CEDIGAZ, the International Information Center on Natural Gas, has just released its « Medium and Long Term Natural Gas Outlook 2019 ». Cedigaz Scenario incorporates government ambitions in the context of the energy transition that is underway. It is built upon the implementation of strong energy efficiency programmes and increased diversification of the energy mix based on the NDCs. Cedigaz Outlook 2019 highlights that natural gas has a crucial role to play to support the energy transition and meet all targets of the NDCs. However, this will not be enough to reach the +2°C target: emissions in the Cedigaz scenario would put the world closer to a +3°C path. The future expansion of natural gas in the energy mix is driven by the competitiveness and abundance of gas resources in gas-rich markets (North America, Russia, Middle East, Mozambique), which will expand LNG export capabilities. Positive developments of unconventional gas, especially in the US, and liquefied natural gas markets will continue to reshape natural gas supplies.

Natural gas demand grows by 40% from 2017 to 2040, with Asia leading the growth.

- Energy consumption is expected to grow by 0.9%/year up to 2040.

- The extent of the economic growth is mitigated by significant improvements in energy efficiency, as energy intensity is expected to fall by 2.4%/year.

- In Cedigaz Scenario which integrates government targets, renewable energies account for half of the incremental energy supply over 2017-2040.

- Natural gas stands as the fastest-growing fossil fuel over 2017-2040 (+ 1.4%/year).

- In contrast, the growth of oil is expected to slow down sharply to 0.3%/year, while that of coal is negative (- 0.1%/year).

- As the energy transition to a sustainable energy system accelerates, natural gas demand growth slows strongly after 2025 to 1.1% /year over the 15-year period, compared to 2%/year over 2017-2025.

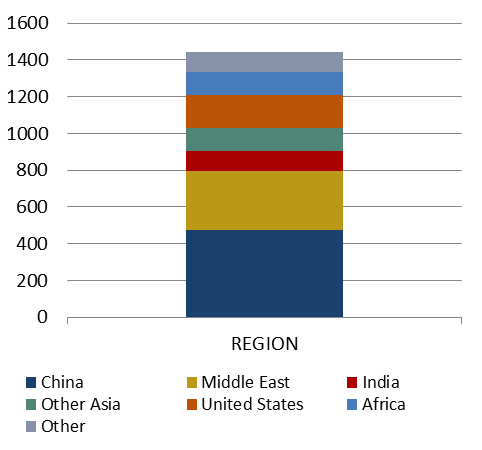

- In absolute terms, natural gas demand records a volumetric gain of 1442 Bcm over 2017-2040, accounting for 35% of the global energy demand growth.

- Industry (mainly petrochemicals and manufacturing) and power generation account for respectively 44% and 40% of the global gas demand growth.

- The largest contribution to the growth of gas-fired power generation comes from China, the Middle East and the US.

- Growth in the industrial sector is the strongest in China, the Middle East, the US, South & C. America and South-East Asia.

- All markets transition to a more sustainable pattern of growth, but at a different pace.

- In Europe, the long term growth of natural gas demand is uncertain and peak annual gas demand could be reached as soon as the middle of the next decade in the context of the policy-driven decarbonization of the energy supply.

- In Cedigaz Scenario, biomethane accounts for more than 10% of European gas supply by 2040.

- By 2040, natural gas continues to play an important role in almost every market.

- Asia is by far the most important source of gas demand growth, accounting for around half of the incremental volume. Projections on gas demand in most of emerging Asian markets have been revised upward compared to the previous Outlook.

- China accounts for one-third of the incremental gas demand over the outlook period.

- The Middle East is the second largest growth market area, accounting for 23% of the global gas demand growth. A more significant deployment of solar and wind and/or even more generous support policies could reduce this growth from 2025.

Fig 1: Natural gas incremental demand over 2017-2040 (bcm) by region and sector

Source: Cedigaz Medium and Long Term Gas Outlook 2019

Natural gas supply will diversify and become increasingly available, backed by conventional and unconventional low-cost resources

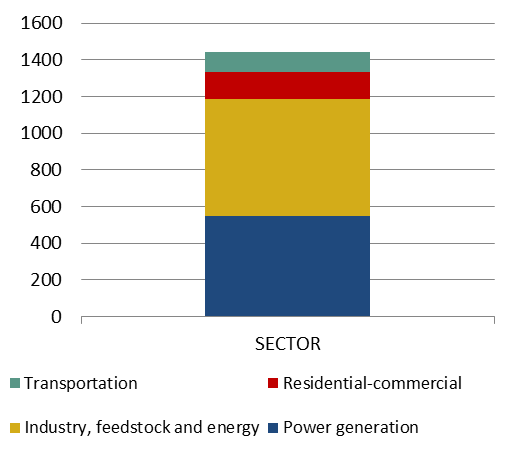

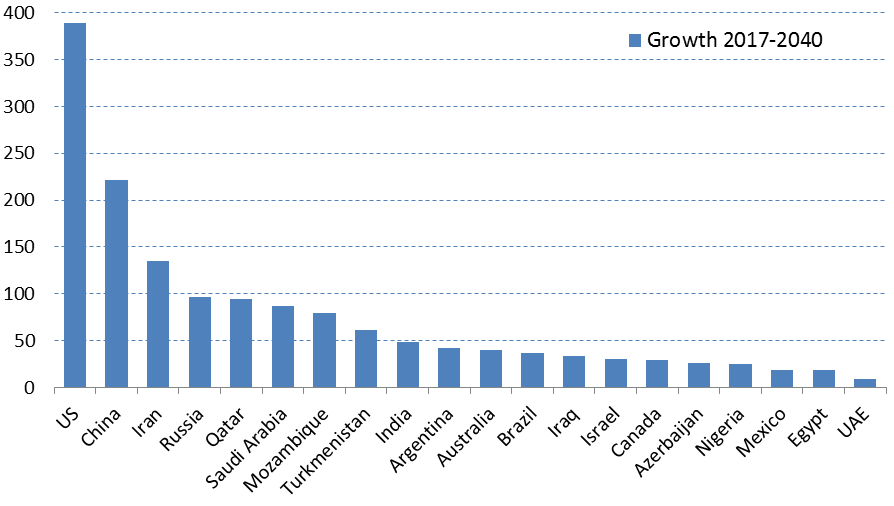

- The US, the Middle East, the CIS and Africa are the main sources of gas supply growth.

- The US is forecast to lead the global expansion of gas and LNG supply and will play a growing influence on the global gas balance and international pricing.

- US gas production surges by 50% to 1160 bcm in 2040. The US bolsters its leading producer position, especially in the medium term, accounting for 40% of the global incremental supply up to 2025.

- Outside the US, significant production growth are also expected in China (+ 221 bcm), Iran (+ 135 bcm), Russia (+ 97 bcm) and Qatar (+ 95 bcm).

Fig 2: Natural gas absolute production growth by country (bcm), Top-20 largest increases

Source: Cedigaz Medium and Long Term Gas Outlook 2019

- Unconventional gas production (including shale gas Tight gas and CBM) contributes for 55% of global supply growth. US shale gas in particular accounts for almost 30%.

- Outside the US, unconventional development will be slow and concentrated in a few countries, with the largest growths expected in China, Canada and Argentina.

The importance of gas trade continues to grow, driven by the growing supplies of LNG

- Interregional (long distance) trade is forecast to grow by around 3%/year over the projection period. The share of long-distance trade in global gas supply rises from 13% in 2017 to 18% in 2040.

- In terms of exports, the CIS will remain the most significant exporting region but its market share will decline, in contrast to the major breakthrough of North America.

- In terms of imports, the Asian market becomes the largest importing region post-2025, while Europe’s weight in global trade diminishes strongly, underpinning a shift of trade flows from the Atlantic Basin to the Pacific Basin.

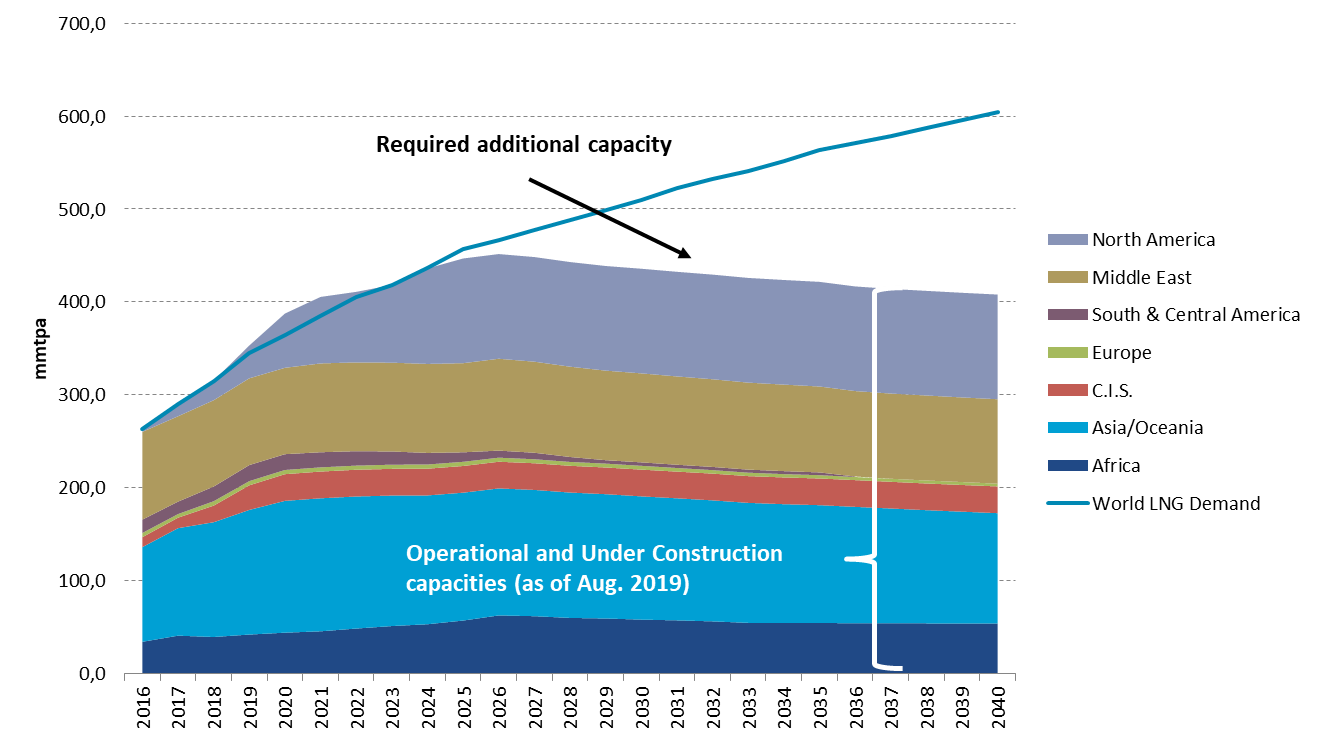

- LNG expands more rapidly than pipeline gas to secure gas supply where local production falls short of demand.

- International LNG trade will grow by 3.2%/year to 2040 and long-distance (inter-regional) LNG trade will grow the fastest (+ 4.9%/year), driven by Asia. The share of LNG in interregional gas trade will progress from 39% in 2017 to 60% in 2040.

- Considering a robust outlook for gas demand in China based on official announcements, China’s LNG demand could quadruple to around 200 bcm by 2040, representing a quarter of the global LNG market.

- LNG supply will alter towards a declining role of Asia-Oceania and the Middle East, while the US steadily expands its supplier position.

- Qatar and the US have the potential to become the two leading LNG exporters after 2025, each representing a LNG market share of more than 20%. Mozambique, Russia, and to a lesser extent, Canada, will also provide a growing contribution to global LNG supply.

- New LNG importers and suppliers drive the diversification and globalization of gas markets.

- Emerging markets outside Asia will explain almost 10% of the growth in net LNG imports up to 2040.

- Operating and under construction LNG plants will be sufficient to cover LNG demand until 2022.

- Higher than previously expected Asian LNG demand, propelled by China, has increased industry optimism and confidence resulting in several new FIDs.

- The LNG market should remain well-supplied until at least the middle of the next decade assuming likely additional FIDs (including Qatar expansion projects) in the near future.

- In case of projects’ delays, some tensions could however occur over the 2023-2024 period.

- As of August 2019, it is estimated that only 10 Mt of new LNG capacity, in addition to current operating and post-FID projects, is required to meet international LNG demand in 2025. But thereafter, this supply gap grows rapidly to 75 Mt in 2030, 140 Mt in 2035 and almost 200 Mt in 2040.

Fig 3: LNG demand versus effective existing and under construction LNG supply capacities

Source: Cedigaz LNG Outlook 2019

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.