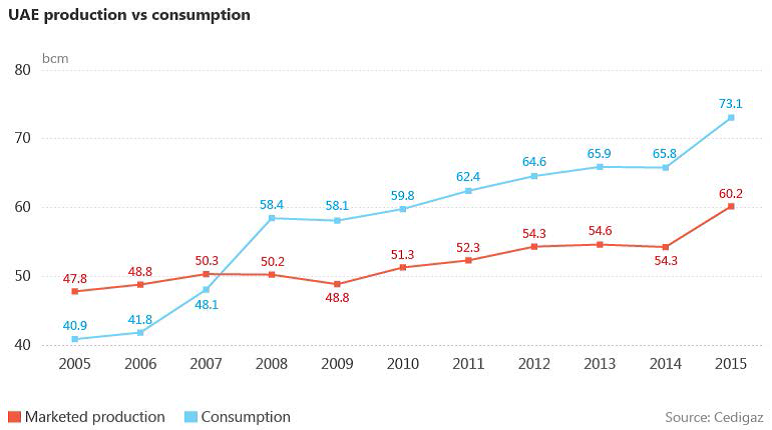

The United Arab Emirates (UAE) is one of the world’s longest-established LNG exporters. But despite holding the world’s sixth largest gas reserves, LNG imports into the federation increased at an impressive rate since 2010, when the Jebel Ali floating terminal in Dubai started up. With gas representing more than 90% of the power fuel mix, LNG purchases have been key to fill a widening supply deficit in order to match rapidly growing gas-to-power demand. Today, LNG remains at the heart of the UAE’s strategy to meet rising energy consumption and support economic and industrial expansion in times of reduced oil income and budgetary constraints. Cedigaz’s latest report examines the risks and opportunities inherent to this strategy and asks whether it is viable in the medium to longer term.

The United Arab Emirates (UAE) is one of the world’s longest-established LNG exporters. But despite holding the world’s sixth largest gas reserves, LNG imports into the federation increased at an impressive rate since 2010, when the Jebel Ali floating terminal in Dubai started up. With gas representing more than 90% of the power fuel mix, LNG purchases have been key to fill a widening supply deficit in order to match rapidly growing gas-to-power demand. Today, LNG remains at the heart of the UAE’s strategy to meet rising energy consumption and support economic and industrial expansion in times of reduced oil income and budgetary constraints. Cedigaz’s latest report examines the risks and opportunities inherent to this strategy and asks whether it is viable in the medium to longer term.

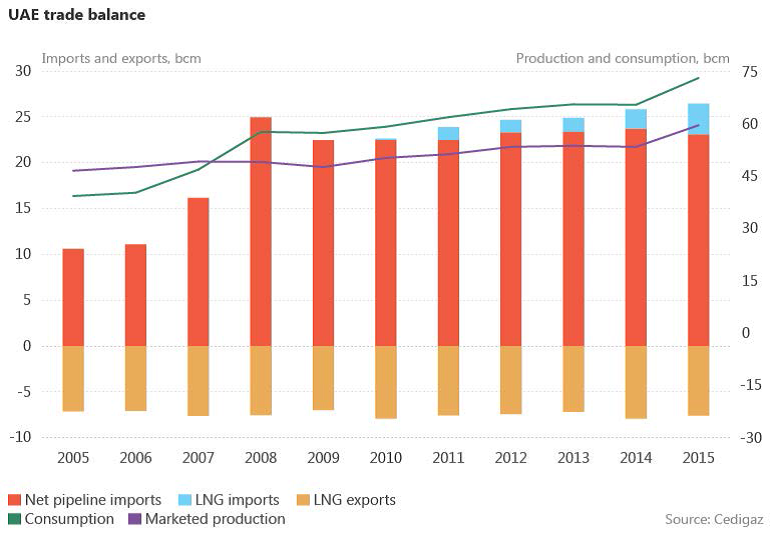

The surge of global LNG supplies and lower LNG pricing offer a window of opportunity to address a structural gas shortage at more attractive prices. LNG is also helping diversify the UAE’s supply portfolio, allowing it to reduce the dependence on gas imports from Qatar through the Dolphin pipeline, giving it more commercial and strategic leverage. In fact, taking into account the growth of its LNG capacity via new FSRU projects, the UAE looks on track to become a net LNG importer by 2020, coinciding with the expected height of the developing LNG supply wave on global markets.

The surge of global LNG supplies and lower LNG pricing offer a window of opportunity to address a structural gas shortage at more attractive prices. LNG is also helping diversify the UAE’s supply portfolio, allowing it to reduce the dependence on gas imports from Qatar through the Dolphin pipeline, giving it more commercial and strategic leverage. In fact, taking into account the growth of its LNG capacity via new FSRU projects, the UAE looks on track to become a net LNG importer by 2020, coinciding with the expected height of the developing LNG supply wave on global markets.

The growth of LNG takes place against significant investments made in nuclear, clean coal and renewable energy projects, all designed to reduce the share of gas-fired generation and help reduce carbon emissions post-2020. This transition comes with the introduction of greater energy efficiency and conservation measures, which should impact future power demand trends.

But as the UAE’s largest oil and gas producer, Abu Dhabi emirate is facing other competing priorities when examining future gas supply allocation. In particular, gas demand for enhanced oil recovery purposes – accounting for 28% of gross production – remains key to maintain oil output and protect revenue. Furthermore, the expiry in 2019 of the ADGAS’ sole long-term LNG sales contract offers the opportunity to revise its export strategy post-2020, and potentially redirect supplies to the domestic market.

But crucially, the availability of cheaper LNG has reduced the imperative to develop domestic sour gas fields as lower oil prices have dented investment appetite from international partners, for now. The high costs of extracting and processing sour gas reserves combined with the dominance of subsidized gas prices mean production is unlikely to take off in any significant way in the medium term. Lower LNG prices may represent an opportunity to minimize costs and supply risks in times of low oil revenue and robust energy demand, but as the reports finds, the pace and effectiveness of gas pricing reforms will be a driving factor in creating positive pricing signals and alleviating the longer-term risks associated with LNG and wider import dependence.

Fatima Sadouki – Independent Energy Specialist for CEDIGAZ

Complete report – Does LNG have a long-term future in the United Arab Emirates? CEDIGAZ March 2017 – 30 pages – PDF Format – public price €395 (VAT excluded)

Contact: contact@cedigaz.org