CEDIGAZ, the International Association for Natural Gas Information, has just released its « Medium and Long Term Natural Gas Outlook 2016 ». This scenario, which incorporates key objectives of current and also planned national energy policies, highlights the growing role of natural gas as a bridge fuel towards a long-term increasingly renewable-based, efficient and sustainable energy system. Given the vast low-cost coal resources, the future expansion of natural gas in the global energy mix will be driven by the implementation of energy and environmental policies aiming to shift away from coal and oil to cleaner fuels within the context of a gradually decarbonising electricity system. In this scenario, the future global natural gas expansion is supported by strong supply growth, particularly of unconventional gas and LNG, in a context of rising prices as energy markets re-balance. CEDIGAZ Scenario’s trajectory is on a 3°C path, with energy-related CO2 emissions increasing by 0.3%/year on average, reaching almost 35 Gt over the 2030-2035 period.

Natural gas demand is projected to grow by 1.6%/year over 2014-2035, driven by emerging markets, where natural gas is making substantial inroads in power generation and industry

- Looking forward to 2035, the total primary energy consumption is forecast to grow at a moderate rate of 1%/year in a context of increased energy efficiency. Global energy intensity is forecast to decline by 2.5%/year (- 4.5%/year in China).

- In this context, gas stands as the fastest-growing fossil fuel over 2014-2035 (+ 1.6%/year). In contrast, the growth of oil and coal is expected to slow sharply, with respective annual rates of 0.2% and 0.1%. We see major Improvement in the sustainability of supply as wind and solar are the fastest growing fuel sources through 2035 (+ 8%/year). China alone explains a quarter of their expansion, followed by the US and Europe.

- Natural gas will increase its relative share in the global primary energy supply from 21.4% in 2013 to 23.9% in 2035. The trend decline in oil share continues, as oil is backed out from power generation and the manufactured industry. After expanding since 2000, coal share reverses down and gradually declines to reach parity with gas by the end of the projection period. The share of renewables rises substantially but is capped by their intermittency.

- The pace of gas demand growth has been revised downwards compared with Outlook 2015. INDCs ahead of COP21 have been taken into account, meaning greater efforts to meet environmental goals via the deployment of renewables & increasingly efficient technologies. In Europe in particular, the 2030 Climate & Energy Package leaves little room for gas demand growth in volume terms. However, the share of gas in the power generation mix progresses at the expense of coal against the background of the rise of renewables.

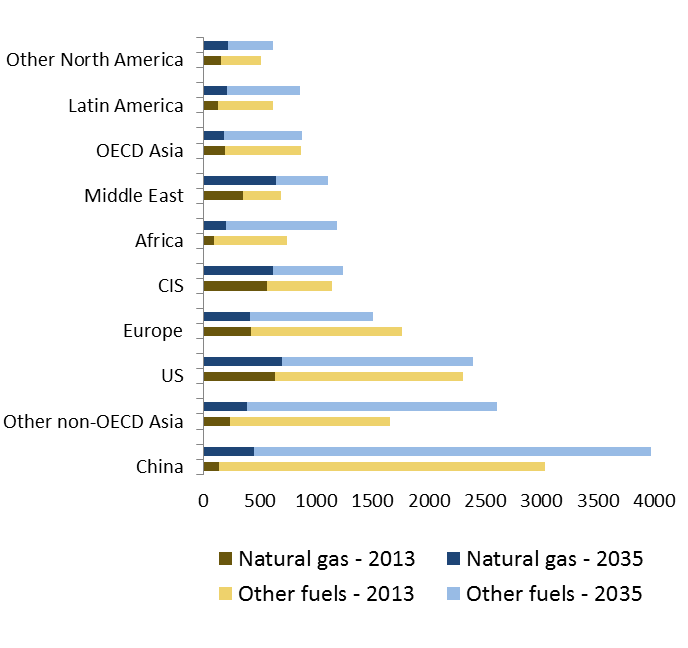

- Virtually all of the additional energy is consumed in emerging economies and 85% of gas growth come from emerging economies. The US is the only industrialized market to record a significant growth in gas consumption in volume terms, thanks to the competitiveness of shale gas and the adoption of the Clean Power Plan.

- China and the Middle East lead the way in gas demand growth, accounting for respectively 27% and 25% of the incremental volume over the projection period.

- The power sector remains the main powerhouse behind gas expansion. Natural gas makes substantial inroads into the power generation mix in China, the US, Russia, the Middle East and Africa in particular.

- Substantial growth in gas use in the manufactured Industry is also expected in the Middle East, China, India, Latin America, Southeast Asia, and also the US.

Prospects for energy and natural gas demand by zone (Mtoe)

Natural gas supply is driven by the US (shale gas), Asia-Oceania (unconventional gas) and the Middle East

- Natural gas production is expected to grow everywhere, with the exception of Europe (-2%/year).

- The main centres of gas production growth are the Middle East (Iran), Asia (China, Australia) and the US (shale gas).

- On the national scale, the US, China, Iran, Australia and Russia are expected to show the largest production gains.

- On emerging markets, implementing regulatory and price reforms is critical to boost investments in E&P (including unconventional gas).

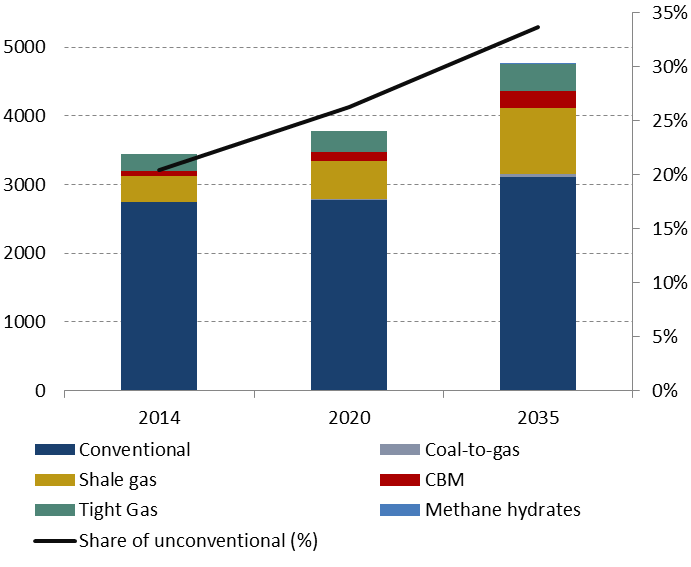

- Unconventional gas will provide more than two-thirds of global additional supply and will account for 34% of global gas output in 2035, up from 20% in 2014.

- Outside North America, unconventional gas growth will be concentrated in China, Australia and, to a lesser extent, Argentina. Unconventional development elsewhere will be small and slow due to public opposition (Europe), and economic and environmental challenges.

Prospects for global natural gas production (bcm)

Interregional trade will account for an increasing share of global supply

- Net interregional (long distance) trade is forecast to grow by 2.7%/year from 398 bcm in 2014 to 690 bcm in 2035, due to Asia’s (post-2020) and Europe’s growing import dependence.

- Interregional pipeline flows grow by 2%/year, boosted by Central Asia and Russia’s exports to Asia, mainly China. With 30% of its total gas import being Russian, Europe will remain strongly dependent on Russian gas, which will maintain its competitiveness.

- LNG increases more rapidly than pipeline gas after 2020.International LNG trade is set to increase by 3.4%/year to 2035.The share of LNG in interregional flows will progress from 47% in 2014 to 53% in 2035. In Europe, LNG will play a fast-growing role to ensure a flexible, secure, diversified and optimized supply portfolio.

- North America emerges as a large-scale exporter, covering 18% of total net interregional exports by 2035, at the expense of the Middle East and the CIS.

- LNG will lead to a growing internationalization of gas markets with flexible LNG and hub pricing expanding in Europe and Asia, supported by US LNG.

- In CEDIGAZ Scenario, the availability of low-cost US shale gas resources will be gradually restricted in the long term, leaving space for some other international LNG projects (Canada, East Africa) underpinned by fully or partially oil-indexed long term contracts.

Armelle Lecarpentier, Chief Economist of Cedigaz

For more information: info@cedigaz.org

https://www.cedigaz.org/shop-with-selector/

Cedigaz (International Center for Natural Gas Information) is an international association with around 90 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.