- In a context of post-Covid economic recovery and an induced rebound of the prices of all energy commodities, the second quarter 2021 saw an unprecedented and steady rally of international spot prices, driven by growing European and Asian gas demand.

- In Europe, low gas inventories, an unseasonable and persistent cold weather as well as the highest recorded carbon prices have propelled the TTF price, which provided a strong upside to Asian spot prices.

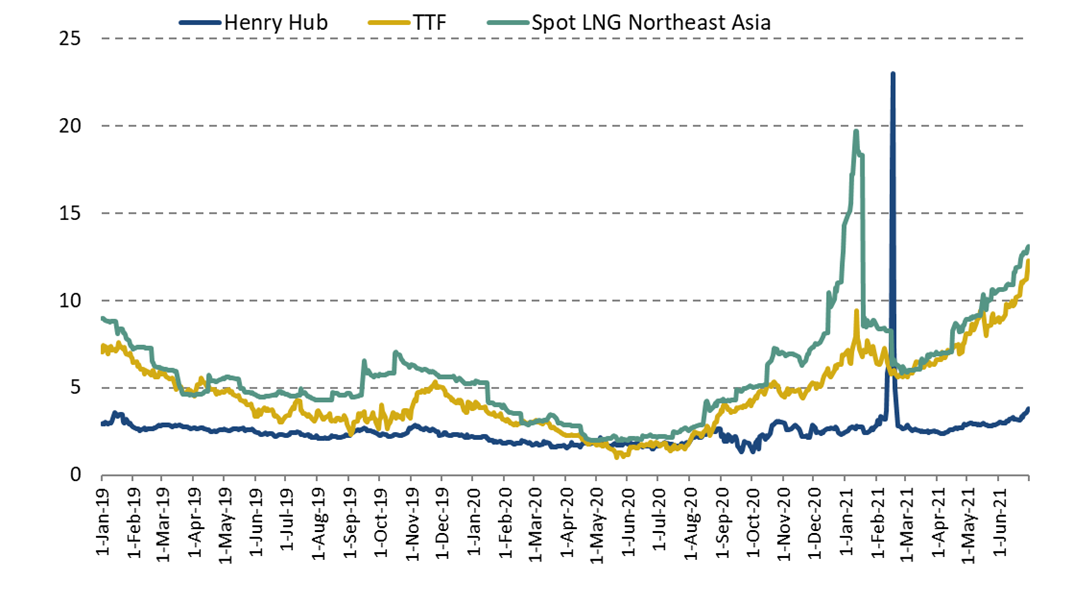

- During the second quarter, Asian spot prices rose even faster than European spot prices because of surging Chinese LNG demand, rising oil prices and LNG supply outages. This results in a growing price premium to the European price. During the second half of June, Northeast Asian spot LNG prices have jumped by $2 to $13/MBtu at the end of the month, more than $10/MMBtu higher than they were this time last year and their highest levels since 2014 for the same summer period.

- As of end-June, the TTF July contract rallied to the highest recorded level of about 12$/MBtu, while July Northeast Asian term spot prices have rallied above 13$/MBtu. It is exceptional to see such price spikes during summer months.

- In the second quarter 2021, global LNG supply returned to growth, driven especially by China, which became the world largest LNG importer before Japan. On a tightening LNG market, LNG suppliers targeted higher-priced Northeast Asian markets, resulting in some tensions on the European gas supply.

- European storages have been dried up. Storage refilling needs leave space for growing European LNG and gas imports in the coming months, suggesting strong competition between Europe and Asia for LNG supplies. Europe is set to keep a key role as a balancing market. As LNG supply has tightened, the evolution of Russian pipeline gas exports will have a significant impact on markets and prices.

- Asian LNG demand is also set to remain strong, especially in China, driven by the economic recovery and industrial revival.

- Oil-linked prices extended gains in the second quarter following the uptick of oil prices. Spot prices held well above the oil-indexed contract price in June and even reached parity with oil at the end of the month.

- Forward curves suggest this unusual bull run to continue in the second half of this year, driven by strong demand, with European and Asian spot prices at historic highs. Gas inventories below seasonal averages on both sides of the Atlantic point to continued price support going forward.

- The short-term outlook remains subject to heightened levels of uncertainty regarding in particular the economic recovery and the evolution of the pandemic.

Evolution and prospects of international spot prices

Looking at the second quarter only, the TTF price jumped from 1.7 $/MBtu in 2020 to 8.6 $/MBtu in 2021 compared to 4.3 $/MBtu in 2019. The average Northeast Asian spot price also jumped from 2.2 $/MBtu in 2020 to 9.6 $/MBtu in 2021, compared to 4.9 $/MBtu in 2019. The Henry Hub rose from 1.8 $/MBtu to 2.9 $/MBtu year on year, compared to 2.5 $/MBtu in 2019.

This bullish trend occurs in a global context of an economic recovery which fuels energy demand and supports prices of all energies: oil, coal, electricity and gas. On the supply side, production outages occurred, and tensions mounted despite quick US LNG exports and higher Russian pipeline gas exports to Europe.

In Europe, low gas inventories, an unseasonable and persistent cold weather as well as the highest recorded carbon prices have propelled the TTF price, which provided a strong upside to Asian spot prices.

During the second quarter, Asian spot prices rose faster than European spot prices mainly due to the rebound in Chinese LNG and gas demand, against the background of the post Covid-19 economic growth.

In the US, the Henry Hub price climbed in the last days of June, on the back of an extreme heat wave and drought conditions (restrictions on hydroelectricity) in the West, which propelled electricity use for cooling. During the last week of June, the Henry Hub spot price rose from $3.3 MBtu to $3.7/MBtu.

Figure 1: Evolution of international daily spot gas prices ($/MBtu)

Source: Reuters, IFPEN, Cedigaz

Evolution of oil-indexed contract prices

The average oil-indexed price gained further momentum in the second quarter in parallel with the surge of the oil prices seen in the first quarter, considering the several month lag in pricing formulas. The average oil-indexed price was assessed at 8 $/MBtu in the second quarter 2021, compared to 6.9 $/MBtu in the first quarter and 5.9 $/MBtu in the last quarter 2020.

Most term supply contracts to Japan are linked to the Japan Crude Cocktail (JCC), a monthly average of costs for crudes delivered to the country that tracks spot crude prices with a lag of a few months. In June 2021, the average Japanese LNG price was estimated at 8.5$/MBtu, a strong increase from the 8 $/MBtu in May and 7.5 $/MBtu in April.

Because of the unexpected jump of spot prices in Asia during the second quarter, the oil-indexed price stood at a significant discount to the spot price in June. At the end of June, Asian spot prices were even trading at parity with Brent.

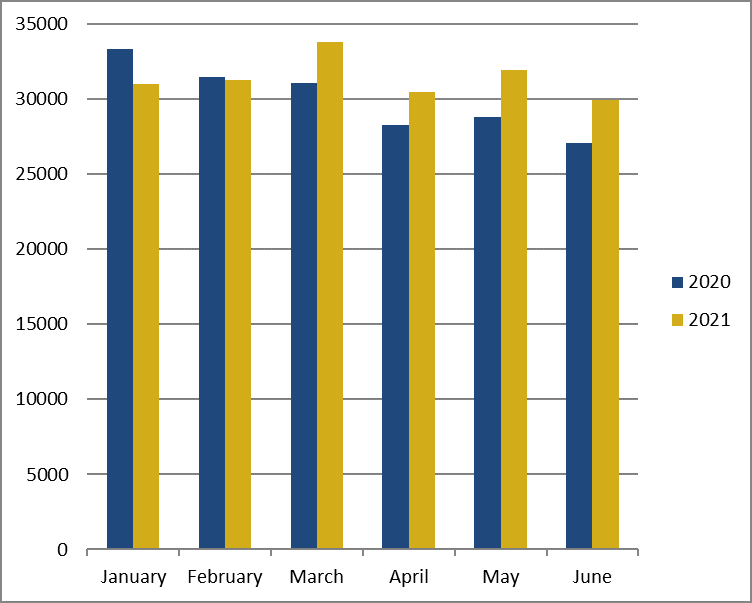

Recent developments in the global LNG market

In the second quarter 2021, global LNG supply grew strongly, up an estimated 10% from a year earlier, driven by Asian LNG demand, especially in China. The global LNG supply thus continued to be massively oriented to Asia, which absorbed more than 70% of total LNG exports today. Deliveries to Europe have kept slowing in April and May, as higher-priced northeast Asian markets pulled cargoes away from the continent. It is also worth noting the strong growth of LNG imports in South America (Brazil, Argentina), which now accounts for 6% of global LNG demand, compared with 3% in 2020.

China overtook Japan to become the world largest LNG importer. Key contributors to the surge of Chinese gas demand included:

– strong manufacturing activity and a boom in export orders received by factories, probably due to operational restrictions on factories in other countries as part of measures to limit the spread of the COVID-19 virus.

– coal-to-gas switching policy in the industrial sector before winter 2020/2021, as part of the environmental measures implemented to reduce emissions.

– supply tightness for other fuels (restrictions on coal production and on coal imports from Australia, shortage of hydroelectricity), which caused a severe power shortage in the Guangdong area.

– colder-than-expected early spring (April) followed by a warmer than usual climate (May-June) boosting cooling needs (south of the country, Guangdong area).

Figure 2: Evolution of global LNG supply (000 t)

Source: Cedigaz provisional estimates

2021 Outlook

At the end of the quarter, the TTF July contract rallied to the highest recorded level at about 12$/MBtu, contributing to the jump of Asian spot prices. In the last days of June, spot prices stepped up strongly following Gazprom’s decision not to book any additional interruptible pipeline capacity through Ukraine in an auction. July Northeast Asian term spot prices have rallied above 13$/MBtu. These prices are more than 10$/MBtu higher than they were last year and 8.5 $/MBtu above the 2019 July level. It is exceptional to see such price spikes during summer months.

Forward curves suggest a continuation of current bull ride in the second half of this year, driven by growing demand backed by an economic upturn. The persistent rally could be attributed to growing demand for all energy commodities, especially for power generation and industry. Low gas inventories are fuelling the bullish sentiment. As of 30 June 2021, European gas storages were 33 bcm or 25% below the level of last year. Moreover, coal-to-gas switching in Europe remains strong as European carbon prices recently rallied to record highs (€56/t) amid a stricter environmental regulation and economic growth. Norwegian supply outages and expectations of low wind output have also boosted prices further.

In Asia, Futures prices are supported by expectations on warmer than average temperatures in the coming months and strong consumer demand in Northeast Asia, especially in China. Anticipations of persistent buoyant oil prices are also a key determinant of Asian pricing.

Strong competition for summer LNG between Europe and Asia is likely to remain. The gas market is expected to tighten this coming winter, according to market sources and analysts.

It is however important to notice that important short-term factors can more or less ease the current price boom: a slower-than-expected industrial activity because on uncertainties on the pandemic development and economic recovery, a return to growth of coal production and the resorption of the power deficit in China, unexpected weather conditions and fewer plant outages as the maintenance season has ended.

Armelle Lecarpentier, Chief Economist, CEDIGAZ

Contact us: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.