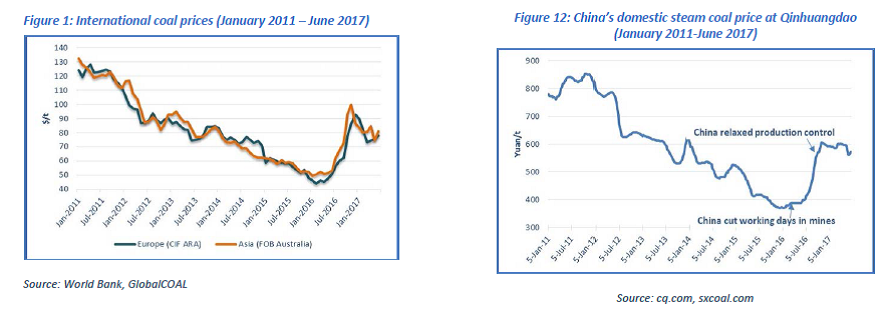

Despite a decline in global coal demand for the second consecutive year, international steam coal prices doubled in 2016. This massive rise may seem paradoxical; in fact, it responded to market fundamentals: a tightening of the international market due to an unexpected surge in Chinese coal imports and the inability of exporters to meet this sudden increase. The surge in Chinese imports was not due to increasing demand – Chinese coal consumption in 2016 fell for the third year in a row– but to domestic production restrictions mandated by the Chinese government from April 2016. To remove excessive and outdated capacities in the domestic coal sector, that weighed on domestic coal prices, the government required coal mining companies to cut operating days from 330 to 276 a year. The new regulation led to a fall in coal production, shortages of coal and a steep increase in domestic coal prices, forcing power utilities to turn to the international market. However, after five years of low prices and reductions in investment, exporters were not able to respond to this sudden demand and international prices increased to clear the market.

Fig. 1 and Fig 12

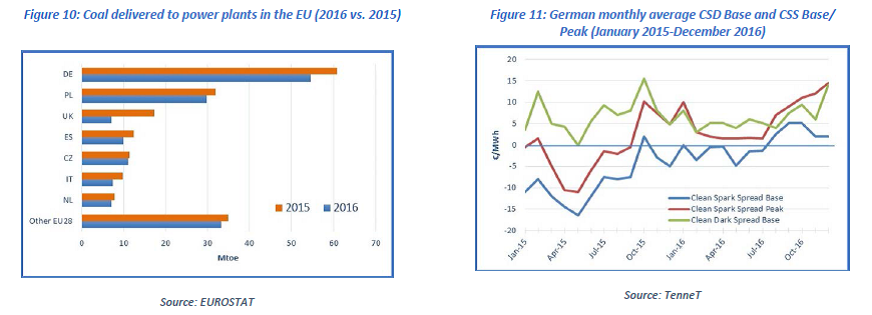

Higher international coal prices had a large impact on the European coal and energy market. It was less felt in Asia, where in many countries, coal (and gas) prices are regulated by governments, and do not necessarily follow international trends. As coal exporting countries were not able to ramp up their exports rapidly, increased prices displaced coal demand in the most price-sensitive markets: the power sector in Europe, and to a lesser extent, imports by India. Therefore, EU coal demand and imports fell significantly in 2016. Higher coal prices resulted in a loss of competitiveness of coal against gas in Europe, triggering coal-to-gas switching. Virtually all European countries reduced their coal consumption in 2016, though to varying degrees. The United Kingdom and Germany accounted for 60% of the decrease. In the United Kingdom, the carbon tax paid by power generating companies, on top of the price of CO2 allowances, structurally advantages natural gas over coal. In Germany, natural gas-fired generation became competitive in peak hours and from August 2016 also in off-peak hours, although still less competitive than generating baseload electricity with coal. Coal-to-gas switching resulted in significant changes in the structure of the EU power mix, with the share of coal reduced to 21.6% in 2016, while the share of gas gained 3 percentage point to 18.6%. Going forward, coal-to-gas switching in Europe will continue to be influenced by the relative fuel prices, but also by European regulation on air quality and CO2 emissions, as well as by national policies.

Higher international coal prices had a large impact on the European coal and energy market. It was less felt in Asia, where in many countries, coal (and gas) prices are regulated by governments, and do not necessarily follow international trends. As coal exporting countries were not able to ramp up their exports rapidly, increased prices displaced coal demand in the most price-sensitive markets: the power sector in Europe, and to a lesser extent, imports by India. Therefore, EU coal demand and imports fell significantly in 2016. Higher coal prices resulted in a loss of competitiveness of coal against gas in Europe, triggering coal-to-gas switching. Virtually all European countries reduced their coal consumption in 2016, though to varying degrees. The United Kingdom and Germany accounted for 60% of the decrease. In the United Kingdom, the carbon tax paid by power generating companies, on top of the price of CO2 allowances, structurally advantages natural gas over coal. In Germany, natural gas-fired generation became competitive in peak hours and from August 2016 also in off-peak hours, although still less competitive than generating baseload electricity with coal. Coal-to-gas switching resulted in significant changes in the structure of the EU power mix, with the share of coal reduced to 21.6% in 2016, while the share of gas gained 3 percentage point to 18.6%. Going forward, coal-to-gas switching in Europe will continue to be influenced by the relative fuel prices, but also by European regulation on air quality and CO2 emissions, as well as by national policies.

Fig. 10 and Fig 11

Due to its weight on the international coal market, China drives international coal prices. Hence, changes in energy and environmental policy in China are felt worldwide. The Chinese government intends carrying on with its supply reform, as domestic production capacity is still in surplus and the potential for increasing coal demand is limited as China moves to the new normal and fights against air pollution. The government, however, is closely monitoring the effect of the supply reform on domestic coal prices to avoid price volatility. It has defined a desired price range ($73-83/t) for domestic coal prices. Any variation above or below the range is likely to trigger policy intervention from the Chinese authorities. Since the second half of 2016 and the rise in Chinese imports, international prices have closely tracked Chinese domestic prices. But they also respond to regional market conditions (e.g. power plant outages, cold spells or hot temperatures) and are expected to remain volatile.

Due to its weight on the international coal market, China drives international coal prices. Hence, changes in energy and environmental policy in China are felt worldwide. The Chinese government intends carrying on with its supply reform, as domestic production capacity is still in surplus and the potential for increasing coal demand is limited as China moves to the new normal and fights against air pollution. The government, however, is closely monitoring the effect of the supply reform on domestic coal prices to avoid price volatility. It has defined a desired price range ($73-83/t) for domestic coal prices. Any variation above or below the range is likely to trigger policy intervention from the Chinese authorities. Since the second half of 2016 and the rise in Chinese imports, international prices have closely tracked Chinese domestic prices. But they also respond to regional market conditions (e.g. power plant outages, cold spells or hot temperatures) and are expected to remain volatile.

Today, the international coal market is precariously balanced at around $75/t. This relative balance means that small changes on the supply and demand side can easily move the market into tightness or oversupply. Going forward, one can expect price volatility coinciding with every unexpected shift in supply and demand.

Sylvie Cornot-Gandolphe – SCG Consult for Cedigaz

Contact: contact@cedigaz.org