CEDIGAZ, the International Information Center on Natural Gas, has just released its « Medium and Long Term Natural Gas and LNG Outlooks 2020 ». Cedigaz Scenario assumes the effective realisation of official energy plans and climate policy targets. It is built upon the implementation of strong energy efficiency programmes and the expansion of low carbon technologies. It highlights that natural gas will play a growing role in the world energy mix to meet both the growing energy demand and climate policy targets. The future expansion of natural gas in the energy mix is driven by the competitiveness and abundance of resources in gas-rich countries (North America, Russia, Middle East… ), which will expand LNG export capacities required to meet the growing gas demand, especially in emerging Asian markets. Despite a post-pandemic recovery assumed post-2021, the Covid-19 pandemic has a meaningful impact on the economy, investments, energy prices and gas demand in the short and medium term. Therefore, the future expansion of gas in the next two decades is conditioned on the timely materialization of investments, especially in the upstream and LNG business, which represents a key challenge in a context of low oil and gas prices.

- Multi-wave pandemic scenario: short and medium-term impact on natural gas activity

- In Cedigaz Reference Scenario (multi-wave pandemic), it is assumed that the COVID-19 pandemic will translate into a contraction of 4.5% of the world real GDP and a decline of nearly the same magnitude of 4% of global gas demand in 2020.

- Global gas and energy demand are forecast to recover slightly in 2021 before accelerating in the following years as the pandemic resorbs and Asian gas demand rebounds. Emerging economies’ gas demand is less affected by the COVID-19 pandemic than that of mature OECD and CIS markets.

- There is both a short and longer term negative impact of the Covid-driven economic crisis on energy and gas demand: in the revised Outlook, the COVID-19 pandemic results in a loss of world gas demand of 85 bcm in 2025 and 100 bcm in 2040 (2% lower than the pre-COVID level).

- These losses mainly affect domestically produced natural gas (especially shale gas), as well as gas transported by pipelines (Russia, North Africa).

- However, LNG demand in the medium and long term is not affected because of an expected rebound post-2021 in emerging markets of Asia and a continued growth in Europe, which plays a role of balancing market, in a global situation of a surplus of low-cost LNG supply lasting until 2023.

- The economic downturn induced by the COVID-19 pandemic and the lower oil and gas prices have led to halving the short and medium term growth of US gas production to 1.5%/year up to 2025.

- The COVID-19 is projected to have only a short-term negative impact on the global LNG demand, which is expected to grow slightly by 1.6% in 2020 and 3% in 2021 in the base case scenario. These can be compared to previously-anticipated growths of 6%/year before the COVID-19, resulting in a loss of 30 bcm over the two-year period 2020-2021.

- The post-pandemic recovery and long term growth in natural gas demand and supply

- Energy consumption is expected to grow by 0.8%/year from 2019 to 2040 in the revised Outlook. India and China account for respectively 33% and 25% of the global energy demand growth.

- The growth of natural gas demand slows from 2.8%/year over 2009-2019 to 1.7%/year over 2019-2025 and 1.1%/year over 2025-2040.

- This tendency can be explained by the strong expansion of low carbon and efficient technologies, especially in Europe, which is forecast to evolve on the 2°C trajectory.

- In Cedigaz Scenario which integrates government targets and climate goals, renewable energies account for almost two-thirds of the global incremental energy supply over 2019-2040.

- However, natural gas stands as the fastest-growing fossil fuel and expands its market share in the world energy mix from 23% in 2019 to 25% in 2040, while that of coal and oil declines strongly.

- Natural gas plays a growing role in the energy mix of every main regional market, with the exception of some emerging Asian markets (Pakistan, Southeast Asia), where gas is in competition with oil, coal and renewables.

- The growth in gas demand is strongly driven by natural gas-fired power generation in China and the Middle East, as well as industrial uses (including petrochemicals) in most of emerging markets worldwide.

- In Europe, natural gas demand continues to growth in the medium term, driven by power generation, but reaches a peak towards the end of the current decade before falling sharply in the context of the policy-driven decarbonisation of energy supply.

- The future growth of natural gas partly depends on investments in low-carbon gas. In Cedigaz Scenario, bio-methane accounts for more than 10% of European gas supply by 2040 and 5% in China.

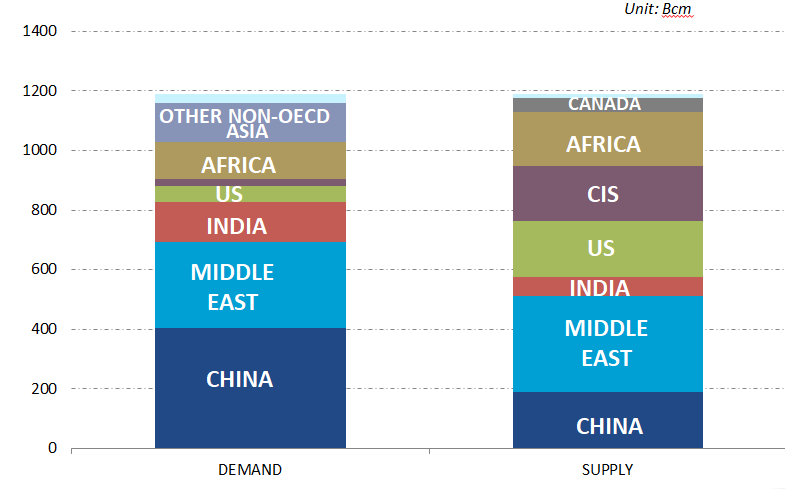

- Asia and the Middle East contribute for respectively 58% and 24% of global gas demand growth. China alone accounts for one-third of the incremental gas demand over the outlook period. Asia will become the leading natural gas consuming zone by 2040, with a global market share of 30%.

- The future growth in gas demand is supported by the expansion of supply from gas-rich countries which hold abundant low-cost resources, in particular the US, Qatar and Russia.

- These producers will expand LNG export capabilities with flexible destinations, playing a growing role in global gas supply and pricing and also driving the commoditization of the gas market and regional prices’.

Figure 1: Incremental natural gas supply and demand growth by source 2019-2040

- Future growth in gas demand is conditioned by new investments in LNG infrastructure.

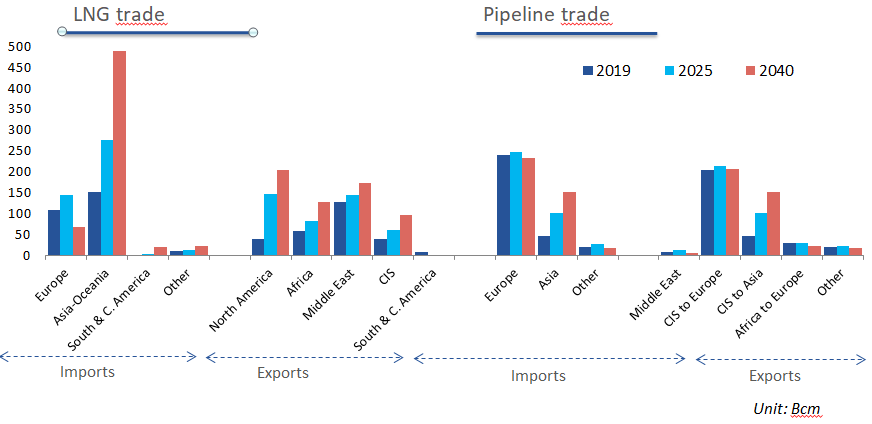

- Inter-regional trade covers more than half of the future growth in world gas demand over 2019-2025 and around a quarter of that over the period 2025-2040.

- Inter-regional pipeline trade is expected to increase by 1.3%/year up to 2040, mainly driven by CIS exports (Russia & Central Asia) to China, as this latter will diversify its supply portfolio. In Europe, Russian pipeline gas is expected to regain market share in the medium and long term as LNG supply tightens.

- LNG trade is the main source of this growth, expanding by around 4%/year over 2019-2040, so that its share of inter-regional trade grows from 47% in 2019 to 60% by 2040.

- LNG plays a growing role in both Europe and Asia in the next five years to meet the growing regional production/demand gaps in a context of sufficient and competitive LNG supply.

- In the longer term, the center of gravity of natural gas trade shifts further from Europe to Asia, where emerging markets absorb the bulk of the incremental LNG supply.

- On the supply side, growing diversification and competition will reshape the gas business. Qatar and the US have the potential to become the two leading LNG exporters from 2025 onwards, each representing a LNG market share of more than 20%, followed by Australia (15%).

- Russia, Canada and Mozambique will also provide a growing contribution to LNG supply, without forgetting the arrival of new potential LNG suppliers like Argentina.

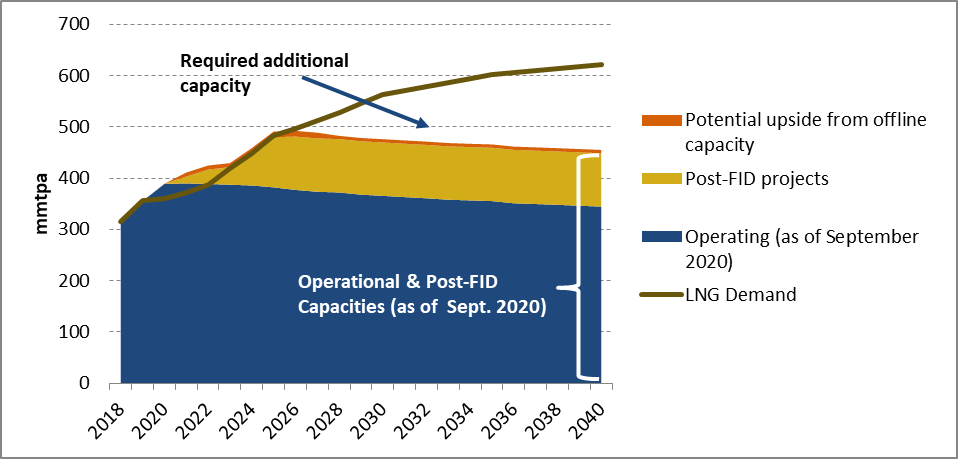

- Despite projects’ delays, post-FID projects are sufficient to cover global LNG demand until 2025/2026. The LNG market is expected to remain oversupplied in the next three years, before gradually rebalancing as LNG demand in Asia rebounds.

- An additional LNG liquefaction capacity of 86 mt is required to cover the global LNG demand by 2030 and this gap rises to 167 mtpa by 2040.

- The growth in LNG trade over the outlook period is conditioned on the capacity of the industry to limit and even reduce the investment costs, especially because of lower oil and gas prices than in the past.

- There are risks to this positive outlook for natural gas as upstream and LNG investments could be challenged in a case of prolonged low oil and gas prices. In this bearish view, US shale gas production and related LNG export projects would be impacted for a long time.

Figure 2: Prospects for inter-regional gas trade (bcm) 2019-2040

Figure 3: Prospects for LNG market balance (Mt) 2019-2040

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG, low-carbon gases and unconventional gas in an exhaustive and critical way.