CEDIGAZ, the International Association for Natural Gas Information, has just released its « Medium and Long Term Natural Gas Outlook 2017 ». This scenario, which incorporates national energy plans, highlights the growing role of natural gas as a key transition fuel towards an increasingly renewable-based, efficient and sustainable energy system. In this scenario, natural gas demand is expected to rise by 1.6%/year over 2014-2035 and its growth in absolute terms will outstrip that of all other energy sources. The strong expansion of LNG supply and the abundance of both conventional and unconventional resources will help gas to expand its role in the energy mix to the detriment of coal and oil. In a context of increased globalization of gas markets and diversification of natural gas supply, spot pricing will be a growing component for the commercialisation of gas. Many countries have policies that should favor gas consumption over other hydrocarbon sources, especially in the power sector. Coal-to-gas switching contributes to a strong decline in the future growth of carbon emissions. However, this will not be enough to reach the +2°C target: emissions in the Cedigaz scenario would put the world closer to a +3°C path.

Natural gas demand will pursue its short and medium-term growth trajectory to 2035, rising at a gradual pace of 1.6%/year, under the impulsion of China and the Middle East.

- Energy consumption is expected to grow less quickly than in the past (+ 1%/year), as the extent of the economic growth is mitigated by the decline in energy intensity.

- The gradual transition in the fuel mix is set to continue, with renewables (hydro included), together with nuclear, accounting for more than half of the incremental energy demand to 2035.

- Natural gas stands as the fastest-growing fossil fuel over 2014-2035 (+ 1.6%/year). In contrast, the growth of oil and coal is expected to slow down sharply, with respective annual rates of 0.3% and 0.1%.

- In the forecast period, the growth in absolute consumption of gas will outstrip that of all other energy sources. In relative terms, wind and solar are the fastest growing fuel sources through 2035 (+ 8%/year), driven by increasing competitiveness.

- Natural gas will increase its relative share in the world primary energy supply from 21.2% in 2014 to 23.9% in 2035, this latter is similar to coal by this horizon. Natural gas is viewed as a bridging resource in the transition towards an increasingly renewable-based and decarbonised energy system.

- China and the Middle East lead the way in gas demand growth, accounting for respectively 28% and 24% of the incremental volume over the projection period.

- At the national level, the largest growths in gas demand are recorded in China, India, Iran, the US and Saudi Arabia.

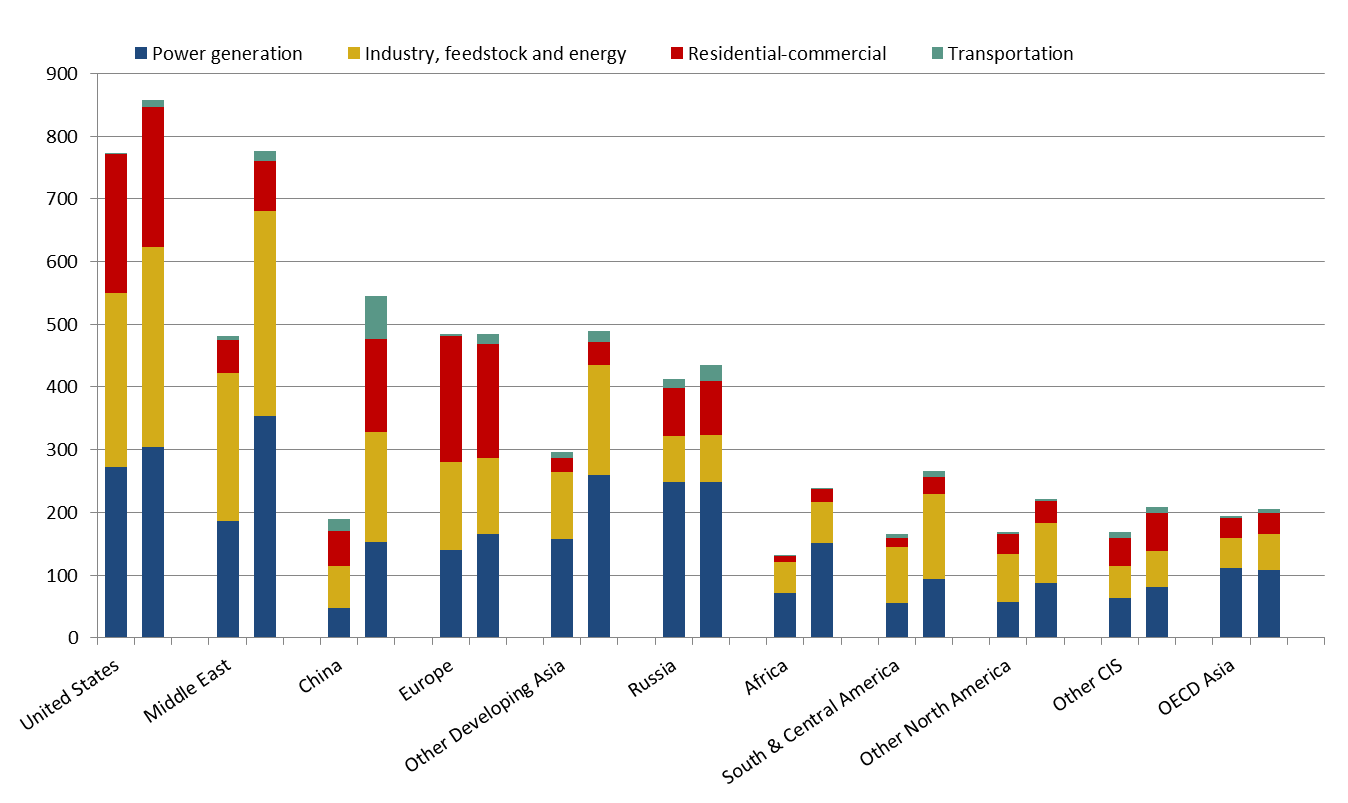

- Power generation remains the largest source of global gas demand growth and is also the key driver of the diversification of the fuel energy mix against the background of global electrification. The largest growths in gas-fired power generation come from the Middle East, non-OECD Asia and Africa.

- Growth in the industrial sector will also remain robust in petrochemicals and manufacturing in the US and emerging markets (Asia, Middle East and South & Central America).

- In CEDIGAZ Scenario, although the future growth of global carbon emissions declines strongly, energy-related CO2 emissions still increase to 34.9 Gt by 2030-2035, corresponding to a +3°C trajectory.

Prospects for natural gas demand by sector (Bcm)

Source: Medium and Long Term Natural Gas Outlook 2017, CEDIGAZ

Source: Medium and Long Term Natural Gas Outlook 2017, CEDIGAZ

Natural gas supply will diversify and will incorporate a growing share of unconventional gas, driven by North America and Asia.

- The expansion of global gas supply will be driven by unconventional gas in North America and Asia, as well as conventional gas in Russia and the Middle East.

- At the regional level, the largest production gains are expected in the Middle East (+ 315 bcm), Asia-Oceania (+ 294 bcm) and North America (+ 294 bcm).

- At the national level, the largest growths in volume terms are posted in the United States, China, Iran, Russia and Australia.

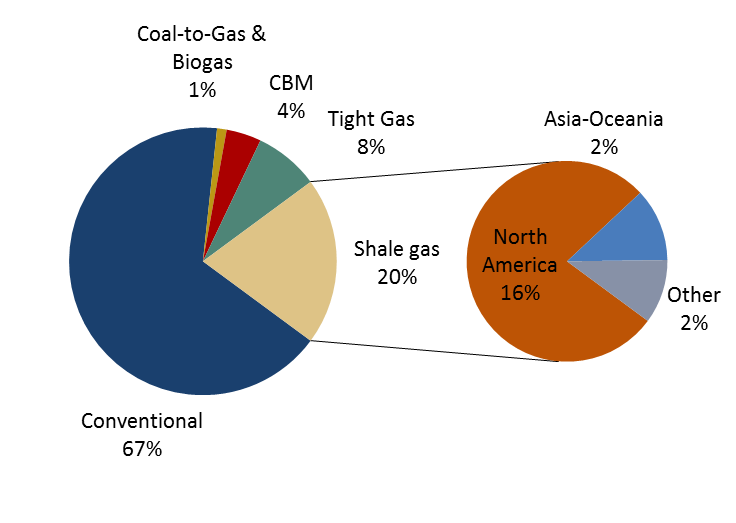

- Unconventional gas accounts for a third of global gas production in 2035 (20% in 2015).

- Shale gas production accounts for almost half of the increase in gas supply, driven by the US, where shale gas output rises by 3%/year.

- Outside North America, unconventional gas growth will become more apparent after 2020. However, unconventional gas production will remain concentrated in a few countries, chiefly China, Australia and Argentina, because of public opposition (Europe), investment, regulatory and environmental challenges.

- Global markets will continue to be well supplied until the first half of the next decade but additional investments are required to bring new infrastructures on line and meet the growing gas demand.

- In a context of increased globalization and integration of gas markets thanks to the expansion of the LNG trade, the spot market will have a growing impact on gas supply.

Global natural gas production in 2035

Total = 4747 Bcm

Source: Medium and Long Term Natural Gas Outlook 2017, CEDIGAZ

Source: Medium and Long Term Natural Gas Outlook 2017, CEDIGAZ

Interregional trade will account for an increasing share of global supply.

- Net Interregional (long distance) trade is forecast to grow by 3.1%/year from 392 bcm in 2015 to 729 bcm in 2035. It thus increases much faster than demand, as import dependence grows both in Europe and Asia. In these markets, the diversity of both pipeline and LNG sources tends to improve the security of supply.

- The CIS will remain the leading exporting region but its market share will decline. North America emerges as a large-scale exporter, covering 20% of total interregional exports by 2035.

- The largest growths in interregional flows come from CIS’ exports to China and US’ LNG exports to Asian emerging countries.

- Interregional pipeline flows grow by around 2%/year. Europe will remain 30%-dependent on Russian gas, which will maintain its competitiveness.

- LNG increases more rapidly than pipeline gas. The share of LNG in interregional flows will grow from 44% in 2015 to 55% in 2035.

- International LNG trade will grow by 3.7%/year to 669 bcm in 2035. Asian emerging markets will explain more than 70% of the incremental imports.

- Additional LNG export capacity is required post 2023 to meet rising natural gas demand.

By Armelle Lecarpentier, Chief Economist

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with around 80 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.