This year, the traditional Cedigaz Annual Seminar held on 29th June coincided with a time of apparent respite for the European and global gas markets. Europe managed to avert a major supply crisis last winter, stocks are high, and storages could be full by September, and gas and LNG prices have softened from record breaking levels in 2022. But as stated by Cedigaz’ newly appointed chairperson Mickaele Le Ravalec in her opening speech, supply fears remain very much alive for the winters to come, underpinning continued tensions and price volatility risks across global gas and energy markets.

These risks are compounded by increased pressure to accelerate the energy transition, to reduce Europe’s dependence on Russian gas, as well as to drive energy efficiency and savings.

European gas participants stand therefore at a crossroads of multiple, greater uncertainties encapsulated in the perennial trilemma of ‘Decarbonization, Affordability and Security’.

Carving a medium to longer path is proving more difficult for the gas industry. But discussions during the seminar also warned against a euro-centric view of the energy crisis. Indeed, the repercussions of last year’s energy crisis into global markets are still unfolding through relentless inflation, industrial demand destruction, currency and liquidity crunch, as well higher fuels and food prices in developing countries.

LNG to the Rescue

In an already-tight global gas market, the interruption of Russian gas flows to Europe led to a loss of 77 Bcm, or 20% of 2021’s European gas consumption (a 55% drop in Russian pipeline gas exports) in 2022, according to Cedigaz data. This sparked unprecedented price spikes and volatility rates on European spot gas market, with the spot price in Europe averaging around €126/MWh in 2022.

In the words of a many delegates during the seminar, markets functioned well by sending the right price signals across gas and LNG markets. Gas participants responded quickly by boosting gas production when possible. Reverse flows across the European gas system were increased, and storage facilities remain an essential lifeline (stocks were 20% higher than the historic average at the end 2022).

LNG imports, especially from the United States, proved instrumental in filling the supply shortage in Europe, posting a 70% annual increase to 60 Bcm. LNG has now become a baseload fuel in Europe’s gas supply mix.

Traditionally described as a ‘sink’ market for global LNG trade, Europe became a premium market competing with Asia. However, its ability to attract sufficient flexible LNG supplies was also aided by weaker gas demand from Asian importers. China, where the zero-Covid policy was still in full swing, posted a historic decline in gas demand of 1.3% in 2022, according to Cedigaz data.

High Prices Come With a Cost

But LNG demand also declined as record price spikes proved too prohibitive for other developing nations. Many switched to other fuels due to high gas prices (including more carbon-intensive fuels such as oil products and coal). Others saw their term deliveries diverted to higher-priced destinations in Europe. Some could not afford to secure cargoes on the spot market as their foreign currency reserves dwindled significantly after Russia’s invasion of Ukraine sparked record energy and commodities price spikes. Increased inflationary pressure and the stronger dollar mean that many developing countries were forced to spend their foreign currency reserves to support their exchange rates. Bangladesh for instance, had to stop spot deliveries during summer 2022 due to steep prices.

As a result, amid soaring inflation, a historic geopolitical crisis, and an economic downturn in non-OECD countries (China, Russia), global gas demand fell 1.6% to 4000 bcm, with the European market being the most affected, according to Cedigaz data.

European gas demand fell by 13% in 2022, which also helped to balance the system. Only around half of this demand drop was due to structural factors, primarily gas savings’ measures introduced under the REPowerEU plan in May 2022. The aim of the plan is to boost energy savings and efficiency and reduce the dependence on Russian gas through greener fuels, among other targets.

This was also driven by milder weather as well as demand destruction from industrial participants who either switched to other fuels or shut their plants due record gas prices and extreme price volatility. Some participants at the seminar expressed renewed concerns that many of these industrial players remain reluctant to restart their sites in view of high prices on the forward curve.

Next Winter Demand

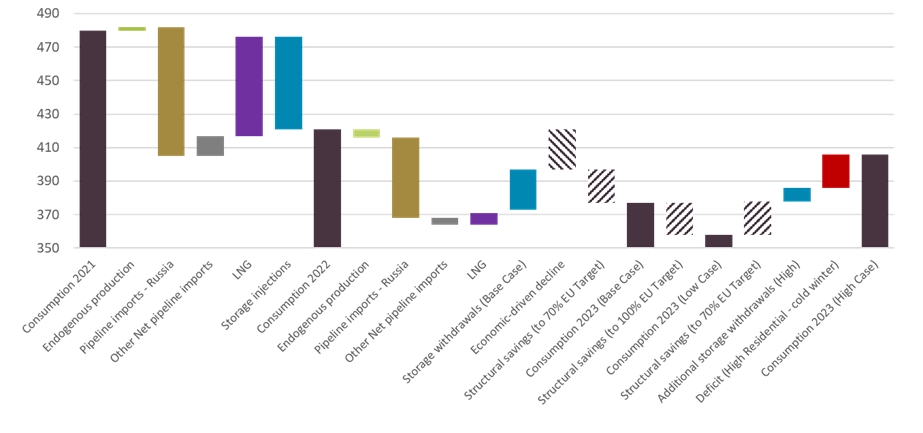

Despite a declining trend of the TTF price since August 2022, the contango structure on the forward curve still shows a high winter risk. According to Cedigaz scenarios, supply risks for next winter will heavily depend on weather conditions. European nations and the UK could face a gas supply deficit in the event of colder-than-average temperatures next winter. However, no major shortage is predicted for Europe in case of normal weather conditions, and a continued reduction of natural gas consumption (- 15% target).

European gas supply in 2022 and 2023 Outlook – EU & UK natural gas balance (Source: Cedigaz Analysis)

Market players remain extremely cautious with regards to supply security until at least 2027, when new LNG capacity from Qatar and the United States is expected to come on stream.

New Supply Contracts as an Insurance

In this context, efforts to secure incremental supplies for the short to medium term are still being pursued. Additional volumes from producers such as Turkmenistan, and from North Africa (Libya and Algeria) were cited as possible options, although these options come with commercial, political, and technical challenges.

Beyond incremental volumes, European buyers have been struggling to justify signing new medium and long-term contracts, both for pipeline gas and LNG. This is against a backdrop of increased competition between buyers for future supplies as illustrated by the growing number of new long-term deals recently signed by Asian buyers, led by China, for future capacities with Qatar. If there are any lessons to be learned from the Russia-Ukraine situation, delegates at the seminar emphasized the urgent need for new long-term supply contracts as insurance against any unforeseen disruptions, regardless of potential oversupply risks in the future.

This is not to say that the supply picture is not uncertain. To an extent, some participants have also been hesitant to commit to new long-term volumes as they still account for a potential resumption of Russian pipeline gas imports in the future, depending on the unfolding of the Russia-Ukraine war. The volume, if any, remains subject to debate.

The disrupted supply picture has been underpinning lingering price volatility on European forward markets. As a result, the strong dominance of TTF-linked indexation in many European contracts is now triggering calls for a diversification of indices to a more balanced basket of TTF, Brent and Henry Hub prices.

Demand and REPowerEU

As things stand, the biggest risk for gas players is on the demand front in the context of the energy transition. In fact, the REPowerEU plan was questioned by some participants during the seminar. Under the plan, the EU increased its 2030 target to 45% of renewables in its mix, up from 40% under its Fit for 55 2030 target. Among other targets, it also wants to boost its biomethane production to 35 Bcm by 2030. The EU set a 10 Mt production target of domestic renewable hydrogen production and 10 Mt of hydrogen imports to replace fossils fuels like gas, coal in hard-to-decarbonize industries and the transport sector.

However, the REPowerEU plan remains a non-binding document and an evolving blueprint. Its targets are deemed highly ambitious. What worries gas participants is the absence of clear pathways for meeting each of these objectives. Crucially, European gas buyers are struggling to commit to new volumes that might be needed to fill any energy gap in the transition to a net zero future.

Hydrogen

For instance, despite increased investments in hydrogen projects across the globe in 2022, delegates at the seminar stressed that many constraints are still coming in the way for hydrogen to scale up rapidly. These include the need to speed up financing in Europe for both projects and infrastructure (including for existing and new pipelines as well as hydrogen underground storage). For example, the tax credits proposed under the Inflation Reduction Act (IRA) in the United States were cited as a suitable solution to provide more incentives to investors.

Fundamentally, participants at the seminar cited a lack of access to renewable capacity (or ‘electron scarcity’) as a main difficulty. Many are banking on imports from other regions, such as North Africa to complement local projects. In the shorter term, imports from the US are considered a serious option, on paper at least, as they are estimated to be cheaper than local production. More policy clarity under the IRA is eagerly awaited on this matter.

In view of such uncertainties, some participants stressed that the focus on hydrogen targets based on renewables from policy makers deepens the risk of missing opportunities offered by other sources of hydrogen applied with technologies like CCS, if they are cost competitive.

Biomethane

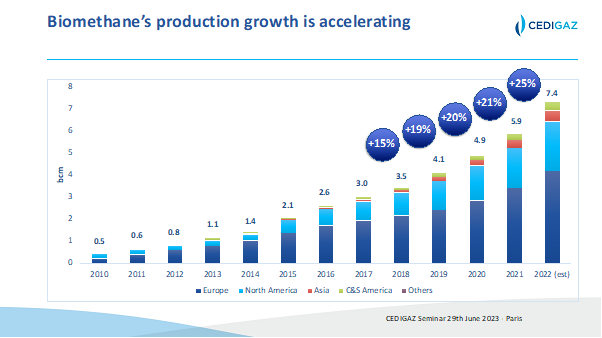

Based on Cedigaz research, the EU’s goal to produce 35 Bcm of biomethane by 2030 looks ambitious compared with current production of around 2.7 Bcm. But it is achievable, provided the right incentives are in place. The growth of global biomethane production rose at an impressive rate over the past years, due to a combination of decarbonization policies and market factors. In Europe, production rose in 2022 in response to the Ukraine crisis. Production costs are estimated in a range of €55-90/MWh and were competitive against market gas prices when these hit record levels above the €100/MWh mark.

Flexibility Deficit and Transition(s)

Better visibility into future gas demand is not just essential for security of supply. Delegates at the seminar warned against a high risk of flexibility deficit.

The growth of green derivatives products heralds the ushering of a more complex ecosystem of new energy sources and dedicated infrastructure. The drive for energy efficiency and the diversification of fuels such as biomethane, ammonia, hydrogen-based electricity and synthetic fuels that will be used by different end-users will trigger a paradigm shift in the way markets operate.

But none of these are realistically expected to be developed at the same pace. Equally, as CCS is gradually developed, more CO2 storage capacity will be required. The need for increased flexibility also applies in the transport sector with the deployment of EVs. In the residential and commercial sector, the potential deployment of hybrid heat pumps calls on increased peak power flexibility during the winter season.

Such examples highlighted the need for the gas industry to better communicate its views and technical expertise to the wider public. Fundamentally, the requirement for flexibility against multiple products transitions generates increased complexity when it comes to modelling future gas demand scenarios.

Infrastructure Deficit

The Ukraine crisis took place at time when the gas and energy prices had already increased in 2021, as post-Covid demand recovered faster than supply capacity additions. Following the easing of lockdown restrictions, demand jumped back in 2021 partly due to nuclear power issues in France, and supply tightness on global LNG markets. At the time, a severe drought in Brazil boosted gas-fired generation to replace hydro-generation, a risk that persists with the return of El Nino weather phenomenon.

The concept of signing additional long-term contracts as an insurance against unforeseen events is equally valid for infrastructure such as new LNG import terminals and storage capacities as sources of flexibility to temper the effect of price volatility.

But the current uncertainty regarding in particular future gas demand and high volatility risks are not conducive to sufficient infrastructure investments. Therefore, ‘Black Swan’ events such as the Ukraine crisis underscores the need to better anticipate fluctuations in investment cycles that are so intrinsic to the industry – even in a well-functioning market. While the crisis could not be predicted, such an approach can prevent (or at least reduce) extreme price volatility.

In a strong message during the seminar, market participants called the European Commission to shape more realistic projections and scenarios for future gas demand from the short term out to 2050.

Conclusion

There is a general understanding among participants and policy makers at national and EU levels that natural gas remains a key component of the transition to net zero. Participants at this year’s Cedigaz seminar stressed just how essential the role of natural gas and of other gases will be to bring much-needed flexibility as the transformation of the energy system is proving incredibly complex.

Amid continued geopolitical, financial and market instability, industry voices are calling for more balanced interventions from governments and the European Union. This is not just to help dispel volatility in the short term, but to help reduce longer-term threats, at best, and rein in the ripple effects of today’s energy crisis into the global population and economies. The ramifications of Russia’s invasion of Ukraine have set a precedent in the need to enhance global collaboration and help carve a clearer path that can balance not just security of supply, affordability, and sustainability but also equitability. In the run-up to COP 28 in November, the EU in particular is also urged to take a leadership role, including to promote energy innovation across global markets.

While the gas industry is used to operate in uncertain market conditions, the magnitude of today’s risks is unprecedented, participants said at the seminar. Gas supply hinges on many variables and externalities, while for demand, there is an imperative to account for the practical complexities inherent to the energy transition and ultimately provide visibility to investors. In this regard, the priority is to redesign a more realistic way forward based on commercial and technical challenges, fundamentals, and objective intelligence and data, such as those provided by the Cedigaz community.

Fatima Sadouki – Independent Energy Specialist – for CEDIGAZ