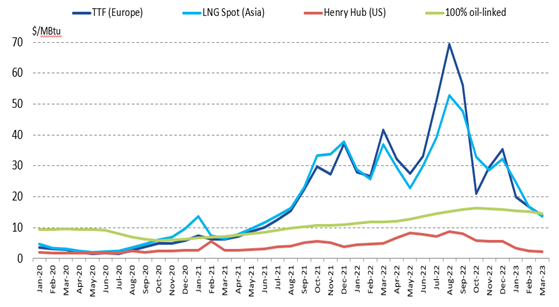

In the first quarter of 2023, European and Asian spot prices continued the downward trend observed since the summer of 2022, despite the fall in Russian pipeline gas deliveries. European gas prices have reached their lowest level since the summer of 2021 but remain two to three times higher than the historical average. These relatively calm market conditions are due to several factors: a milder than normal winter which has reduced gas consumption for space heating, continued strong LNG imports into Europe and lower gas consumption in all sectors. These developments have kept European storages at record levels, which is a bearish factor on forward prices.

Evolution of international gas prices in the first quarter of 2023

In the first quarter of this year, the EU TTF price was 42% lower than in the previous quarter, at $16.8/MBtu (€54/MWh), returning to a level similar to that in the third quarter of 2021. The TTF bottomed out at $12.6/MBtu (€40/MWh) on the 20 March, its lowest level since the summer of 2021. European market fundamentals are bearish. It is estimated that in the first quarter of this year, EU gas consumption was 17% below the seasonal average. Against this background, continued strong imports of LNG and Norwegian gas have allowed to both replace Russian pipeline gas and ensure a very high level of gas storages.

The average Asian spot price has fallen from $25/MBtu in January to $12.6/MBtu today, showing a very strong correlation with the European price. It is also the lowest level recorded since the summer of 2021. Natural gas demand in Asia remains weak and LNG stocks are still very high in Northeast Asia, limiting the need for LNG imports and explaining the spot LNG price decline.

Asian and European spot prices have recently fallen below oil parity for the first time since the summer of 2021.

Figure 1: Evolution of monthly international gas prices

Source: Reuters, IFPEN, CEDIGAZ

The US price Henry Hub fell sharply in the first quarter of 2023. It even reached its lowest monthly level since September 2020 in March. Warmer than normal temperatures, strong domestic production and abundant gas stocks have put strong downward pressure on the Henry Hub price.

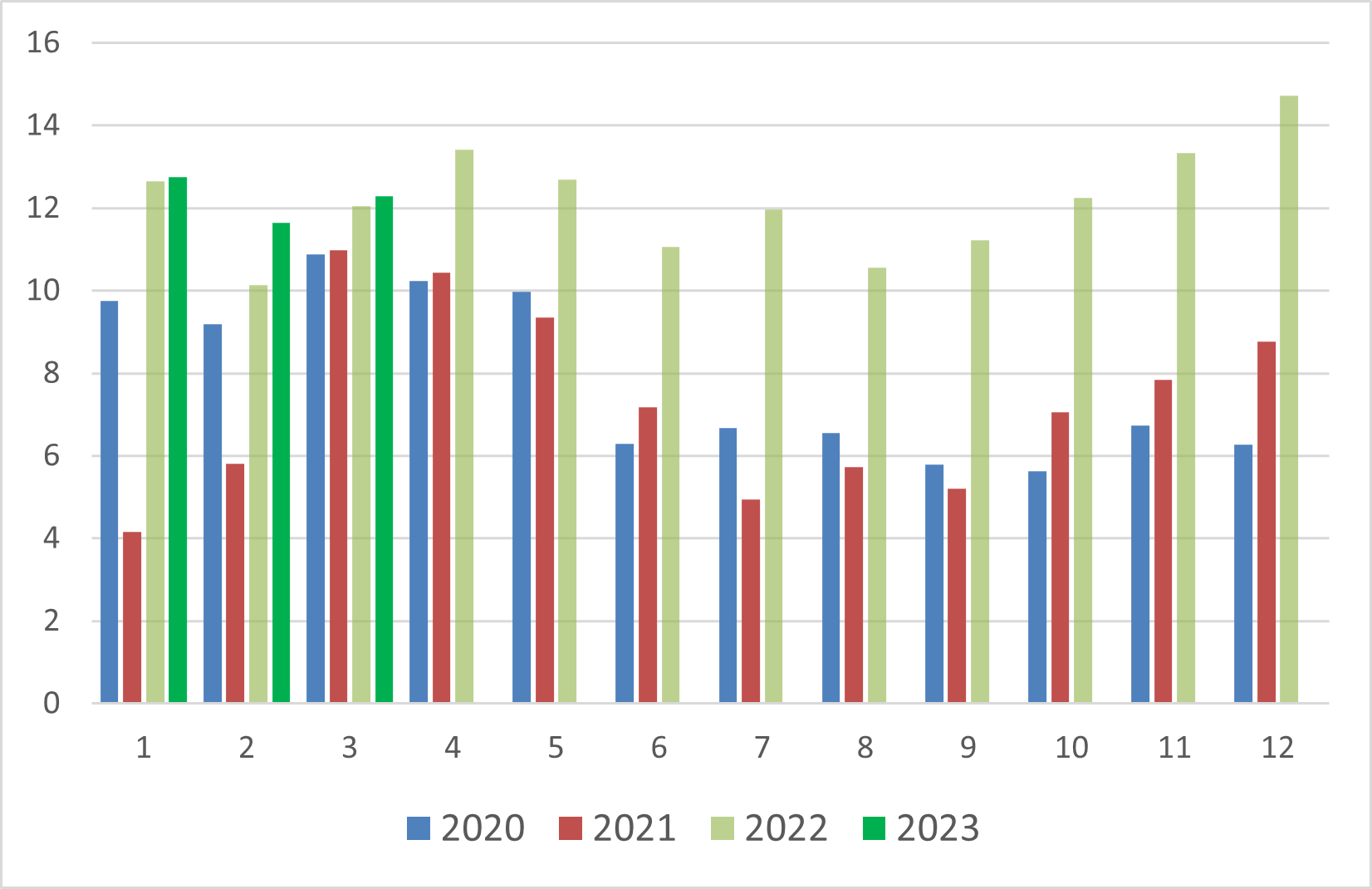

Evolution of international LNG trade

According to Cedigaz, global LNG supply reached 135 bcm in the first quarter of 2023, an increase of 2% from the previous quarter and 5% from 2021. Global LNG supply reached a record high for the month of March, supported by the US (restart of the Freeport plant) and Nigeria.

Europe (EU and UK) continued to import massive quantities of LNG. Its LNG imports amounted to 37 bcm in the first quarter, which is 5% and 75% higher than in 2022 and 2021 respectively for the same period of the year. Growing LNG inflows are facilitated by the ramp-up of regasification capacity in North West Europe. Germany has started importing LNG and already holds three regasification terminals. In March, there was a sharp increase in LNG imports into North West Europe (Netherlands, Belgium, UK) and Spain to compensate for the drop in LNG deliveries to France due to strikes at LNG terminals.

As in the previous quarters, the growth in LNG imports in Europe is taking place at the expense of Asia, where LNG demand remains sluggish due to mild weather and the lack of competitiveness of LNG, which favours the substitution of gas by other energy sources. LNG demand was still particularly weak in China in January and February as the economic conditions remained fragile, before a slight recovery in March. In addition, the abundance of LNG storage in North-East Asia limits import needs.

Figure 2: Evolution of monthly net LNG imports in Europe (Gm3)

Source: CEDIGAZ LNG Service

Price Outlook 2023

The very high level of European and Asian stocks and the prospects for a continued probably weak demand in these regions (use of nuclear and other energy sources, industrial destruction and energy savings) limit the risks of tension on the markets for this summer 2023.

With a volume of 625 TWh (58 Bcm), EU underground storages reached a record filling rate of 56% at the end of March. The EU stock level is 65% above the 2017-2021 average. With the current stock levels, the volume of injection needed this summer to reach the target of a 90% fill rate by 1 November is halved. France is in a specific situation, with a filling rate of 28%, well below the European average. This is due to the technical need not to overfill aquifer storage and more recently to the LNG supply cuts caused by the strikes in March.

However, there are still uncertainties regarding market conditions for the coming winter. The structure of European forward prices in contango (prices rise after the summer and as the winter of 2023-24 approaches) has become more pronounced in March. The full convergence between European and Asian spot prices indicates a risk of tension on the global LNG market balance. Apart from climate conditions, the evolution of the economic growth and the extent of the expected recovery of LNG demand in China will have a key impact on the security of supply as we approach the next winter. A likely reduction in Russian LNG deliveries (which currently account for almost 8% of EU gas supply) due to political pressure is also a risk factor.

Armelle Lecarpentier, Chief Economist, CEDIGAZ

Contact us: contact@cedigaz.org

Cedigaz (International Center for Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). CEDIGAZ collects and analyses worldwide economic information on natural and renewable gases in an exhaustive and critical way.