conditions, e.g. the prices expected for long-term contracts or LNG spot prices in Europe.

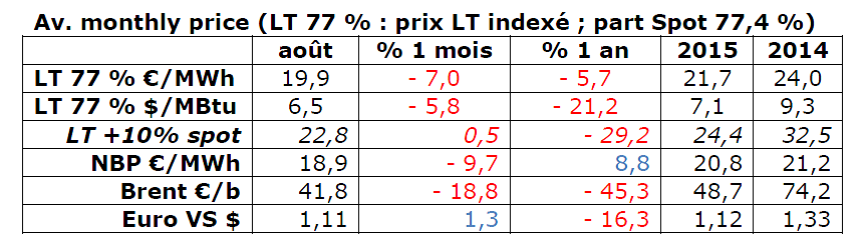

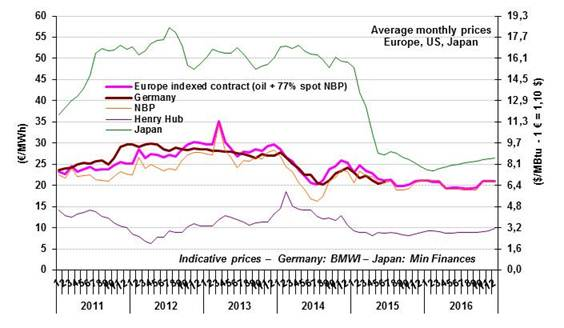

Indexed European price: down 7% in August

The indicative European price now incorporates a spot share (NBP) of 77.4%, in line with the new mode of computation adopted in France. This price is converging with the average German price, an indication that, in Europe, short-term markets are gaining influence to the detriment of formulas indexed primarily on oil.

The indicative European price now incorporates a spot share (NBP) of 77.4%, in line with the new mode of computation adopted in France. This price is converging with the average German price, an indication that, in Europe, short-term markets are gaining influence to the detriment of formulas indexed primarily on oil.

In August, the new indicative price (LT 77%) stood at €19.9/MWh ($6.5/MBtu), down by 7.0% in one month and by 21% since the beginning of the year. This reflects the decline in both the NBP and oil prices. If current trends persist (the Brent at $50/55/b), the market could see a convergence between the “100% oil,” “LT 77%” and NBP prices by year end, in the vicinity of $7/MBtu. This has not happened since 2006.

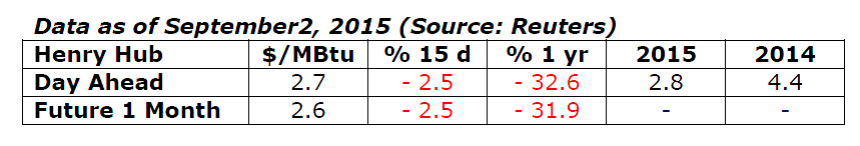

The U.S. market (Henry Hub): moderate variations

The Henry Hub averaged about $2.8/MBtu in July and August ($2.7 to 2.9/MBtu) with moderate fluctuations (from -4.9 to +5.8%). Market forecasts still predict price stability for the years to come ($2.9/MBtu in 2016 and slightly over $3 in 2017), which is consistent with DOE data. The latter still see production growing strongly (5% in 2015) despite the sharp downturn in drilling activity (-40% since November). So far, the impact of this trend on production at shale basins has been limited.

The Henry Hub averaged about $2.8/MBtu in July and August ($2.7 to 2.9/MBtu) with moderate fluctuations (from -4.9 to +5.8%). Market forecasts still predict price stability for the years to come ($2.9/MBtu in 2016 and slightly over $3 in 2017), which is consistent with DOE data. The latter still see production growing strongly (5% in 2015) despite the sharp downturn in drilling activity (-40% since November). So far, the impact of this trend on production at shale basins has been limited.

By Guy Maisonnier, Senior Economist – IFPEN