Recent trends in world natural gas demand

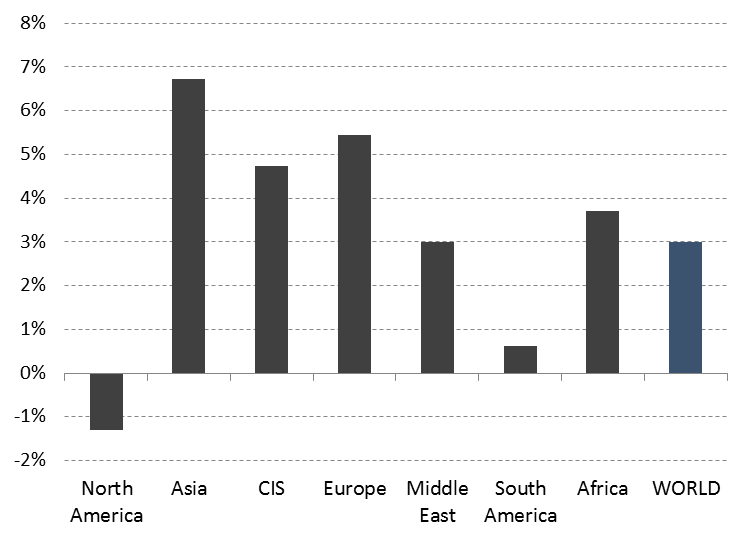

The year 2017 still highlights the strong competition between natural gas, coal and renewable energies. While the global economic recovery has strengthened, it is estimated that growth in global gas consumption accelerated to 3% in the first three quarters of 2017, compared to the same period last year. But, at the same time, global consumption of coal would have increased at a similar pace, driven by Asian countries. In China, coal consumption increased significantly in 2017 after three years of decline. This increase is linked to an acceleration in electricity demand.

Many factors contributed to the strong expansion of global gas demand in 2017. As in 2016, Europe and China were the fastest growing gas markets. For the third year in a row, European gas consumption recorded strong growth in 2017, provisionally estimated at 5%, after a steady decline over the period 2010-2014. Many factors were at play: coal-to-gas switching in power generation as gas competitiveness versus coal improved; the replacement of some coal-fired power plants: a steady trend in the heating sector; the gradual economic recovery; a reduction in hydropower; French nuclear problems and a greater use of gas in transport. At the international level, it is China that has seen the largest increase, in absolute terms, in its gas demand. Cedigaz preliminary estimates show a record growth of 18% (+ 35 Bcm) in 2017, double the average growth rate observed over the period 2010-2016.

In 2017, some consumption trends have reversed in big markets. In the US, the share of natural gas in electricity generation has declined to the profit of renewables in a context of higher natural gas prices. Russia’s gas consumption has rebounded mainly due to heating needs and the revival of industrial activity. In South Korea & Taiwan, gas consumption was increased due to nuclear energy shortage.

Variation in gas consumption in 2017 (January-September)

Source: Cedigaz Provisional Estimates

Source: Cedigaz Provisional Estimates

Growing production and supply capacities

On the supply side, natural gas production recorded a strong growth in 2017. World gas production increased by 4% in the first three quarters of 2017, according to Cedigaz provisional estimates. We note a positive trend in the United States, as shale gas production accelerated (Pennsylvania). In 2017, the United States moved from being a net importer to a net exporter. In Russia, natural gas production rose sharply in 2017, at an estimated rate of 8%, to support strong growth in exports and domestic demand. Since 2014, Russia has significantly increased its exports to Europe and its market share in European supply has steadily increased. Numerous projects (including Yamal LNG), will significantly increase Russia’s production and export capacities in the future. In Iran, production growth is driven by the ramp up of South Pars phases and this development is primarily dedicated to the domestic market. There was also a substantial growth in Norway’s gas production in 2017 (+ 7%), as the government has raised the production cap at the Troll field, which led to growing exports to the United Kingdom. In Egypt, production began to grow after seven years of decline thanks to the commissioning of the West Nile Delta Project. Egypt plans to become self-sufficient in the short term thanks to the ramping up of major projects, including the Zohr field, which began production in December.

One of the other highlights of the year 2017 is the announcement of Qatar to lift the moratorium on the development of the giant North Field to increase national gas production by 30% by 2024. These recent supply-side developments will be critical to securing and diversifying supplies while limiting market tensions. However, we must not exclude geopolitical risks, which could be a wildcard.

The LNG industry as a key engine of natural gas expansion

The year 2016 has really marked the beginning of a new massive wave of expansion of the LNG supply (+ 7%). This latter has increased in intensity in 2017, with an additional gain estimated at 30 Mt (+ 11%), the largest increase ever recorded since 2010. Around half of this growth is attributable to Australia and more than a third to the United States. China alone has absorbed around 40% of the additional LNG supply to meet the strong growth in domestic demand. LNG was favored over pipelines imports which were less competitive throughout most of the year.

As in 2016 and contrary to what was predicted by many analysts, there was no significant surplus of LNG on the international market in 2017, which would seek taker in North-West Europe, where there is excess import capacity. On the other hand, Southern European countries have significantly increased their purchases of LNG. The LNG market has experienced tensions in Asia in the last months of 2017, as evidenced by soaring spot prices. The market is expected to remain tight until the end of winter 2017-2018. This is particularly due to China, which continues to increase its consumption of gas for heating instead of coal amid cold winter.

Given the ramp-up of the expected LNG supply in 2018 and 2019, there are many questions about how quickly the market can rebalance. Reduced investment could result in a supply shortfall from 2023 (Cedigaz Outlook). The 2017 year shows that the market is rebalancing under the effect of very strong demand in Asia. Thus, the market could rebalance at a faster pace than expected if Asian demand, driven by China, continues to soar. Moreover, recent developments in the LNG market have led to an increase in spot liquidity and trading.

A lack of investment in a context of uncertainties

The investments that have been made in exploration, the development of new fields and the transport infrastructures (LNG) have been insufficient in recent years. In 2017, only a final investment decision was made for a liquefaction project, that of Coral in Mozambique. Lack of investment reflects uncertainties about future gas demand, which is conditioned by competition from renewable energies, and in some countries by coal competition for electricity generation. Without competitiveness on the basis of market prices, the future development of natural gas in the energy mix will depend heavily on the implementation of political and regulatory levers that will favor the substitution of coal for gas. The challenge is to support the rise of renewables in the context of the transition towards a sustainable energy mix.

For more information: contact@cedigaz.org

Our website: https://www.cedigaz.org/

Cedigaz (International Center for Natural Gas Information) is an international association with around 80 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas and LNG in an exhaustive and critical way.