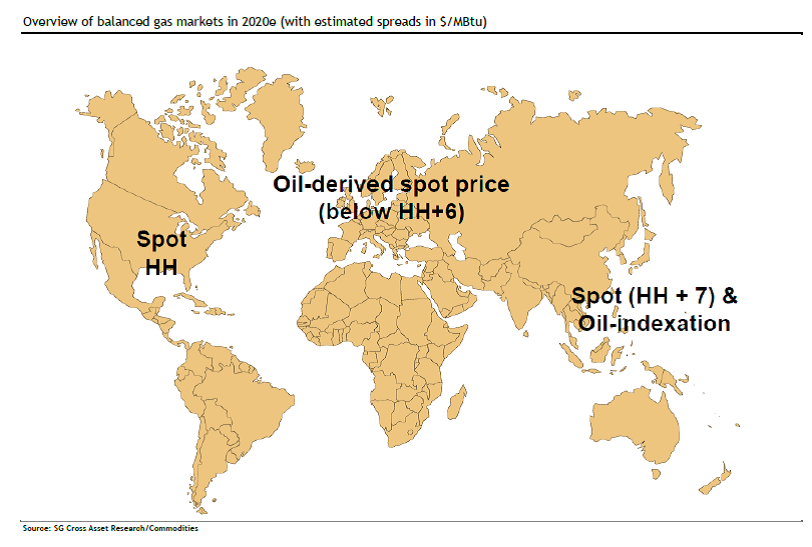

Since the 2013 RWE-Gazprom arbitrage, we estimate that less than 50% of the wholesale gas sold in Europe is under oil-indexation contracts. According to the International Gas Union, gas-to-gas competition accounted for 53% of total gas consumption in Europe in 2013.

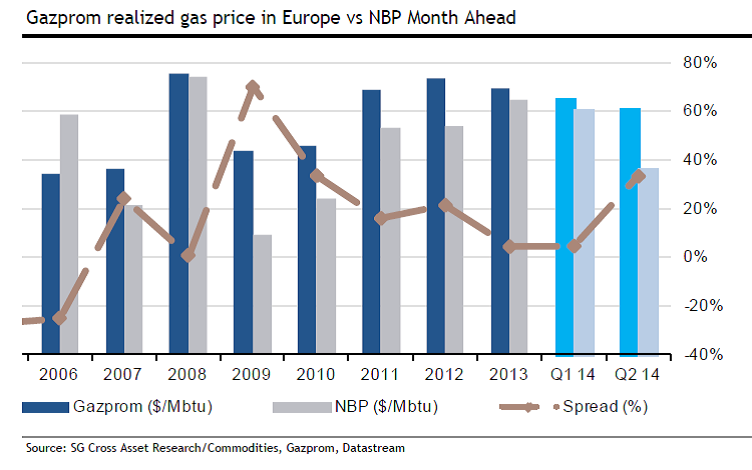

If we look at the average yearly prices of natural gas sales realized by Gazprom in Europe (where oil-indexation predominates) and compare these to the average NBP Month Ahead price, we find that:

– Prior to the crisis, Gazprom’s oil-indexed prices in Europe were trading around the NBP with a spread that ranged from -27% to +24%; this can be explained by the time lag (3 to 9 months) used in the oil-indexation price formulae.

– In 2008, both prices were completely in line.

– In 2009, with the full impact of the economic crisis, spreads increased to a massive 70%! This also shows that, in 2009, European gas prices did not move down as fast as oil prices.

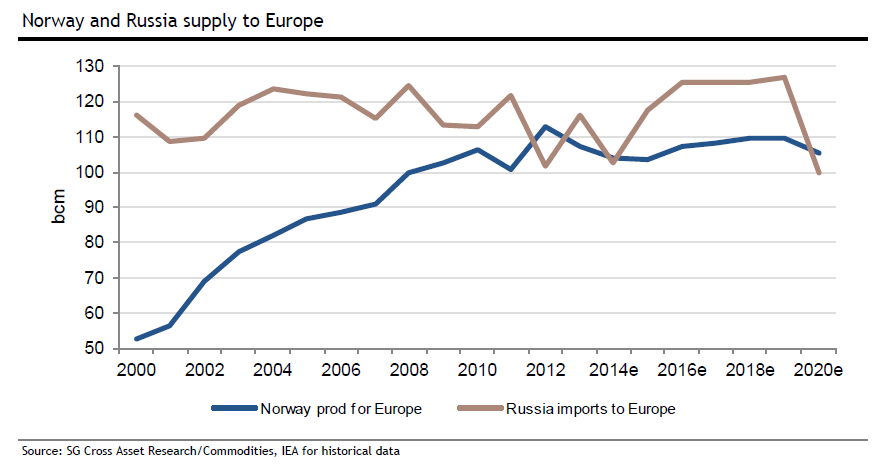

– From 2010 to Q1 14, renegotiations and arbitrations on the one hand and higher spot prices on the other have resulted in spread compression. In 2013, prices were nearly aligned (with less than a 5% spread), indicating that prices are once more closely linked. By not pushing volumes too much, Gazprom/Russia and Statoil/Norway not only avoided a price war in 2011-2013 but managed to reset spot prices to a level acceptable to them.

– In Q2 14, Russia pushed a lot of gas into Europe (to incentivise injection into storage to mitigate any potential disruption via Ukraine later in the year) while we witnessed very weak demand (-18.1% in H1 14 vs H1 13). As a result, spot prices went down, further increasing the spread with the recently disclosed Gazprom figure for its realized price in Europe.

– Moreover, with the Brent price having rapidly slid to below $60/b, this situation could reverse and some oil-indexed contracts with a low slope (around 10%) could provide a cheaper price than the spot market in the coming months. Spot prices could, in the future, become more expensive than oil-derived ones if oil prices were to drop significantly for an extended period of time.

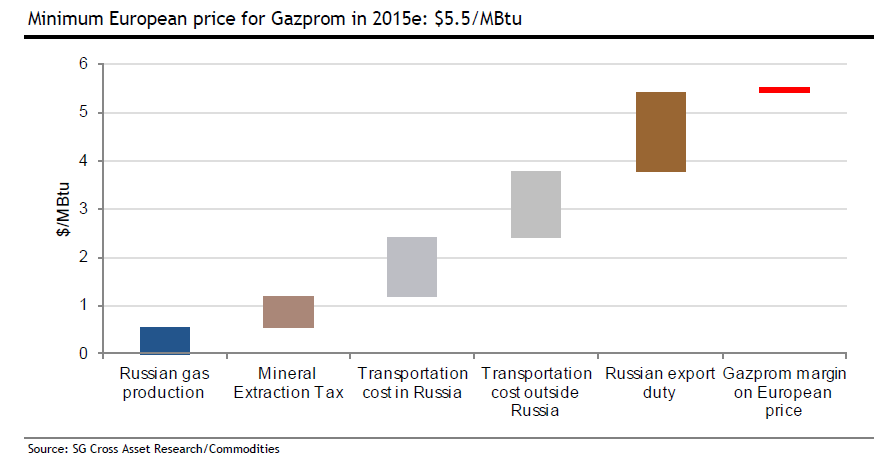

In a $60/b oil world, Gazprom’s realized price in Europe could be around $5.8/MBtu, still above its full cost, but a level that could be viewed as too low for producers.

However, in a world of lower oil-index prices, the Russians and the Norwegians, who have market power in Europe, will swing supply to manage the spot market at a level acceptable to them.

… To a potential price war?

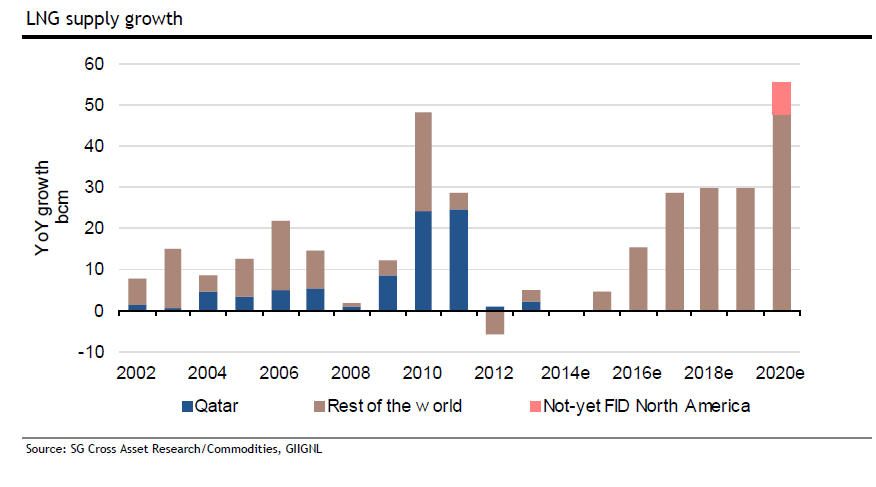

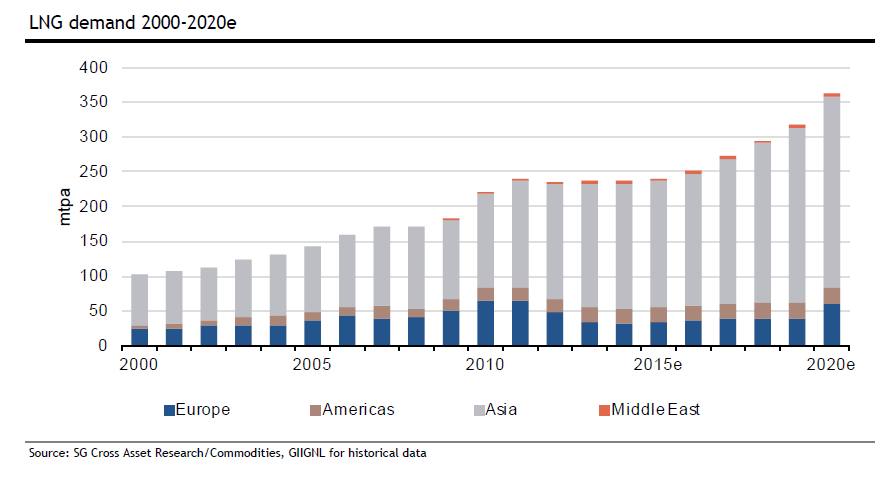

The drop in oil price has occurred just ahead of a new wave of LNG supply coming from Australia and a progressive restart of nuclear reactors in Japan that should reduce Japanese LNG demand…

On top of the 45 mtpa being built (Sabine Pass, Cameron, Cove Point and Freeport), we expect 5mtpa of additional US LNG to get an FID in the coming year.

In 2020e, 5 mtpa of extra not-yet FID US LNG can be absorbed as Europe takes nearly as much LNG as in 2011. In this case Gazprom would have to reduce its European exports to the minimum level seen in 2012.

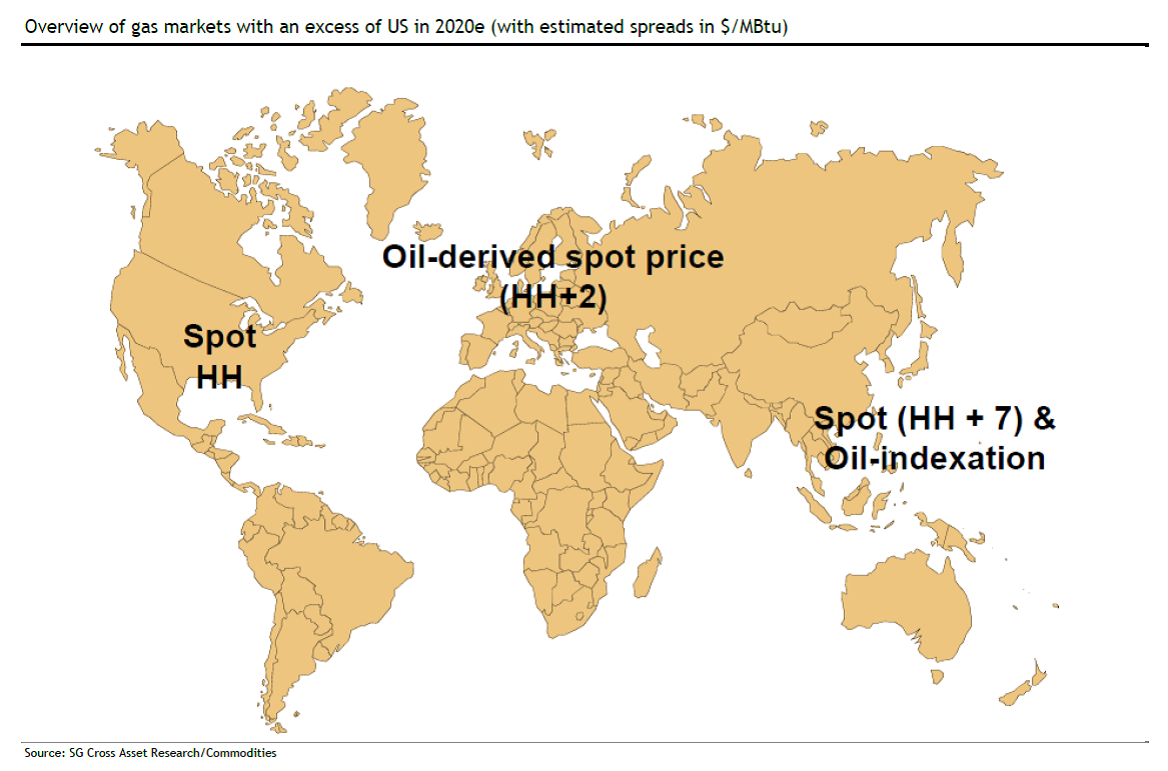

Extra US LNG (above our 50 mtpa forecast) at a time when the long-term decline in gas demand in Europe is set to resume could trigger a price war as we suspect Gazprom is not willing to reduce its volume below the 2012 minimum level.

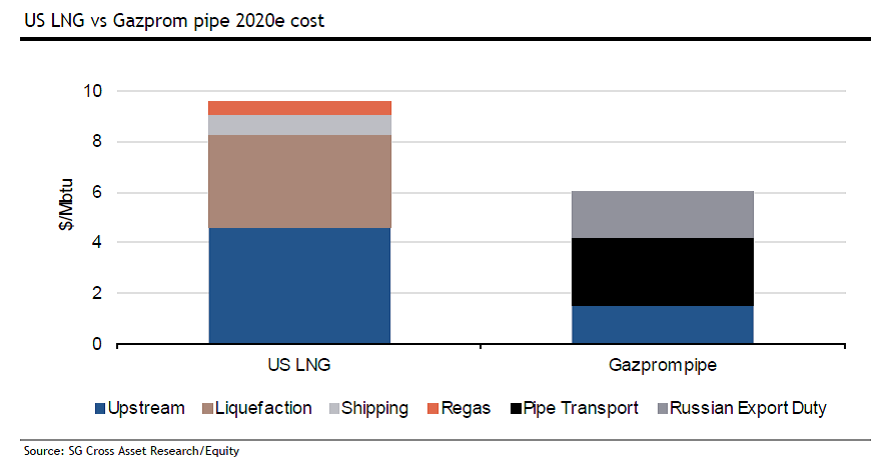

And as Gazprom has both market power and the lower supply cost, it can engage in a price war that will push US LNG out of Europe and will lead to US trains having to stop production. But to stop US LNG cargoes from berthing in Europe, the European price will have to be around HH + $2/MBtu as liquefaction (c.$3/MBtu), regas (c.$0.5/MBtu) and part of the shipping costs (c.$0.5 out of a total of $1.5/MBtu) are sunk costs. After mothballed regas in the 2010s, we could see mothballed LNG trains in the US in the 2020s.

But we are not there yet. In the meantime, the Russian Yamal LNG project could suffer delays due to sanctions. And the consensus on US LNG exports could be revised down closer to our 50mtpa forecast as falling oil prices could also weaken the case of Henry Hub-linked LNG pricing…

Dr. Thierry Bros

Author of the book “After the US shale gas revolution”, Editions Technip

bros.thierry@gmail.com