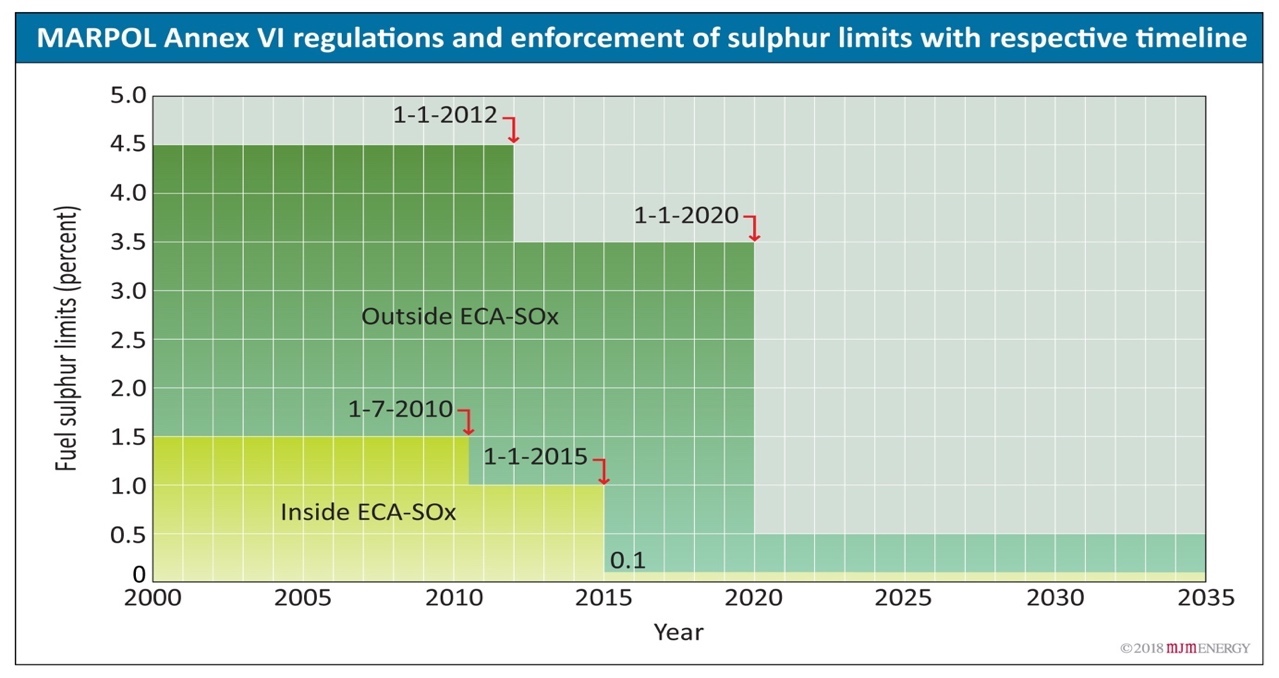

Changes to the IMO emissions standards will see the global sulphur limit in marine fuel reduced from 3.5% to 0.5% from 2020.

Marine fuel is a huge energy market which is currently dominated by oil products. However, tighter environmental regulations, particularly MARPOL Annex VI, are driving changes in fuel requirements, especially with regards to sulphur emissions, both in the Emission Control Areas (ECAs) around the coasts of North-West Europe and North America, but also globally, particularly as the 0.5% sulphur limit applies globally from January 2020 . LNG has opportunities in this sector as a low-sulphur fuel, although it also faces strong competition from low-sulphur oil products, sulphur scrubbing technology, and potentially from electric vessels. Currently there are known to be around 139 merchant vessels using LNG as a fuel, with a similar number on order. Whilst LNG-fuelled shipping has been slow to take off, it is now growing rapidly, particularly as supply infrastructure coverage has improved significantly in recent years. LNG is likely to become a fuel of choice for newbuilds in many sectors, whilst there may also be some LNG conversions.

What are the IMO emissions standards coming into force in 2020?

There are two separate sets of emissions standards under MARPOL – global limits of 3.5% sulphur at present, reducing to 0.5% in 2020, and tighter limits of 0.1% in Emission Control Areas covering much of North America and North-West Europe. MARPOL also sets emissions standards for nitrogen oxides (NOx), particulate matter (PM), and greenhouse gases (GHG).

What are the possible options for ship owners?

Ship-owners and operators have three main options to meet the tighter 2020 sulphur limits – continuing using fuel oil but install gas scrubbers, burn cleaner but costlier liquid fuels, or switch to LNG as a fuel. In addition in some cases it may be feasible to use electric vessels or other developing technologies but these are likely to be limited to specialist uses in the medium-term. A comparatively high level of non-compliance is expected initially.

What are the opportunities for the LNG market?

The reducing global sulphur limits provide a remarkable opportunity for expansion of the LNG-fuelled shipping market, however, this will be constrained by competition from scrubbers and other fuels.

Current state of play – how is the industry planning for the 2020 regulations?

There are concerns about the degree of readiness of the industry for the new regulations, with only one year to go until January 2020. At the large end of the market there has been significant investment in installing scrubbers, whilst in the middle and the smaller end of the market most ships are likely to switch to lower sulphur blends of fuel oil and gas oil, or to delay compliance with the regulations. LNG is a small but growing sector, and could become fuel of choice for many newbuild applications over the medium-term.

CONCLUSION

Volumes of LNG used for shipping are currently tiny, with the IEA estimating 0.73bcm in 2017. This will grow rapidly as the fleet expands, and also as over 100 LNG-ready ships are likely to switch over to utilizing LNG once the 0.5% sulphur limit comes in in 2020. There is a wide variation in forecasts for LNG demand by 2025 ranging from 4 to 41bcm/year, however, most forecasts place marine LNG demand at 8-11bcm/year in 2025, increasing to 22-49bcm/year by 2040.

Meeting this level of LNG demand will require additional LNG supply infrastructure at ports and in other locations, however, such infrastructure has expanded significantly in recent years, particularly in Europe, and is likely to be able grow to match demand as required.