According to a new report by CEDIGAZ, the International Center for Natural Gas Information, LNG as a fuel will capture a significant market share in the transport sector by 2035. The greatest potential is seen in road transport, were annual demand is projected to reach 96 million tons per year (mtpa) in CEDIGAZ’ base scenario while demand in the marine sector could grow to an estimated 77 mtpa. The rail sector could add another 6 mtpa to global demand. However, the development of LNG as a transport fuel faces a number of challenges, and will have to go hand in hand with the development of fuelling infrastructure.

Fuel cost differentials will drive the growth in trucking sector

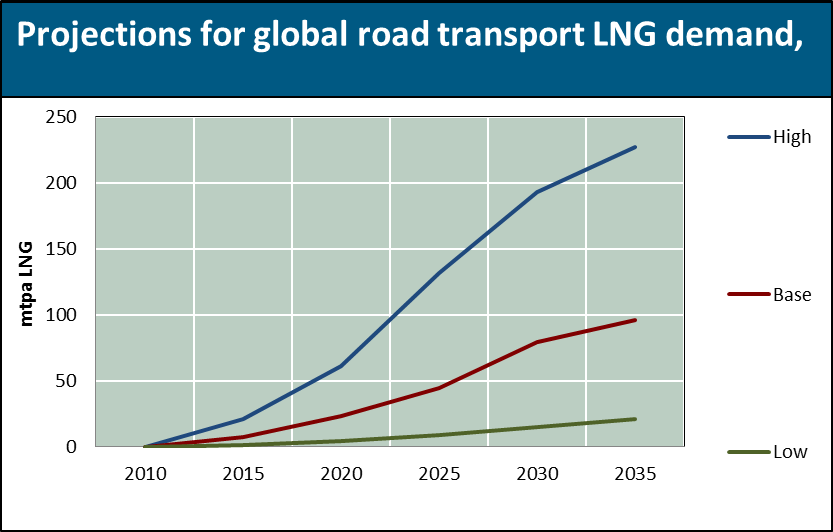

Use of LNG in land transport will be largely limited to heavy duty vehicles (HDV) and will essentially be driven by the difference between the price of diesel and that of LNG. In contrast with the marine sector, environmental legislation is unlikely to play a major role in triggering the adoption of LNG as a fuel for land transportation, as traditional fuels and technologies will be able to comply with the gradual tightening of emissions standards. However, the cost advantage of LNG relative to diesel currently provides a strong economic incentive in the trucking industry. In its base scenario, CEDIGAZ projects a worldwide demand of 45 mtpa in 2025 growing to 96 mtpa in 2035, with China representing almost half the global market. China has several features that combine to make it a prime candidate for the development of LNG in the road sector. The country has the world’s largest inland goods transport market and has already developed an extensive LNG supply infrastructure, initially as a means of transporting gas from remote fields or to consumers who were not connected to the pipeline supply network. With at least 100,000 LNG vehicles and 1,100 refuelling stations at the end of 2013, China already has a head start over the rest of the world in this nascent market. However, gas price reform in China may slow LNG growth there. LNG should also carve out a significant market share in the US, Europe and the rest of Asia.

Use of LNG in land transport will be largely limited to heavy duty vehicles (HDV) and will essentially be driven by the difference between the price of diesel and that of LNG. In contrast with the marine sector, environmental legislation is unlikely to play a major role in triggering the adoption of LNG as a fuel for land transportation, as traditional fuels and technologies will be able to comply with the gradual tightening of emissions standards. However, the cost advantage of LNG relative to diesel currently provides a strong economic incentive in the trucking industry. In its base scenario, CEDIGAZ projects a worldwide demand of 45 mtpa in 2025 growing to 96 mtpa in 2035, with China representing almost half the global market. China has several features that combine to make it a prime candidate for the development of LNG in the road sector. The country has the world’s largest inland goods transport market and has already developed an extensive LNG supply infrastructure, initially as a means of transporting gas from remote fields or to consumers who were not connected to the pipeline supply network. With at least 100,000 LNG vehicles and 1,100 refuelling stations at the end of 2013, China already has a head start over the rest of the world in this nascent market. However, gas price reform in China may slow LNG growth there. LNG should also carve out a significant market share in the US, Europe and the rest of Asia.

Environmental legislation will be key in the marine sector

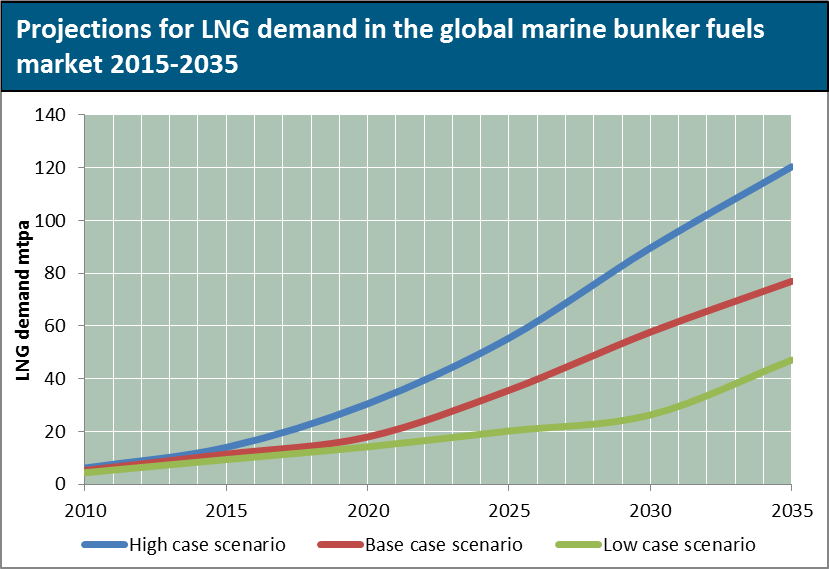

There is little doubt that the use of LNG as a fuel will grow in the marine sector, though the rate and pace of growth will be highly dependent on the timing and geographical scope of emissions restrictions set out in the MARPOL treaty. Compliance with the new emissions limits will require either: to switch to cleaner but more expensive oil-based fuels, to implement costly flue gas treatment technologies, or to switch to LNG. Economic analysis taking into account all relevant factors (capex, opex, operational constraints, loss of cargo space etc.) show LNG to be a very attractive solution when compared to other compliance solutions, although the breakeven time will depend on several parameters such as the age of the vessel, the cost differential between LNG and traditional fuels, and the time spent in Emissions Control Areas (geographic areas with stricter emission standards under the MARPOL treaty). CEDIGAZ’ base scenario projects the demand for LNG as a marine bunker fuel to reach 35.7 mtpa in 2025 and 77 mtpa in 2035.

There is little doubt that the use of LNG as a fuel will grow in the marine sector, though the rate and pace of growth will be highly dependent on the timing and geographical scope of emissions restrictions set out in the MARPOL treaty. Compliance with the new emissions limits will require either: to switch to cleaner but more expensive oil-based fuels, to implement costly flue gas treatment technologies, or to switch to LNG. Economic analysis taking into account all relevant factors (capex, opex, operational constraints, loss of cargo space etc.) show LNG to be a very attractive solution when compared to other compliance solutions, although the breakeven time will depend on several parameters such as the age of the vessel, the cost differential between LNG and traditional fuels, and the time spent in Emissions Control Areas (geographic areas with stricter emission standards under the MARPOL treaty). CEDIGAZ’ base scenario projects the demand for LNG as a marine bunker fuel to reach 35.7 mtpa in 2025 and 77 mtpa in 2035.

LNG in rail could play a role in a small number of countries

Rail has a relatively low share of energy consumption in the transport sector. In addition, the potential for LNG in the rail sector is likely to be most evident in countries with high levels of long haul freight and low level of penetration of electric powered traction in the freight sector, conditions found in relatively few countries. In CEDIGAZ’ base case, LNG demand in rail is projected at 0.9 in 2025, 3 mtpa in 2030 and 6.2 mtpa in 2035. The countries with the highest potential are the United States, China and India.

Cedigaz from LNG in Transportation (October 2014). 401p. Public price €2400 (15% Early Birds discount before Nov.15.)

Cedigaz (International Center for Natural Gas Information) is an international association with around 90 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.